Identifying and attracting potential startup firms has so far been a game of chance, with far too much money chasing far too few opportunities. Those most experienced at this game are leading Silicon Valley Venture Capital firms (VC firms). Studies at Harvard University show that entrepreneurs receiving financing from VC firms have only an eighteen percent chance of success. However, a learning curve does take place and if those same entrepreneurs succeed and obtain VC backing for a second startup, they now have a thirty percent success rate.

Even with their access to the most promising startup opportunities, VC firms still perform worse than the NASDAQ index and make most of their money on fees and cuts of the value of successful startup's Initial Public Offering (IPO).

Will Startup Accelerators applying "Wisdom of Crowds" to portfolio management outperform current best practices and could a three-step process consisting of Self-Selection, Crowdsourced Competition and the use of Prediction-Market mechanisms improve the hit-rate of these risky investments? Research conducted both at the Fraunhofer Institute and Hanyang University suggests this is quite possible, so, how does one shepherd the nascent firms though this process?

1) Self-selection of applicants: The first major challenge is to encourage the right applicants and here, the use of competitions with monetary rewards has been shown to be effective. Addressing prospective applicants conventionally calls for email blasts, conference announcements, trade magazines, newspapers, new social media, on and offline user groups. Having a strong brand image from the beginning, such as top VC firms and/or endorsements from investment celebrities can definitely make a big difference for an accelerator, however one cannot count on a viral marketing effect since only six in a million posts go viral.

When one has finally caught the attention of potential applicants, they need to be directed to a quick and easy online application, making the process transparent, interactive and supportive for especially promising candidates.

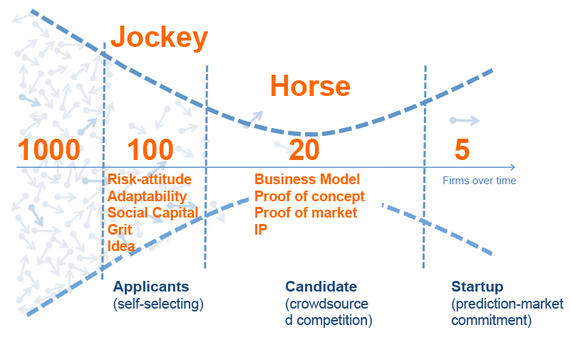

Since the number of applicants can be huge, a necessary self-selection process will weed out those with low entrepreneurial quality. At this point, the jockey is more important than the horse, meaning, the quality of the team is key here, not the plan itself. Interviews with serial-investors suggest that lead indicators for entrepreneurial success at this stage are: Risk-attitude, Adaptability, Social Capital, Grit and Passion for an Idea, so, insure that applicants self-select based on these qualifications.

2) Crowdsouced competition of candidates: Following the application process, suitable candidates are selected over a month long period, using crowdsourcing. The scope of applicants is likely to be broad, which means that a team of twenty or more experts, in various domains, will be required to judge the applications. It is essential for the accelerator to have a solid professional technical network, which also provides the benefit of offering an immense opportunity for the startup accelerator to acquire new knowledge and insights.

Once twenty percent of candidates have made the cut, these candidates need mentoring and now the horse becomes important - developing and executing a good plan. Over a three to six month period the applicants' business model is honed while proof of concept and market is carried out. The opportunities for creating Intellectual Property Rights (IPR) are identified and the ownership and/or use of these rights resolved though negotiation.

3) Startups selected by use of prediction-markets: Finally, the top twenty percent of the candidates need to be consolidated into a top five percent, which will then be offered VC funding. Studies at Hanyang University have shown that the use of prediction-market mechanisms can be effective in fostering breakthrough innovative ideas while providing an early lead indicator for the most promising business opportunities. The candidates themselves, the accelerators and even outside observers and prospective users could be invited to place bets on the outcome of this phase, effectively crowdsourcing the selection of the winners.

After identification of the most promising startup firms, these firms would then be mentored and financed though the engineering development, marketing and full-scale introduction of a wide range of offerings catering to various markets.

Effectively and efficiently managing a portfolio of startup companies requires extra attention to identification and mediation of risk. Crowdsourcing offers one way to address the recruiting, mentoring and final selection and provides the best guarantee for the success of these startups.