Let's be clear. I think that there is a fair change of a repetition of the global financial crisis. After the financial crash of 2007-2008, major central banks ran to the rescue of the world economy by pushing interest rates to zero (or below) and filling the world with artificial liquidity through programs of quantitative easing. These measures have distorted asset prices in a way that has not seen in modern history. I consider it to be unlikely the asset bubbles they have created can be reined in without seriously damaging the underlying economy.

At the same time, politics are in disarray. There has been a fierce backlash against, e.g., globalization in developed countries. Tensions, especially in Europe, are running high. Elections in France, the Netherlands and in Germany could lead to starkly opposing outcomes, with other winners pushing for exit from the common currency and others for a transfer or a political union, which is highly unpopular in the Northern member states of the euro.

These developments bear a comparison to run-ups to two very different eras with some very different outcomes. These are the global recession and fast recovery in the 1980's and the Great Depression in the 1930's.

1980's and the global recession

The 1970's ended with high inflation, which was driven mostly by the oil price shocks and loose monetary policies aimed at establishing full employment. Jimmy Carter appointed Paul Volcker to run the Fed in 1979. By that time, citizens and corporations were grown tired of the raging inflation, which had reached double-digits. The US economy was basically in stagflation (no growth + inflation). After Ronald Reagan become the 40th President, Volcker enacted draconian measures to bring down inflation. The Fed funds rate was raised to 20 % (June 1981) and by 1982, inflation was brought down to 3.8 percent. High rates were kept in place for two years with the support of President Reagan. They crushed inflation expectations but created a recession, which turned into a fast recovery fueled by tax reductions and financial deregulation.

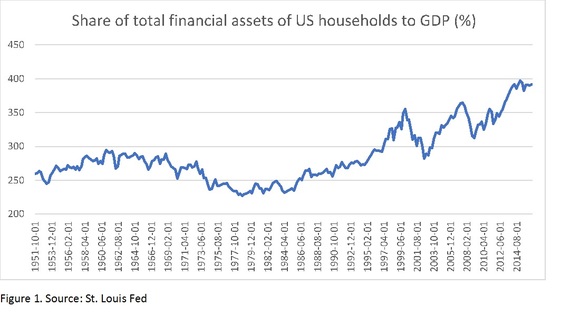

Although inflation is currently under control, asset price inflation has been fierce, which has led to a financial bubble induced by the ultra-loose monetary policies (see Figure 1).

The question is, where do we go from here? Volcker and Reagan worked together to bring down inflation and create a recovery. What will Donald Trump and Janet Yellen (or some other future Fed president) do? Could the asset bubble be wound down causing only a mild recession followed by a brisk recovery? I am skeptical, but economic wonders have been achieved before.

1930's and the Great DepressionCurrent situation could also lead to a considerably more negative outcome, which would bear similarities with the 1930's. This scenario demands a fair amount of speculation, but I consider the following to be firmly within the realm of possibilities.

The world had enjoyed on very high economic growth, globalization (which peaked before WWI, however) and political stability after the First World War. US rose to global economic dominance through astonishing accumulation of private capital and due to the destruction of private capital in Europe. Capitalism was living its heyday.

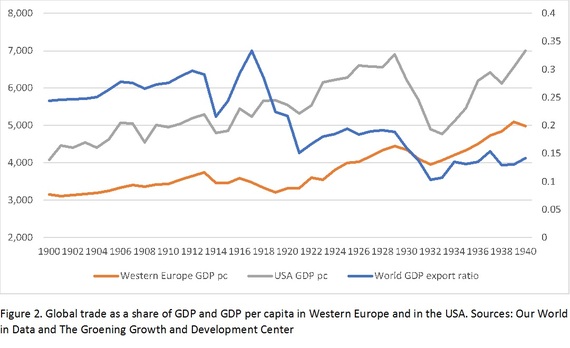

The crash of the US stock market between October 24 and 29 in 1929, which followed the crash of London stock market in September, started a global financial crisis. After the crash, voices for nationalistic and isolationist policies grew and countries tried to protect their economies with tariffs and barriers sparking an international trade war. Global economy halted and the crisis morphed into the Great Depression (see Figure 2). It shed over 40 billion of the GDP of the US alone and eventually led to the onset of the most destructive war world has ever seen.

Although the tone of some political discussions bear similarities to the 1930's, there are three important differences between now and the 1930's: rising employment, lack of (oppressive) ideology and international cooperation. However, if for example the US stock market would crash, it would onset crashes also in other major markets. This would send financial markets into panic with flocks of investors heading for the 'exists' at the same time. Fire sales would ensue collapsing the prices of assets and bonds. Banks all over the world would suffer balance sheet crippling losses leading them in the verge of failure, starting from developing countries and Europe. Central banks with their already stretched balance sheets would be unable to stop the fall and global financial crisis would commence. Due to the crisis, unemployment would rise and international cooperation would become under heavy strain. Failing financial and political systems would give a raise to ideological movements, like (maybe) socialism. If this were come to be, political leaders would face the same options as in the 1930's. That is, to embrace global coordination and push through harsh and possibly career-killing corrective measures or resort to isolationism and protectionism. How would they choose?

World at cross-roads

Although historical comparisons, like the one presented here, are never fully comparable to the present day, they do shed some light on the possible outcomes. It may be impossible to avoid a global recession or a crisis within the next few years, but lot depends on responses when it hits.

Distrust to political leaders, the "elite" and the media has grown to exceptional levels even among the high-income and college educated citizens. The current course of concentrated wealth accumulation, centered decision making (especially in Europe) and biased media practices will only lead to democratic backlashes, like Brexit, and hurl us towards a catastrophic outcome if (when) the next crisis hits.

The world is at cross-roads. We can either embrace the democratic process and pragmatism or resort to ideologies, like globalism, federalism, populism or isolationism. In any case, we cannot dodge the decision.