Professors aside, who doesn't get a chuckle from "Why is academia so cut-throat? Because the stakes are so small"? This quip actually springs from Sayre's Law which reads, "In any dispute the intensity of feeling is inversely proportional to the value of the issues at stake." Little League parents and Judge Judy claimants prove this every day.

Like the theory of relativity, Sayre's law has a general application, not just a special one. In Sayre's case, the general application is to our society as a whole, and a special application is to our political discourse. It is well known that Congress is more polarized than ever, as is the electorate. In the recent presidential election, 90 percent of Republicans and 93 percent of Dems voted along party lines, up from 90 percent and 89 percent respectively, in 2008 and 85 percent and 67 percent, respectively, in 1980. Yes, a smaller percentage of Republicans voted for Ron Reagan against Jimmy Carter than for Romney versus Obama.

There is intensity in the current dispute between Reps and Dems, yet the value of the issues at stake is tiny, just as Sayre predicts. Much is made on the right of Mitt Romney's fiscal stewardship vis a vis Obama's, but Romney's budget called for federal government spending capped at 20 percent of GDP while Obama's 2013 budget calls for spending to be 24.3 percent (same as it was in 2012 ) easing to 22 percent by 2018.

Yet most people don't know of this relatively small difference. In an electronic survey I conducted of one hundred people self-defined as 'very interested in politics', split 50/50 Republicans and Dems, 33 percent answered correctly to a question on relative budgets. Before you congratulate our panel on their savvy in knowing the difference was 2 to 4 percent of GDP, realize that it was a multiple-choice question and 30 percent of the respondents thought Romney's budget was more than 16 percent of GDP lower than Obama's, and another 30 percent guessed that it was more than 9 percent of GDP lower than Obama's. They would have done no worse had they picked answers at random.

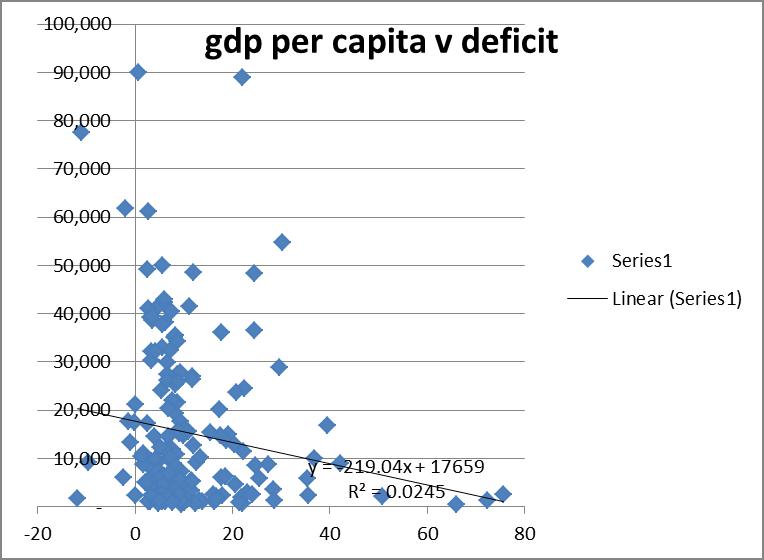

What's more, there is no evidence that federal spending is inversely correlated with GDP. In fact I did a scatter plot (see below) of government spending as a percent of GDP for 177 countries on which there was data available, and the result was that government spending was slightly positively correlated with GDP per capita, as were tax revenues. So we're fighting like cats and dogs over numbers that are essentially the same and meaningless anyway.

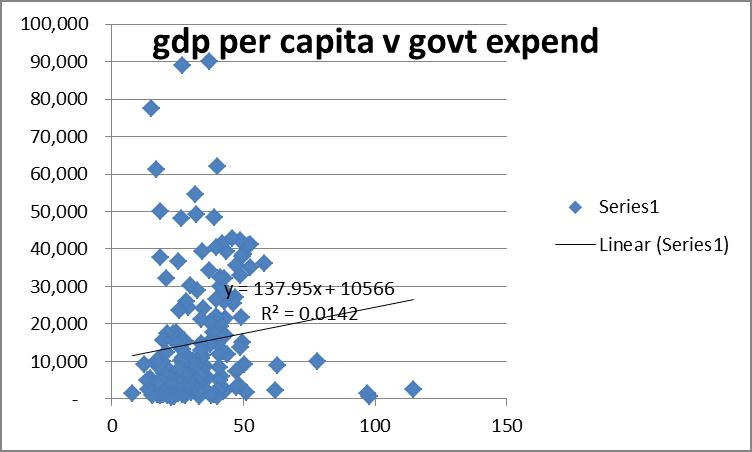

Meanwhile, when deficits are plotted versus GDP per capita (also below) there is a slight inverse correlation, suggesting that deficits, not spending, are a real problem for our well-being. Yet neither candidate had a real plan to reduce deficits. Which brings us to the panic du jour, the 'fiscal cliff.' If you're a cave dweller, first off, I appreciate the lengths you have gone to read this post, and second, here is what is meant by fiscal cliff: the repeal of the Bush-era tax cuts, and the implementation of across-the-board spending cuts as per last year's budget agreement. The combined effect is to reduce the deficit at some cost to short-term GDP. Sounds like a reasonable tradeoff, but to hear the lamentations on the media it's as if the wives of Conan's enemies were reading copy on CNBC.

The Wall Street Journal, which runs about three features a day on the dangers of the cliff, wrote that the Congressional Budget Office issued "warnings over inaction." I was a bit dubious, since to my mind, the repeal of tax cuts that did us no discernible good and the implementation of across-the-board spending cuts to a bloated budget was not a bad idea. In fact when the sequestration (the mandatory spending cuts) was first announced I thought it was brilliant -- a way for lawmakers to give us the fiscal restraint we needed with the political cover they needed. ("I didn't vote for that spending cut that closed your military base.") So I checked the CBO's numbers and did a few back of the envelope calculations and found, unsurprisingly, that going over the cliff was not inevitably a disaster, it might actually be positive as the GDP lost from reduced spending could be more than offset by the gains from a reduced deficit.*

So the brightest thing Congress has done this century, the sequestration, is universally treated by the media as a disaster. Could there be short-term market turbulence in going over the cliff? Of course, just like there was when U.S. government debt was downgraded in 2011. But now a year later the stock market is 6 percent higher than before the downgrade. With regard to economics, we fight like George and Martha over things that don't matter, and are in agreement (on the wrong side, possibly) on things that do. Sadly Professor Sayre is no longer alive (he died in 1972), but it's unlikely the bookers at CNBC and staff at The Wall Street Journal would know his phone number if he were.

Pros and Cons of going over the cliff, in numbers

The fiscal impact of reduced spending would be 2 to 2.5 percent lost in GDP:

The CBO estimates GDP would grow 0.5 percent in 2013 while the Fed had expected growth of 2.5 to 3 percent without the cliff.

But reducing the deficit would add 1.5 percent to 2 percent of GDP in the first year alone:

The CBO report says going off the cliff would cut the deficit from 8 percent of GDP to 4 percent in the first year. According to my scatter plot of deficit to GDP, each 1 percentage point less of deficit equals 0.5 percentage points gain in GDP, we'd gain 4 x 0.5 percent = 2 percentage points of GDP.

Summary: We'd lose 2 to 2.5 percent due to the spending cuts, but we'd gain 2 percent due to the deficit reductions in the first 12 months. Oh, and there would be another 2 percent gain in future years as the deficit closed another 4 percent.

GDP versus Government Spending, by country

GDP versus Government Deficits, by country