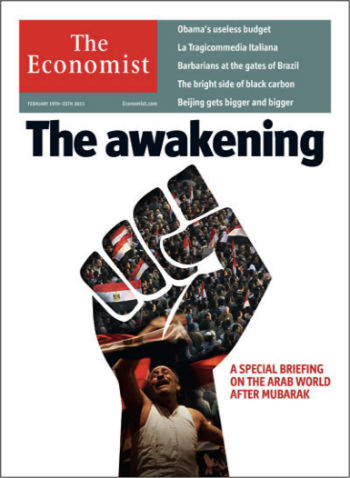

First, let's admire this fist:

The Economist put this on its cover earlier this year to celebrate the Arab Spring.

Let's use it, today, for the Occupy Wall Street movement.

People raising their fists, peacefully, against "greed is good," against wildly inequitable distribution of wealth, against fortunes made on derivatives and bail outs and what Warren Buffett called "financial weapons of mass destruction." Fists raised against not just fast money, you know, the stuff of 1,000 pt. drops in the Dow in 20 minutes and the stuff of Goldman Sachs 2010 bonuses "trimmed to $16 billion."

People raising their fists not against tyrants and political oppression, but against the hegemony of distant bankers and invisible investments, going who knows where on the planet and doing who knows what to who knows who in the ever-accelerating pursuit of maximum financial speed -- more, bigger, faster, and unlimited gains for them with their hands on the levers.

I see your fists and raise you a tent. A tent?

Not just any tent. This tent:

In this tent on a farm field in Vermont last year, 600 of us from more than 30 states and several foreign countries gathered and committed $4 million to 12 small food entrepreneurs from around the country who are creating jobs, getting toxics out of the food chain, restoring soil fertility, preserving ground water, keeping carbon in the soil and out of the atmosphere, fighting diabetes and otherwise striking at some of the root problems -- literally and metaphorically -- of our economy and our culture. Showing the way towards life after fast food and fast money.

This is the tent of Slow Money.

In it, we are beginning to put some of our money to work as far from Wall Street as far can be... that is, near where we live, in things that we understand, things that bring tangible, immediate benefits to our communities.

We are starting with small food enterprises, which bring fertility to the soil of the economy: small organic farms, grain mills, creameries, local slaughterhouses, seed companies, compost companies, restaurants that source locally, butchers and bakers and, sure, a beeswax candlemaker or two, food hubs, community kitchens, community markets, school gardens, niche organic brands, makers of sustainable agricultural inputs, and more.

Could this be the beginning of a new kind of investing, something as powerful, in its own right, as protest? As powerful as conscientious objection? Can we call it conscientious investing?

We invite some of you to take a break, let your arms down and give your fists a rest. For a few days.

Join us in San Francisco, October 12-14, where we will be for the Slow Money's 3rd National Gathering. Folks from all across the country, and from Europe and South America, too, working together to support a new kind of entrepreneurship, a new kind of investing for the 21st century.

Our goal: one million Americans investing 1% of their money in local food systems, within a decade. We think this is the path towards an economy that is healthier, fairer, more balanced, more sustainable.

While we use the 99%er side of our brain to protest against the bad 1%, let's also use the slow money side of our brain, and our heart, to roll our sleeves up and begin investing a good 1%.

And maybe, just maybe, we'll find our way to life after fast money.

--

Woody Tasch is Chairman of Slow Money, whose 3rd national gathering takes place at Ft. Mason, San Francisco, October 12-14. Tasch is author of Inquiries into the Nature of Slow Money: Investing as if Food, Farms and Fertility Mattered.

Our 2024 Coverage Needs You

It's Another Trump-Biden Showdown — And We Need Your Help

The Future Of Democracy Is At Stake

Our 2024 Coverage Needs You

Your Loyalty Means The World To Us

As Americans head to the polls in 2024, the very future of our country is at stake. At HuffPost, we believe that a free press is critical to creating well-informed voters. That's why our journalism is free for everyone, even though other newsrooms retreat behind expensive paywalls.

Our journalists will continue to cover the twists and turns during this historic presidential election. With your help, we'll bring you hard-hitting investigations, well-researched analysis and timely takes you can't find elsewhere. Reporting in this current political climate is a responsibility we do not take lightly, and we thank you for your support.

Contribute as little as $2 to keep our news free for all.

Can't afford to donate? Support HuffPost by creating a free account and log in while you read.

The 2024 election is heating up, and women's rights, health care, voting rights, and the very future of democracy are all at stake. Donald Trump will face Joe Biden in the most consequential vote of our time. And HuffPost will be there, covering every twist and turn. America's future hangs in the balance. Would you consider contributing to support our journalism and keep it free for all during this critical season?

HuffPost believes news should be accessible to everyone, regardless of their ability to pay for it. We rely on readers like you to help fund our work. Any contribution you can make — even as little as $2 — goes directly toward supporting the impactful journalism that we will continue to produce this year. Thank you for being part of our story.

Can't afford to donate? Support HuffPost by creating a free account and log in while you read.

It's official: Donald Trump will face Joe Biden this fall in the presidential election. As we face the most consequential presidential election of our time, HuffPost is committed to bringing you up-to-date, accurate news about the 2024 race. While other outlets have retreated behind paywalls, you can trust our news will stay free.

But we can't do it without your help. Reader funding is one of the key ways we support our newsroom. Would you consider making a donation to help fund our news during this critical time? Your contributions are vital to supporting a free press.

Contribute as little as $2 to keep our journalism free and accessible to all.

Can't afford to donate? Support HuffPost by creating a free account and log in while you read.

As Americans head to the polls in 2024, the very future of our country is at stake. At HuffPost, we believe that a free press is critical to creating well-informed voters. That's why our journalism is free for everyone, even though other newsrooms retreat behind expensive paywalls.

Our journalists will continue to cover the twists and turns during this historic presidential election. With your help, we'll bring you hard-hitting investigations, well-researched analysis and timely takes you can't find elsewhere. Reporting in this current political climate is a responsibility we do not take lightly, and we thank you for your support.

Contribute as little as $2 to keep our news free for all.

Can't afford to donate? Support HuffPost by creating a free account and log in while you read.

Dear HuffPost Reader

Thank you for your past contribution to HuffPost. We are sincerely grateful for readers like you who help us ensure that we can keep our journalism free for everyone.

The stakes are high this year, and our 2024 coverage could use continued support. Would you consider becoming a regular HuffPost contributor?

Dear HuffPost Reader

Thank you for your past contribution to HuffPost. We are sincerely grateful for readers like you who help us ensure that we can keep our journalism free for everyone.

The stakes are high this year, and our 2024 coverage could use continued support. If circumstances have changed since you last contributed, we hope you'll consider contributing to HuffPost once more.

Already contributed? Log in to hide these messages.