(This post was originally published at Capitol Startup)

"If you gave a shit about the future of America you'd change your stance" said an avid Bernie Sanders supporter, in response to my skepticism.

Arguing against the idea of "free college for all" does not make you a bad person. But what kind of monster wouldn't want EVERYONE to get a free college education??

This is the problem when you try to simplify an immensely important yet complicated situation into a binary choice. First of all, there's a lot of incorrect assumptions and bad leaps of logic embedded in that question. Of course I want everyone to have the opportunity to go to college. The disagreement is how we make sure this opportunity is available to everyone, and all I'm suggesting is that saying "screw it, make it all tuition-free" is probably not the best solution. But hell, it's a lot easier to attack me than to, you know, counter my skepticism with facts.

The fact is that there are legitimate issues with Bernie Sanders' "College For All" Plan. And I'd venture to guess that exactly 100 per cent of people who LIKE, SHARE and COMMENT on all that annoying Facebook propaganda from "Bernie Sanders For President"' and "Occupy Democrats" haven't even tried to consider any unintended consequences of the policy they're fighting for.

What's in this plan? The basics are:

- The federal government would subsidize $2 for every $1 states spend on college

- To qualify for federal funding, states must meet a number of requirements designed to protect students, ensure quality, and reduce ballooning costs- aka strings attached.

If you have no interest in diving deep into these policies, reading the research and understand the dynamics as best you can -- which is totally fine, it's not for everyone -- then you probably shouldn't be passionately fighting for that policy in the first place, and definitely should not be personally attacking those who disagree.

But if you do want to be a responsible voter, do yourself a favor and at least ponder these questions and concerns regarding Bernie Sanders' plan for tuition-free college-

The term "expensive" is relative. The problem isn't that college is too expensive, because according to every metric and calculation, college is still worth it from a financial and societal perspective despite the rising costs to attend. The real problem is that even though college is still "worth it", the cost to attend has risen to the point where some people who want to go and are qualified to go can't afford to go--that's the problem. The cost of tuition, room & board and fees at a four-year institution rose nearly 130 percent between 1982 and 2013 after adjusting for inflation. But why?

"Between 1998 and 2008, America's private colleges increased spending on instruction by 22 percent while increasing spending on administration and staff support by 36 percent"

-Washington Monthly, "The Administrators Ate My Tuition"

The most obvious culprit is that spending at these universities is OUT. OF. CONTROL. And why wouldn't it be? These universities are competing for a fresh wave of incoming students every year, and in order to attract those students, schools choose to spend more and more on non-academic expenses such as recreation centers and new buildings.

With all this new infrastructure comes costly overhead. Schools raise tuition to pay for these expenses, because they know there is an abundance of money available to students in the forms of grants, scholarships and loans, so the schools know they will get paid regardless of how high tuition is and regardless of how crushing that debt is to their newly-minted graduates.

And this isn't just theoretical. Between 1998 and 2008 at private universities, spending on instructors rose by 22 percent while spending on administration and support staff rose by 36 percent. And this problem isn't only with private colleges--in the California State University system, between 1975 and 2008, the number of full-time faculty members rose slightly from 11,614 to 12,019 while the number of administrators grew from 3,800 to 12,183, which now out-numbers the full-time faculty.

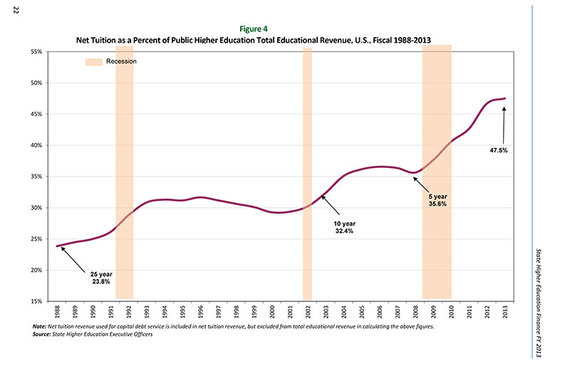

The other argument for why tuitions have risen so much is because state funding for public universities were slashed dramatically in 2008 during the recession.

The numbers don't make sense here though--this only implies that expensive tuition has only been a phenomenon since 2008. For example, in-state tuition at the University of Michigan doubled in real terms between 1960 and 1980 despite state funding for higher education in per capita real dollars rising throughout this entire period until it hit it's peak in the mid 1990s.

