Co-written by Agustin Grube and Chuck Chugumlung

All promising startups have revenue projections with a classic hockey stick shape. However, when these projections are multiplied by market, technology and execution risk, this expected revenue curve often collapses and resembles that of a perpetual money drain.

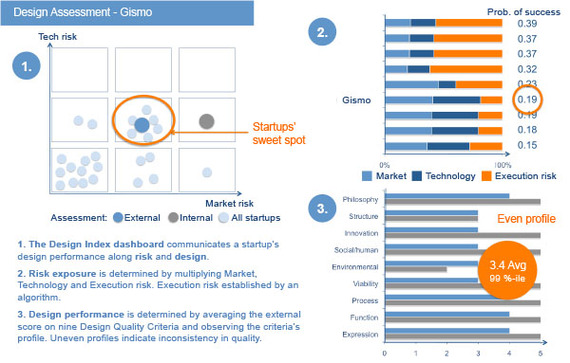

To understand how design creates and captures value, we studied Design Driven Startups, together with Stanford University, Copenhagen Business School, Hanyang University and the University of Paris. The outcome was a Design Valuation Dashboard, a quick and effective tool to determine design performance for early phase startups. When multiple founders and investors independently assess startups, the "wisdom of the crowd" provides three strong indicators of a startup's Design Valuation:

1) Combined Risk (Market risk x Technology risk x Execution risk)

2) Design Quality (an average of nine equally weighted Design Quality Criteria)

3) Design Quality profile (a visual indicator of quality consistency)

Combined Risk

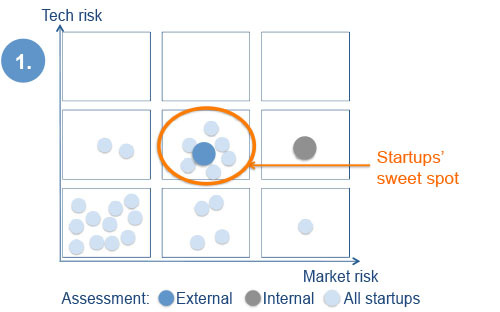

The first step determines the startup's market risk position on a success probability scale from Recognized Needs and Clarified Needs to Realizing Needs. Recognized Needs are where users have well-established needs, Clarifying Needs are improvements to an existing offering and Realizing Needs are where users have latent or unarticulated needs.

The second step is determining the startup's technology risk position on a success probability scale from Current Technology and New Technology to Developing Technology. Current Technology is an offering based on a slightly improved variation of a well-established technology, New Technology is a technology applied from an adjacent business area and Developing Technology is a fundamentally new technology.

The third step determines the startups execution risk position and balances market, technology and execution risk. The Business Opportunity Strength (BOS,) is a multi-variable linear regression prediction model. This model has been developed to include risk and design quality parameters since multiplying the market, technology and execution risk is a strong indicator of overall risk.

If one's risk position is disproportional to the other two, it will unnecessarily increase the total risk, so rebalancing the risk factors can considerably improve the overall performance of the venture.

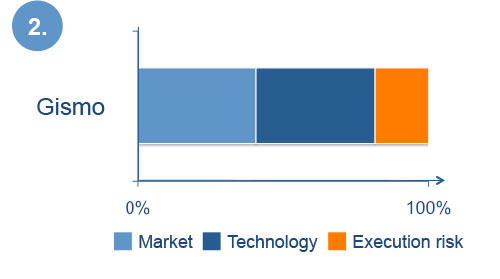

Design Quality

Assessing the design by applying nine Design Quality Criteria can assist in evaluating the startup's design performance. If the average rating is below 2.5, on a scale from one to five, the design falls into the lower fifty percentile, making the design an iffy proposition. If the rating is between 2.5 and 2.8, the design falls into the top twenty percentile and, by focusing on execution; one can still bring significant extra value. If the rating is over 3.3, it falls into the top one percentile and the design is on par with winners of top-tier international design awards. Doing superbly well on design, frees one to look to other opportunities for optimization.

Comparing external and internal expert assessments can assist in identifying inconsistencies in the startup's perception of their design performance. Entrepreneurs tend to be blindly overconfident, preventing them from allocating the necessary high cost-benefit resources to design.

Design Quality profile

The average Design Quality Profile does not tell the whole story since individual criteria may be dangerously low, or, the variation between them a peril to achieving consistent quality. Therefore, one is wise to take corrective measures if the Design Quality Profile becomes too uneven.

When investors explore potential investment opportunities, they can now filter these opportunities through a manageable set of choices using the Design Valuation Dashboard. Startups can be aligned with their risk appetite by applying the market - technology position, balancing the market, technology and execution risk, as well as, their design quality average and quality profile.

Startups can apply the Design Valuation Dashboard to assess their risk position and the probability of their design capability to mitigate this risk and successfully execute. Shortcomings can then be detected early on and corrective measures taken.

Design and Design Driven Startups are effective approaches for aligning technology to market needs. They can reduce risk, secure the best execution and can be applied to incumbent business' units, as well as, academic and government institutions for measuring risk exposure and execution ability.

Creativity seeded by clear constraints reduces ambiguity and the Design Valuation Dashboard clearly shows how to foster the type of breakthrough innovation that will play an increasingly important role in the advancement of a productive society.

Special thanks to Agustin Grube Chuck Chugumlung for researching and co-writing this article