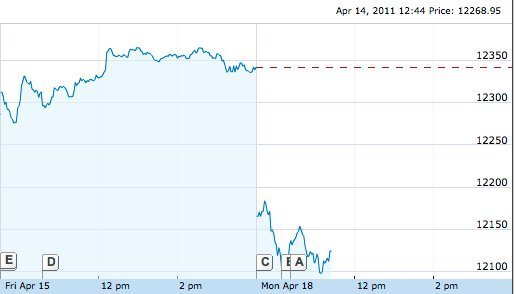

Update: The Dow Jones closed at 12,201.59, dropping 140.25 points for the day (1.14 percent).

On Monday, stocks took a big hit after credit-rating agency Standard & Poor's downgraded the longterm outlook the U.S.'s previously-stable AAA credit rating to negative, citing a lack of faith in the country to address widening budget deficits.

The Dow Jones is currently down by 1.76 percent (217.66 points) to 12,124.17.

"Because the U.S. has, relative to its 'AAA' peers, what we consider to be very large budget deficits and rising government indebtedness and the path to addressing these is not clear to us, we have revised our outlook on the long-term rating," S&P said in a press release.

This is the first time S&P has downgraded the U.S. debt rating, according to CNBC, who also noted that America was briefly on Moody's "negative watch" in January 1996, when Republicans fought against raising the debt ceiling.

Gary Jenkins of Evolution securities says this should be a wake-up call for the U.S. government.

"It is not really a shock that one of the agencies have decided to slightly weaken the overall rating category of the US," said Jenkins, according to the Guardian. "[B]ut what is a surprise is that the agency makes no comment regarding the upcoming requirement to raise the debt ceiling, which if delayed could well lead to a watchlisting in our opinion[.]"

Regardless of the debt limit not being directly addressed in S&P's release, Austan Goolsbee, chairman of the White House Council of Economic Advisers, went on on Bloomberg television to defend the federal government's ability to raise the quickly-approaching debt ceiling, saying it was already "quite clear" the issue would be resolved.

Apart from the political implications, though, this credit downgrade could spell bad news for business around the globe. "A downgrade by S&P is the first step in a series of steps that could have catastrophic effects of the cost of doing business domestically and globally," Peter Kenny, managing director at Knight Capital Group, told Fox Business.

Not everyone, however, believes the S&P's downgrade deserves the attention it has received. The news led The Big Picture's Barry Ritholtz, for one, to ask, "Who Cares?"

"Its not that I disagree with their assessment -- I do not -- but I pay it little heed," Ritholtz said. "If ever there was an organization more corrupt, incompetent, and less capable of issuing an intelligent analysis on debt than S&P, I am unaware of them."

Below is a graph of the Dow Jones drop, according to Google Finance: