Regardless of the market cycle, financial pundits are constantly proclaiming a "stock picker's market," one in which active managers will shine. On the surface, this seems to make sense because no matter the direction of the broad market, there are usually certain stocks outperforming to the upside. Even in my personal experience, I have been witness to the significant rewards afforded to those who can identify and own a portfolio of great companies. There are, however, some alarming crosscurrents taking place in U.S. public equities. Here are my observations.

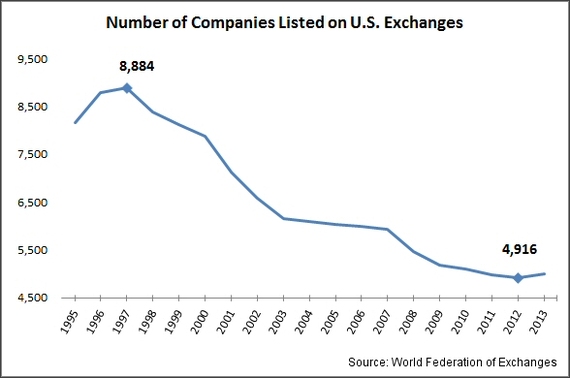

The Incredible Shrinking Stock Market:

The total number of companies listed on U.S. Exchanges has decreased nearly 45 percent between 1997 and 2012. The chart below illustrates the steep and consistent downtrend of the past 15 years.

Reasons for fewer listed companies:

- Delisted/failed technology companies following the bust of the Internet bubble

- Increased M&A activity

- Fewer IPOs

- Rising cost of U.S. regulation and prospect of class action lawsuits

- Growth of buyout funds as an alternative to the public market

One has to wonder, with fewer prospective stocks to choose from, will it be easier or harder to pick the right stocks? Well, that is just half the story.

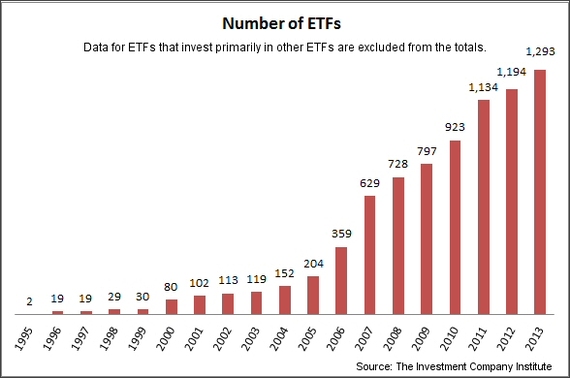

The Explosive Growth of Exchange Traded Funds (ETFs):

Despite a massive reduction in the number of companies listed on U.S. Exchanges, there has been a proliferation of exchange traded funds that own the shrinking base of underlying stocks. According to IndexUniverse, investors pumped a net $188.5 billion into U.S. ETFs and related exchange-traded products in 2013. Reference the chart below and look at the number of ETFs available today. In a letter to investors, Mark Wiedman, global head of iShares, wrote, "More and more, ETFs are becoming the true market."

The growth of the ETF market is unlikely to slow down any time soon. While ETFs have amassed $2.4 trillion in global assets, this accounts for less than one percent of assets in the retirement market, historically dominated by mutual funds. Even mutual fund giant Fidelity recently announced that it would launch its own ETFs, joining ETF powerhouses Blackrock's iShares, State Street and Vanguard.

Tail Wagging the Dog:

Stock prices are being increasingly influenced by the trading of ETFs. Every time there is an index change announced to the S&P 500, we see the impact that ETFs can have on individual stocks. That is, the short term effect of index changes is typically a significant price increase for companies added to the index while deleted stocks experience initial price decline after being removed from the index. According to a study by Goldman Sachs, there has been a higher correlation between the share prices of companies within the same industry groups as the trading volume of ETF assets has increased. In extreme cases, among Russell 2000 companies, some had more than 60 percent of their volume driven by ETF trading.

Investing Out of The Box:

As illustrated above, the mechanics of the market have changed, and I posit that this requires investment managers to also make changes to their investment strategies. In fact, it may even require thinking beyond the traditional style boxes (large/small cap, growth/value, international/domestic) commonly used by institutions, consultants, and mutual funds.

At Runnymede, in additional to traditional equity/bond accounts, we offer a couple strategies that are indeed different. We are advocates of investing the broad service sector because we believe that certain mega trends are benefitting the entire universe of companies from which we select. We also manage an Index Equity Plus strategy that uses ETFs with the goal of achieving less volatility by side stepping major market downturns.

The beautiful thing about investing is that there is not one right way to make money. I do not believe that stock picking is dead so long as investors are willing to be creative in finding new opportunities and developing new strategies.

This post originally appeared at the Runnymede Blog.

What are your thoughts on active stock picking versus passive investing through ETFs? Do you think the art of stock picking is dead?