When the ice breaks up in a northern river and unleashes the spring melt, it's not just an ice cube in a glass warming from 31-34 degrees -- instead, what was a stable, frozen system, becomes a wild, chaotic flood.

The turbulent economics of low carbon energy are similarly poised to ride roughshod over everyone's expectations and transform the conventional dynamics of climate policy. A phase shift is occurring -- and like a spring melt, what follows will be wild and unpredictable.

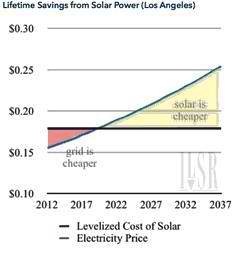

The conventional analysis is that fossil fuels dominate the economy because they are cheaper. At some point in the future, lower carbon energy -- solar power, electric cars -- will reach grid or pump "parity," becoming economically competitive. At this point, energy markets will shift gradually away from fossils.

This smooth, static model conceals reality. In many energy markets, parity is already in the rear view mirror -- but fossil fuels still (temporarily) rule the roost. About 40 percent of the world's coal and oil is burned in spite of the fact that there is, today, a cheaper low carbon substitute.

Asia is still building a huge number of new coal plants, even where the price of their power is over $0.16/kwh. Yet new wind power costs less than $0.08/kwh, solar about $0.12. Leasing and driving a new EV in the U.S. costs less than driving an equivalent gasoline engine -- Goldman Sachs estimates the saving at 17 percent. Yet very few EVs are moving into the 2014 fleet. (The auto industry refuses to offer most EV customers leases, for fear that the electric vehicle revolution will strand their existing engine investments before they have been fully amortized.)

Today's capital investments are locking in tomorrow's carbon emissions. Lock-in, not price, is Big Carbon's ace in the hole, and the biggest climate threat. Every customer who drives a Jeep Cherokee off the lot has effectively signed a 15-year fuel purchase agreement with the oil industry. New calculations by Robert Socolow suggest that future emissions from coal plants built in 2013 exceed total current global emissions from existing coal plants.

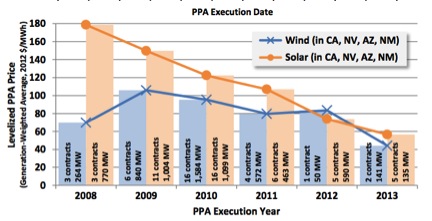

Price is clean energy's disruptive joker. Climate advocates should understand that reducing global emissions of carbon will, unavoidably, lower the cost of energy, not raise it. Wind turbines, solar panels, LED's, heat pumps and lithium batteries are all manufactured products, whose costs fall, some steadily, some (solar panels) precipitously, as more of them are manufactured and sold. As a result, Bloomberg New Energy estimates that two-thirds of future generation capacity will be renewables.

Fossil fuels -- oil, coal and natural gas -- are commodities. The cheapest sources are drilled or mined first -- so as demand goes up, price soars, ever more rapidly with the cost of extracting coal and oil from deeper, more remote or more challenging locations. (Oil and LNG have tripled in price over the last decade, and Asian marine coal doubled.)

Many economists believe that oil price shocks are behind many global recessions. On a smaller scale, unreliable coal supplies have repeatedly disrupted the Indian power sector. Reserves this summer fell into the crisis range. African economies find the sheer costs of importing oil at $100 more than their fragile economies can sustain.

So passing grid or pump parity isn't a smooth glide -- it's more like riding a rough rapid. Consumers should back off fossil dependent cars and power plants long before parity. They will make up in the out years incrementally higher prices at the beginning. But market barriers may discourage them.

That's where public policy counts. Government can speed up parity and low carbon market share by providing investors with reliable markets for first generation clean energy, deploying renewable portfolio standards, EV mandates, feed-in tariffs. Here's what RES's and tax credits did for the cost of renewables in the U.S.

Government should simultaneously enable consumers to choose energy technologies based on the lifetime cost, not initial purchase price -- by creating financing mechanisms that eliminate the capital barriers to choice. Goldman, for example, suggests that a substantial government EV purchase rebate (paid for by taxes on EVs over their lifetime) would unleash a huge increase in EV market share.

Policy should buffer the turbulence for another reason. Unlike the lower costs of manufactured clean energy technologies, permanent gains, the high prices of fossil fuels are volatile. As demand goes down, so does price. Reducing global demand for oil by only 5 percent would slash price by 25-50 percent. For individual consumers, this makes purchasing a solar panel or an EV less attractive -- the cost advantage may go away if the price of coal or oil collapses. But for the economy as a whole, this makes clean energy an even more robust accelerator of growth -- not only do you save the cost of the oil replaced by EVs, but the rest of the oil you still use costs less. For the U.S., China, Japan, Europe and India, the spring thaw of breaking fossil fuel monopolies is going to be an enormous economic turbo-charge -- but it is also going to be a rough and rocky ride.

We need public policy that manages the coming phase change in energy markets -- not imaginary macro-economic models that ignore it and continue to focus on yesterday's problem -- fossil fuel price advantage and the need to price carbon.