With people living longer, getting less 401K matching from employers, helping their children and grandchildren more than ever before, is it possible to create a stress free retirement?

The questions abound: will my retirement investments perform well? Will I retire when I'm planning to and will my money last? Asking the right questions seems easy; however, the answers may be more complex.

Many investors believe their aim should be to save a given amount -- a magic number. Rather than aiming to save a particular total, it's vital to consider how that total is going to be part of your retirement plan. There are two schools of thought: 1) Acquire enough principal to live on its interest at 7 percent, or, 2) Spend down annually.

Don't underestimate the importance of advance planning -- it can save headaches down the road. The first strategy of living off 7 percent principal works as long as it's enough to cover spending. Inflation, stagflation (the occurrence of a recession and high inflation due to the government infusing the money supply with extra cash), taxes, fluctuations in portfolio investments and other variables taken into account mean this isn't guaranteed. Diluting the money supply may be a macroeconomic band-aid; however, it can be a whopper for the retiree and may affect the classic "spending down" model.

Investors easily forget that the moment they begin spending down their principal that not only is their nest egg diminishing, but the earned interest is significantly less. Inflation and stagflation usually equate to spending more for the retiree -- so it's important to allow for variables as much as possible in your retirement plan.

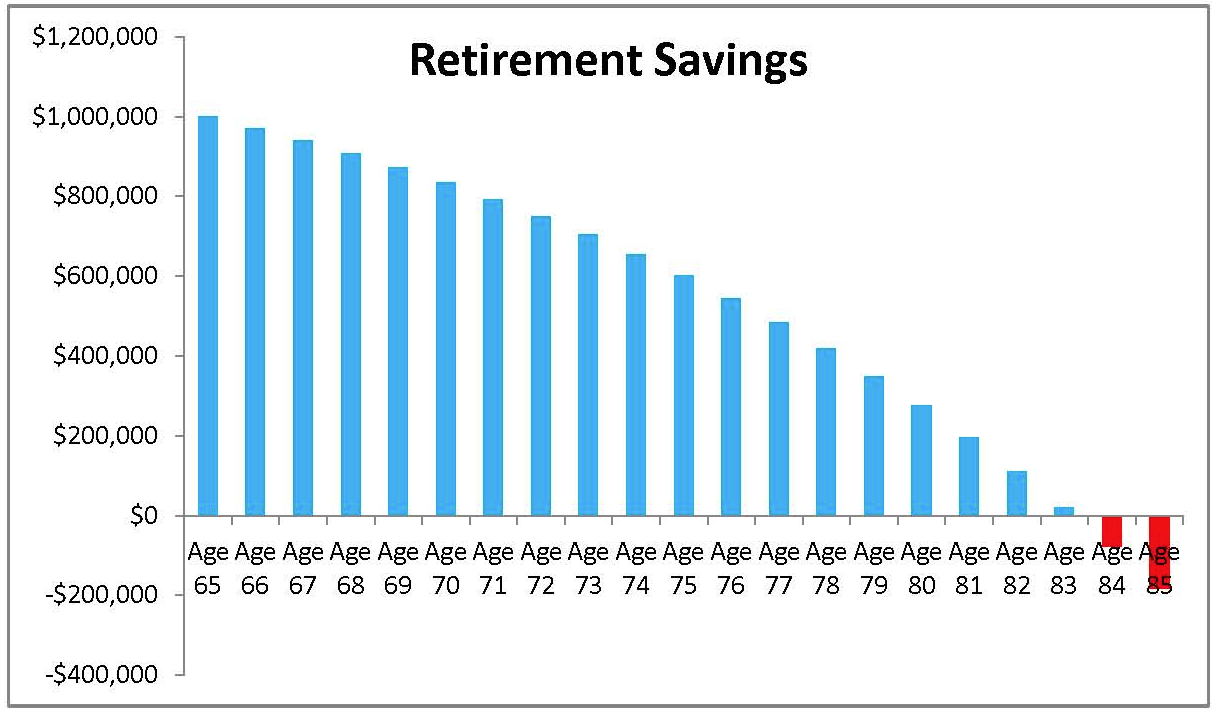

Here is a basic example of what can be achieved when planning starts early. An investor has saved $1M for retirement. He requires $84,000 per year to support his ordinary living expenses ($7,000 in monthly expenses). Many investors believe simply earnings 7% per year will be sufficient in order to accomplish this, without drawing down principal. However, this is not the case. Remember, the investor must pay taxes on his 7% earnings, or if this is in a retirement account, must pay taxes on his withdrawals. Even at a 15% tax rate, principal will degrade to $600,000 by age 75. By age 84, the investor is broke. (Note: The 7% earnings in our example exceeds present market rate; 30-year investments currently earn around 3% today.)

Investors who want to maintain their standard of living need more, yet, many have become increasingly cautious -- not surprising given the global economic picture. History tends to repeat itself, yet, investors don't always listen. 1929, 1973, 1980, the early 2000s, and 2008, to name a few periods in the past 100 years, brought economic fluctuation which affected a wide breadth, yet, the average investor still does not always "recession proof" retirement savings.

General wisdom encourages investors to save: maximize 401K plans (especially if they're matched) and take advantage of pre-tax plans such as a Roth IRA. As investors age, generally risk is not encouraged. But, is there such a thing as "too conservative?" Low interest rates will bring in lower returns and may diminish an investor's purchasing power. According to the U.S. Labor Department, there was a 39 percent loss in purchasing power between 1991 and 2011. If this trend continues, it is likely to reduce the standard of living for retirees and affect even those who have amassed millions.

So what are the alternatives?

•Know what you actually need from year-to-year -- retirement is no time to be in a guessing game about what will work and what won't.

•Consider alternative investment mixes. Experienced, competent, professional wealth managers have the know-how to create an integrated mix of assets and funds. Speak to a fiduciary to learn about what options are available.

•Manage your taxes! One of the mistakes investors make is to think that just because a paycheck isn't coming in anymore, taxes will be both easier and greatly reduced. Wrong! Taxable assets continue to need proper asset protection -- including the money an investor plans to live on in retirement. Want to learn more? Contact us.

The information contained in this article is provided solely for convenience purposes only and all users thereof should be guided accordingly. The Abernathy Group II does not hold itself out as a legal or tax adviser. If you wish to receive a legal opinion or tax advice on the matter(s) in this report please contact our offices and we will refer you to an appropriate legal practitioner.