People who point to state budget cuts as the sole reason why tuitions are out-of-control may be confusing correlation with causation. If state funding decreased, by definition all other sources of income would have a higher share of the percentage- that's math.

So how does Bernie Sanders' plan address the root causes of rising tuition costs and operating expenses? It doesn't, not even a little--it simply passes along the costs to the federal government. But it gets worse. His plan actually removes one of the last controls against runaway costs -- tuition -- and replaces it with federal subsidies that match state spending 2:1 and therefore encourages increased spending since from a state budgeting perspective, everything just became 67 percent cheaper.

"DC is doing such a great job, we should entrust them with more"

-No one ever

At this point, we can all agree that there are certainly problems with the unsustainability of college budgets, both from a revenue and expense side. Our elected officials in Washington DC have been doing such a great job up until this point on managing things that we should obviously extend their reach to our higher education system as well, right?

Our entire governmental system is based on procedures and institutions. And yes, when someone you support is in a position to manage situations, you're happy. But Presidents are only guaranteed to be in that position for four years, Congressmen and Congresswomen two years, and Senators six years. Bernie Sanders' plan is not just empowering Bernie Sanders to impose his will on the higher education system, it's empowering all future Presidents to do so.

What happens when the Presidency changes hands? You're not just injecting more politics into the higher education system, you're ensuring instability by having the federal government subsidize higher education with money that has strings attached.

This issue is compounded when you consider that colleges already have an issue with delivering quality education. According to a Gallup-Lumina poll, only four in 10 Americans believe colleges are transforming to better meet the needs of today's students, and only 13 percent strongly agree that college graduates are prepared to enter the workforce.

Do you really think that the changes we need to make to our higher education system will come from the DC bureaucracy? Nope. Does Bernie's plan do anything to address quality concerns of delivering a modern education? Nope, it eliminates them.

Our country became great because decision-making abilities were decentralized by our checks and balances not only at the federal level -- executive, legislative and judiciary -- but downstream between the federal government and the states, and then between the states and their local governments. It's the classic example of empowering people from the bottom up, empowering people at smaller levels to make decisions, experiment with different strategies, and figure out what works best. This is how innovation happens and best-practices are developed. When you consolidate power to the top, not only do you introduce political instability, but you eliminate the historical source of innovation--innovation we desperately need in the higher education space.

Yes, we want more people to have access to higher education. But there's a huge difference between making something accessible and making something free. Who does tuition-free public university really benefit?

Well it definitely doesn't benefit people who don't want to go to college. It also doesn't benefit those who would rather go to technical, vocational or trade school. If the goal of Bernie Sanders' bill is to give everyone a fair opportunity to continue their education, looking only at colleges and universities is short-sighted, and frankly, selfish.

Considering 34% of college graduates of public four-year universities graduate debt-free, making public colleges tuition-free also wouldn't have benefitted them as much. Since they and their family -- the "1%" -- had the means to pay for college, Bernie Sanders' plan would essentially be spending money on a benefit for people that didn't necessarily need it as much as others.

So not only does Bernie's plan not address the root cause of the accessibility problems of higher education, but its poorly targeted since it fails to help a significant portion of our population, and spends a lot on people who didn't need help in the first place. And when you spend unnecessarily, you need to tax unnecessarily. Since money doesn't just grow on trees, this all points to this plan being a very inefficient proposal.

But wait, there's more (problems)!

What Bernie Sanders wants to do to finance his tuition-free college plan is impose a 0.50% tax on all stock transactions, 0.10% on bond transactions, and 0.005% on all derivative transactions. This structure poses a lot of problems- it favors certain financial instruments over others, it encourages less liquidity in the markets, and it levies too high of a tax burden on financial transactions.

First, let's talk about the size of this tax burden. Even Jared Bernstein, a well-known economic advisor to Joe Biden and a Bernie Sanders ally suggests that this tax is too high-- he says a 0.01% on all stock, bond and derivative transactions -- a level 50x smaller than what Bernie Sanders is proposing -- is appropriate.

