Senator Chris Dodd has good political antennae. He knows that his financial reform bill will come under severe pressure because it has a weak heart -- the provisions that deal with "too big to fail" are simply "too weak to make any sense."

Stung by the hard-hitting critique of Senator Ted Kaufman earlier on Friday and unsure exactly where an increasingly combative White House is heading on the broader strategy vis-à-vis banks, Mr. Dodd took to the Senate floor yesterday afternoon - actually immediately after Senator Kaufman - in an attempt to sustain the momentum behind his approach to "reform".

Note the prominent and rather defensive mention of Delaware, Senator Kaufman's state, in what Senator Dodd said (the wording here is from the verbatim recording, not the official transcript):

"A business, as I say respectfully, in Connecticut or Delaware or Colorado, a homeowner in those states shouldn't have to pay the price because a handful of financial institutions got too greedy, too risky, they were unwilling to examine what they were doing or did, recognizing that the federal government would bail them out if they made a bad choice, which they did."

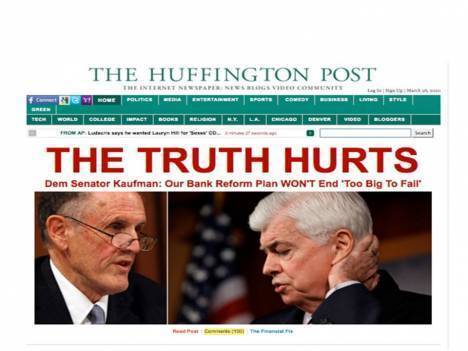

Perhaps it was this picture that did it:

Senator Dodd asserts that "never again should a financial problem of a major financial institution put the rest of the country at risk". But there is no mention of the specific reforms that would prevent this.

Mr. Dodd does express exactly the right general idea,

"First and foremost, never, ever again should a financial institution get so large, so interconnected, produce products that put the rest of us at risk."

But the cognitive dissonance here is extreme. The only purported mechanism to rein in megabanks in the Dodd bill is the resolution authority, but this by definition cannot work for large complex cross-border financial institution - this is the point insisted upon by Senator Kaufman today.

Dodd recognizes the validity of Kaufman's argument at some level, but just cannot bring himself to say that he agrees - or to acknowledge that his legislation does nothing to deal with financial institutions that have already proved themselves to be so large they can damage society.

So we reach an impasse - at least for now. Dodd concedes that too big to fail is the central issue and he implicitly acknowledges that his bill has no way to address the concerns raised by Senator Kaufman (and Paul Volcker and others).

The White House has cleared the way for major progress vs. the financial sector lobby (nice speech by Neal Wolin to the Chamber of Commerce), but does not yet press home its advantage.

Barney Frank knows there is a deep flaw in the current legislation and waits in the wings with a sharp pencil. He previously thought "too big to fail" firms could be taxed down to size; increasingly this seems unrealistic and at odds with the shifting consensus on systemic risk.

Chris Dodd wants to go out in blaze of glory, not with a bill that makes no sense at all on its most critical points.

Ted Kaufman is turning into a relentless critic, Elizabeth Warren is fast becoming a folk hero, and Paul Volcker is poised to make a major speech in Washington on Tuesday. Is Volcker likely to toe the party line and defer to Senator Dodd - or will he lay out in forceful terms what reforms would really mean, i.e., what are the true Volcker principles, who has them, and how would you know?

Financial reform might make for good television after all.