Opower, the shining light of energy usage management and behavior modification, is being

for (what would otherwise be) a whopping $532M. Under normal circumstances this would be a great thing for the energy technology industry. But it's not.See, until this morning Opower was a public company with a market cap of $556M. Yes, it's being bought by Oracle for slightly less than its market cap. For technology startups delivering products to some of the biggest companies in the world -- there are ~27 publicly traded utilities with over $5Bn market cap -- it is rather disheartening to see one of the flag bearers end up this way. Especially when the Snapchats and Pinterests of the world command multi-billion dollar valuations.

So why is it difficult for energy technology startup companies to grow as big or as fast as their social media counterparts? Why are there no unicorns (companies with billion dollar valuations) in energy technology? 3 main reasons (amongst many) for this:

- Policy resistance: This is a system concept where actors all work hard towards their best interests and consequently diminish the value to every actor in the system. The publicly traded utility is focused on maximising shareholder value, the consumer is focused on paying the least possible for secure and stable power, the regulator is focused on protecting the consumer and the technology providers have focused on serving the utility without disrupting business-as-usual. The outcome is a state of resistance where no one's goals are achieved, a suboptimal outcome. For technology startups' innovative efforts end up being particularly stifled in this industry and this puts a cap on how much growth is possible in this sector.

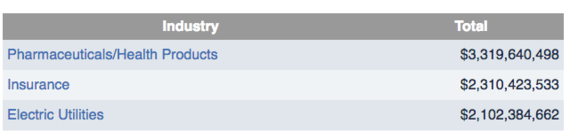

- Regulation and lobbying: The utility industry is, for the most part, heavily regulated. In an odd twist of business logic, the heightened regulation also provides a barrier to entry for smaller entities thereby entrenching the utilities even more. For example an average utility is required to have cash reserves that most technology startups can only dream of. Like pharma and insurance, also heavily regulated sectors, the utility industry spends a lot of money lobbying to maintain this status quo (image below shows the the top lobbying industries). Source: opensecrets.org).

To bring to market a technology that would disrupt the utility business model would require a lot of money and a lot of time (sales cycles of close to 1.5 years) and utilities are slow to adopt the new shiny thing. Two things most early stage technology companies do not have are a lot of money or a lot of time. Another impediment to growth.

To bring to market a technology that would disrupt the utility business model would require a lot of money and a lot of time (sales cycles of close to 1.5 years) and utilities are slow to adopt the new shiny thing. Two things most early stage technology companies do not have are a lot of money or a lot of time. Another impediment to growth. - Behavioural Economics and economies: Accenture (and anecdotallyGoogle) carried out some research in 2010 that showed consumers only spend 6-9 minutes a year, outside of paying bills, thinking about their energy. The research also found that most of the interactions with the utility was negative. Opower was early in using social pressure to get consumers to pay enough attention to their bills to reduce their energy usage. But when you are working with just 6 minutes a year of negative interaction you have a long long way to go. Especially considering the number of minutes you and I spend reading memes, watching cat videos and dream boards with pictures of furniture we might never actually buy. The normal rules and expectations for user engagement do not apply when it comes to energy technology and stifles growth for companies in this space.

Combine the three conditions above and you see why there are fewer energy technology companies that have achieved unicorn status (1 and that company is Nest) than there are Women CEOs at Fortune 500 companies (20).Will this change? Thankfully the answer to this question of whether there will be unicorns in the energy technology space is a resounding 'Yes'. As the utility industry moves to data as the value and energy as the commodity,

, where every device is connected/controllable and becomes an industry with empowered and mobile phone enabled consumers, new companies will sprout up across the value chain to provide what the consumer demands and enable what technology wants (progress).

. It will require entrepreneurs that see the future of technology, are in tune with consumer needs and are savvy in dealing with regulation and government. It will demand a new approach to thinking about the utility industry.That work has already started, similarly to how it started with the internet and some of the more disruptive technologies today...