Aside from the size of the tax burden, why all the different rates? Having a smaller tax on derivatives than bonds and stocks will encourage more investments into derivatives- the exact instrument that Bernie Sanders is always up-in-arms about. But the fact that these rates are different for varying financial instruments is troubling- by playing favorites with these financial instruments in the tax code, private market decision-making is swayed away from what makes business sense to what makes tax-efficient sense, i.e. dodging taxes, and that's never good for the efficiency of the markets or the efficiency of the economy. This is the same logic as why capital gains and income should be taxed at exactly the same rate, a viewpoint held by most Democrats and even a lot of Republicans.

You don't even need to have faith in this logic, because we have historical data with what happened in other countries when they imposed financial transaction taxes.

According to the CBO:

"Umlauf (1993) shows that Swedish stocks fell significantly in the month before the tax took effect. Hu (1998) examined numerous STT changes in Asian countries from 1975 to 1994 and found that increases in transactions costs consistently reduced daily returns. Bond, Hawkins, and Klemm (2004) estimate that the cuts in the stamp duty raised share prices, more for shares with high turnover rates. Amihud and Mendelson (1992) find similar results for high-turnover stocks relative to other stocks.

Matheson (2011) also estimates the impact of an FTT on the cost of capital, with the effects again varying dramatically by holding period and tax rate. A 0.5 percent FTT will raise the cost of capital by 5.0 percentage points for an asset held for just 0.1 years, 0.50 percentage points for an asset held for a year, and 0.05 percentage points for an asset held 10 years."

The CBO also built a model suggesting a 0.50% financial transaction tax would decrease stock market value by 9.3% and 14.6%. The typical response from Bernie Sanders supporters to these facts would be, "Well, the 1% can afford a 14.6% decrease in their portfolios". And while I wouldn't disagree with that, you know who wouldn't be able to afford that loss? People close to retirement who have money saved in their 401k. People who are saving up to buy a house. College endowment funds. State pension funds. This tax taxes indiscriminately, and a double-digit loss hurts a lot more for low and middle-income Americans.

And as Tim Worstall points out, not only would the financial transaction tax be an immediate burden on owners of capital, the long-run effects of lower asset prices and higher costs of capital would actually result in other taxes generating less revenue, such as capital gains and income taxes. When all is said and done, it's very likely that the net tax collection would be negative.

Nothing irks me more than poking holes in a policy proposal without offering up some alternative ideas. After all, if people knew there were other ways to improve college accessibility in America, there is no way a logical person could support the Bernie Sanders' plan.

Schools need more skin in the game for student outcomes

Instead of setting their tuition and forcing students to hit the private markets or government funding to figure out how to finance the tuition costs, would it be possible for schools to self-finance their students? For instance, a school could agree to lend the student money, and in return the student pays x% of their salary after graduation until the initial principal plus interest has been paid off. This would give the schools a very, very strong incentive to make sure they are preparing their graduates to excel in the workplace after graduation. And if a number of schools adopt this method of financing, it would put downward pressure on interest rates and the payback rate, making sure that student are never taken advantage of financially.

Regardless of if this idea is implemented or not, the status quo methods of college financing need to change. Since colleges have an incentive to continue to increase spending, if they know that students have basically an unlimited borrowing capability to pay tuition, according to the Fed, schools will simply continue to raise tuition rates. And as schools continue to spend, the legacy costs associated with that spending will be nearly impossible to cut when the time comes- a vicious cycle.

Variable pricing for college credits

Why does it cost the same amount to attend an interpretive dance class and a mechanical engineering class? Not only do both courses arm students with wildly different marketable skills, but they both cost different amounts to operate, especially from an instruction standpoint. A rockstar mechanical engineer professor and a rockstar interpretive dance teacher require much different salaries since you must compete with offers they are receiving from the private sector.

Variable college credit pricing would be beneficial for students as well as the overall labor force. It would allow students to truly study what they are passionate about without feeling guilty about the cost or potential lack of lucrative employment opportunities after graduation.

Assuming pricing for the credits was tracking the potential earning value after graduation, this new pricing mechanism would also help allocate students into appropriate fields by putting market pressure on over- and under-enrollment into certain majors.

A strong, efficient, well-run higher education system is vital for a prosperous American future- we all agree on this. What we need to discuss though is how, and not only is Bernie Sanders' plan not the only option, it may very well do much more harm than good.

Please leave questions and comments in the comment section below. Let's keep it civil! And if you liked this article, you'll love my piece on the 9 Issues Economists Across the Political Spectrum Overwhelmingly Agree On.