So, where's my bailout? For that matter, where's yours, too?

Anyone having trouble paying their mortgage is almost certainly late on their car or truck loans, too.

It used to be said that a house was the largest expenditure in any person's lifetime; but if someone buys five or more new cars over 40 or 50 years, depending on where they live, those purchases could easily cost more, in total, than their home.

The auto industry is a very powerful and significant part of the US economy and has been for many years; just last week, GM "celebrated" its 100th anniversary by displaying a "near-production version" of their Volt plug-in gas/electric hybrid (below; Steve Parker photo), slated for sale in 2011, maybe 2010. There's not one American alive who ever knew a US without an auto industry.

Import and domestic dealers, in total, have annual sales of about $480 billion from new cars and trucks alone, not counting used vehicle sales, whose totals are even higher. Annual car and truck sales in the US, new and used, amount to a near-trillion dollar business.

People in and out of the auto industry are asking that if millions of home mortgages can be purchased by the government, and which might be re-written to help the borrower, what about the tens of millions of outstanding car and truck loan contracts, many of which are going bad?

And while it can take several months, even a year, to foreclose on and repossess a house and property, missing or being late just three payments on a car loan will, in many cases, result in a repossession.

A vehicle repo often results in a person or family losing their only way to get to and from a job; that is, if they're still employed.

"Well, there's always the bus and train," say some, but in the America west of the Mississippi, useful mass-transit and public transportation are often hard-to-find alternatives to private cars and trucks.

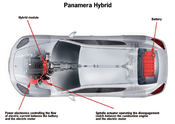

From Denver south to Dallas then west to Phoenix and San Diego, then north to Los Angeles, San Francisco, Portland and Seattle, meaningful public transit, bus and rail, is lacking at best, non-existent at worst. (Porsche-supplied artwork shows a hybrid system concept for their new Panamera four-door; Click on any photo to view them in a larger format).

Industry newspaper Automotive News reports, in their September 23 edition, "

The American Financial Services Association is asking Congress to allow auto finance companies and other institutions to tap the $700 billion bailout fund designed for the troubled mortgage industry. The trade association, based in Washington, DC, also is proposing that automobile loans be classified as "troubled assets" along with home mortgages.

The car-loans question is separate from the $25 billion in government loans being sought by the auto industry to help retool plants to build fuel-efficient vehicles. Congress is considering up to $7.5 billion in funding to begin financing those loans, possibly as early as this week."

The group represents banks, securities firms and asset management companies, and says while they are not prejudging whether securitized auto loans should be in any bailout program, they do say the Treasury Department should have the option of buying and perhaps re-writing car loans as they may well do with home mortgages.

Compared to the $80 billion AIG bailout and the $700 billion bailout proposed for Wall Street, the $50 billion for the Detroit Three, promoted by Sen. Carl Levin (D-MI) to try and save a 100-year old American industry, seems like small change. Now that request has been whittled down to $25 billion, while the race is on by every industry and financial entity to be declared as having "troubled assets."

Other "troubled debt" officially includes (so far) student loans, home equity loans and credit cards.

For the 80 million Americans who did buy a new car or truck in the past five years, many still have at least two years left on their contracts. (Chrysler's cut-away artwork shows Dodge's "Hemi-Hybrid" Durango SUV).

The average price of a new car or truck in the US is now over $30,000. New car and truck loans are regularly written for 60 or even 72 months; gone forever are the 36 and 48 month contracts which many millions of Americans signed in the 1970s through the '90s. In addition to other financial pressures, many millions of Americans now find themselves trapped in car loans of six years, sometimes longer, while being charged high interest rates and getting squeezed by every creditor they may owe.

So far, Wall Streeters haven't been jumping out windows as they did during the First Depression in 1929, but it's easy to see why many home- and car-owners might choose that route out of their obligations. (GMC displayed this Denali hybrid concept at the 2008 Chicago Auto Show).

Many so-called consumer finance experts say people should pay their mortgage first, credit cards second and their car or truck loan third.

The reasoning? People are generally thought to have an easier time finding personal transportation than getting a credit card or home mortgage and that there are more options when buying a car or truck; used cars, a loan from family or friends or dealer financing are just three of those options, many think.

But that belief is just not realistic today, rooted in a time when car payments were not over $800 a month, a fairly typical amount on a lease or purchase contract written for a $40,000 car or truck.

The Detroit Three now say that for $25 billion, whether in loan guarantees (which is what saved Chrysler in 1979) or outright loans from the Fed, they will be able to convert factories made to build trucks to greener facilities making fuel efficient cars, do the research and development necessary to bring the latest and best technologies to Detroit and, ultimately, bring to market the kind of cars, crossovers and trucks which Americans want to buy.

That tired old argument from Detroit, that they built all those big trucks and SUVs for over 20 years was "because the buying public was demanding them," is now officially over. And I never believed that in the first place.

Americans, like European and Asian car-buyers have for 50 years, are finally demanding cleaner and more efficient cars and trucks, and are willing to pay a premium for them, just as long as there are tax incentives from the states and DC after they make their socially-conscious purchase.