We all know what a Tweet is... so what's a Weeb? Weeb is my term for what people in China are doing on Weibo, the Twitter-like service for Chinese.

For those new to Weibo it's pronounced "we bow." But does Wall Street? Bow, that is. Not yet it seems.

Let's take a closer look at each, especially in two ways: 1) what they mean for media and 2) the value compared to each other. How they stack up on Wall Street among investors.

When I first went to China in 1998 there were 6 million people online -- in the whole country, and most of them were government researchers or university students.

Today there are about 800 million, many connecting via mobile.

Most of them are Weebing or using something similar using other services from Tencent or others. But my focus is these two head to head: Twitter vs. Sina's Weibo. Twitter (NASDAQ:TWTR) went public last month and has had a rollercoaster ride so far but up significantly from its $26/share pricing.

First off, I think the short and snappy bleating (the goat sound) both do is the future of media and marketing. The world of Information is free and accelerating. I also see the short form media becoming more widespread vs. the TV/radio/newspaper formats. I Tweet, therefore I am... all in 140k, or less.

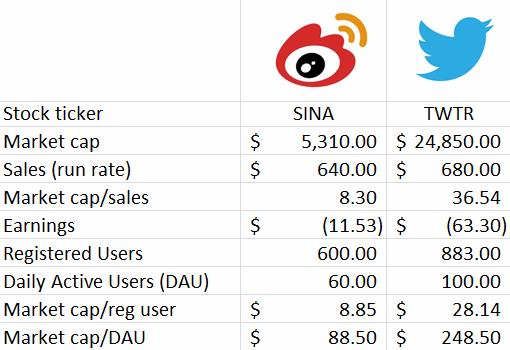

Point two, how do these two compare in valuation? Investors value a Tweeter more than 3x that of the Weeber. The interesting thing is that both companies have about the same level of annualized sales if we take the most recent quarter and annualize it.

Let's go to the tables and charts, made with painstaking care:

Note that Weibo is only a part of Sina (NASDAQ:SINA) but for sake of value it only emphasizes the gap even more with Twitter. All of Sina is valued about 80% less.

I don't own shares of either company. In terms of market I believe China's consumer and ad market is very attractive. Income is growing in China, people are buying gadgets and cars. Just ask any commuter in Beijing stuck in traffic with their smartphones.

We are entering the micro-media age. Welcome. Or should I just say ;)