Herman Cain's defense of those who question the math of his 999 plan is to "run the 'rithmetic." This is a clever Cain ruse, because he knows that most of us not only won't "run the 'rithmetic," but due to Republican efforts to cripple public education most of us can't "run the 'rithmetic." What Cain forgets is that I cheated off of some very intelligent Korean exchange students and earned a minor in mathematics. All my literature major friends thought I was wasting my time with math. According to their logic, as long as I was able to identify Dante Alighieri's allusions to the number three I was mathematically satisfactory. But then Cain showed up and finally gave me something to do with my Casio digital calculator-watch.

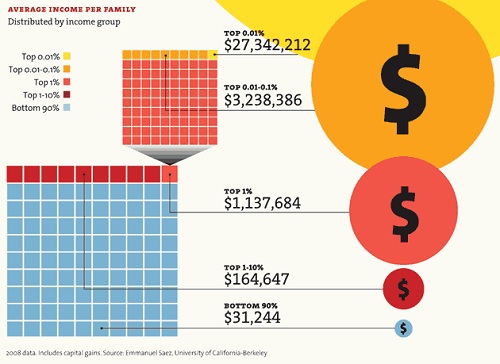

My parents were right: I am average, and as an average American I fell into the 90% demographic of Americans earning an average of $31,244 (Thanks to Mother Jones for the use of their chart).

I made an impressive $27,500.00 dollars last year... ballin! The following calculation will be fairly simple, since I am a single taxpayer with no kids. (Aww ... that last line made my mom cry. I will get married, mom, and make some grandkids, I promise.) Well, onto the math.

Income tax for year 2010:

I had to take away $5,700 for a standard deduction (probably socialism) and $3,650 as a personal exception because I'm single and haven't kissed a girl in months, a payroll tax credit of $400.00, a general sales tax deduction of $1,644.00, opportunity credit deduction of $2,500.00, and a relocation deduction of $4,250.00 which left me with $9,356.00 in taxable income... still ballin.

Since we have marginal tax rates I was then charged...

$8,375 × 10% = $837.50, this left me with $981.00 to be taxed in the next margin -- still marginally ballin!

$981.00 x 15% = $147.15

This left me with $26,515.35 after income taxes ... damn, I sure did make it rain last year, what's up ladies.

Wait, we aren't done yet. I had to pay FICA, which is the sum of the Medicare and Social Security Tax. (Yuck, why did I have to help other Americans!)

$27,500 x 5.65% = $1,553.75

So in total I paid 9.23% in taxes or $2,538.40

This left me with $24,961.40 to buy Che Geuvara t-shirts, Al Franken books, and Cat Stevens CDs.

Of this take home pay I dropped $20,000 on maintaining a modest standard of living. I live in a small one-bedroom apartment, without a television, I steal internet from my neighbors, and I have no wife or kids to spend money on -- so other than the fridge I fill and my Match.com account, I exercise impressive fiscal responsibility.

I paid a 6% sales tax on the aforementioned $20,000 which came to $1,200.00. So last year I paid $3,738.40 in taxes.

Under Herman Cain's plan all deductions would be eliminated and I would pay a 9% income tax:

$27,500 x 9% = $2,475.00

And Cain would increase my sales tax from 6% to a 9% sales tax:

$20,000 x 9% = $1,800.00

So I would have paid a total of $4,275.00 in taxes last year which is a smidge more than the $3,738.40 dollars I paid under the current system. The difference is incremental, but for me and the rest of the 90% of Americans who make an average of $31,244 per year, that incremental difference is quite substantial.

The preceding was a completely selfish, and dare a say a Cain-sian (get it... #TeamHayek) look at the 999 plan -- but there is still a national tax revenue at stake. While I may be paying more taxes under Cain, there are a bunch of millionaires and corporations who will pay so much less under Cain that according to Progress Director of Tax and Budget Policy Michael Linden our federal revenue would have been cut by 50%:

"...the 9-9-9 plan would have generated a bit less than $1.3 trillion in total federal tax revenue (in 2007). That may sound like a lot, but it's only 9.2 percent of GDP. In 2007, we actually collected 18.5 percent of GDP in tax revenue. In other words, the 9-9-9 plan would cut federal revenue in half!"

Have a peek at the adorable table here. According to the tax foundation, Cain's 9% nationwide sales tax is an increase in 47 states. On top of the increase, Cain's tax proposal also impinges on the sovereignty of states. States have the option to give the IRS proxy over their tax structure and they haven't relinquished that right yet -- why would they willfully allow Herman Cain to come in and take over? And doesn't this fly in the face of Cain's desire for small government -- how will taking over a state's tax responsibility lead to a decrease in the government's size? And what does Cain plan to do with Medicare and FICA since his flat tax eliminates all explicit payment into those programs along with all deductions? The 999 plan is a fun slogan but, as it stands now, it is far more fluff than substance. My main problem with Cain's plan is the effect his sales tax will have on the commodity circulation in this country. His impressive wealth accumulation has left him too detached from the common American to properly grasp the ubiquity of the sales tax within our demo.

Remember the story of how the elder George Bush encountered a supermarket price scanner with the astonishment of a child encountering a lightning bug? According to the New York Times, he was amazed with the supermarket technology that, while new to him, had been around for decades. His extreme detachment from the average American has propagated throughout the Republican Party and reappeared in earnest with Cain's 999 plan. A decrease to a 9% income tax will reap a man like Cain significant savings and could make up for his proposed 9% sales tax. But most Americans will actually lose money with Cain's scheme.

Herman Cain is detached from America -- mostly because he doesn't realize how regressive a flat tax is on the middle to low-income classes. This class, which the Republican Party would lead you to believe is being coddled, spends the majority of their income on maintaining basic levels of comfort. Rich people spend a substantially smaller portion of their income on items subject to sales taxes; instead they spend on things called hedge funds, gold-plated gold plates, and advancing methods of alchemy. And with Cain's proposed elimination of the capital gains tax and replacement of the 35% income tax with a 9% income tax, the Scrooge McDucks would bank substantially more money under Cain than they do now. Ayn Rand is on an island with TuPac, Elvis, and Jimmy Hoffa smiling effusively. All this does is tighten the grip on American's already struggling and continually growing lower class by shifting tax pressure from the wealthy to the middle-class.

I guess the 999 plan would work if the majority of Americans quit spending money. It would be like the Bush Tax Refunds but without the refunds. The Bush refunds failed because people either spent the money paying off debt or banked the money for a rainy day, like the day Cain's 999 plan goes into action. Cain's plan would slow commerce and reduce commodity circulation. Commodity circulation is important to the health of an economy, but Bush's refund failed at prompting that circulation and Cain's plan would also impede circulation, and therefore further hinder our economy.

Cain's 999 plan is a catch-phrase, a remnant from his Godfather Pizza days, it is a hollow slogan, make-believe. Let's not fall for make believe.