16 Percent of First-time Homebuyers Say Student Debt Has Kept Them From Buying:

My husband and I would love to own a home, but right now we just can't. Why? Grad school debt. Yep, we're in our 30s, we both have great jobs and, as an economist at Redfin, I spend my days obsessing over real estate. But our crushing six-figure debt from graduate school means we will likely be the last of our friends to become homeowners.

Obviously, we're not the only ones who have mountains of college loans to pay off. Last week, the Federal Reserve Bank of New York reported that student loan debt rose more than five percent in the fourth quarter of 2013, and now exceeds $1 trillion.

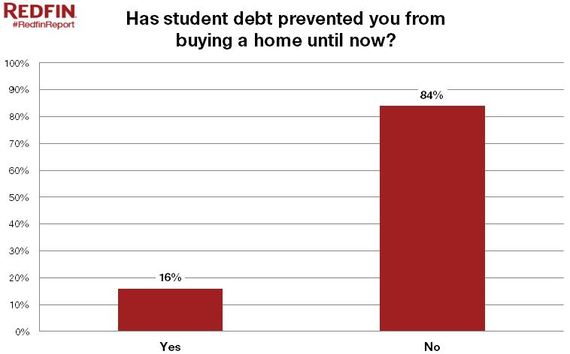

Redfin's Q1 homebuyer survey suggests that these rising debt loads are delaying homeownership among young Americans. From Feb. 20 to 23, Redfin surveyed 1,912 home-buying clients, of which 965 were buying a home for the first time. Among the first-timers,15.9 percent said that student debt had previously kept them from buying a home.

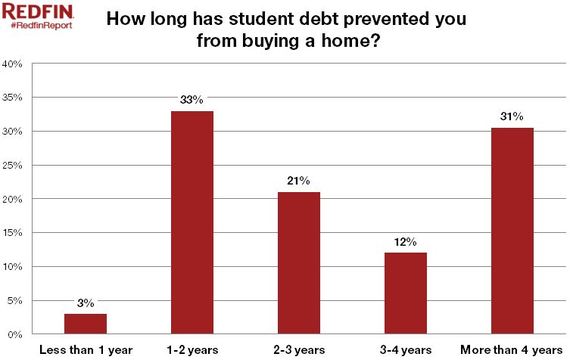

Of these homebuyers surveyed, 33 percent said that student debt had led them put off a home purchase for one to two years while 31 percent said four years or more.

Despite these statistics, Redfin Open Book Lender, John Wheaton, said home buying is still attainable for many student debt holders. According to Wheaton, "Many young people with student loans delay buying a home because they don't think they can qualify for a mortgage. Yet, many of them actually can. Underwriters generally treat student debt in a more positive light than credit card or auto loan debt."

For example, a person with $45,000 in student loans (about $500 per month for a 10-year term), a FICO score of 741 and an income of about $75,000 per year could likely qualify for a property starting at around $375,000 with a five percent down payment, Wheaton said.

When we do the math, my husband and I could technically afford to buy a home right now. But it feels risky. If one of us lost a job, could we still pay a mortgage and make our school debt payment? We probably couldn't.

For others, buying now would mean sacrificing on the home they really want. According to Redfin agent Alex Haried,

For my home-buying clients, student debt hasn't prevented them from buying a home, it has prevented them from buying the home they want. Instead of buying a $350,000 home, they would rather rent for a few more years as they pay down their student debt and then buy a $500,000 home.

With tuition costs soaring, potential homebuyers in the future may have even bigger debt hurdles to overcome. From 2008 to 2013, annual tuition for a public four-year university rose 20 percent to $18,391, according to the College Board. For graduate students, tuition growth is even steeper; the cost for a Master's in Business Administration grew 33 percent between 2008 and 2012. For a top-tier MBA program such as the one at Duke University, students dole out $110,600 in tuition.

More Student Debt, Fewer First-Time Home Sales:

As if young Americans aren't already strained by a weak economy and rising home prices and mortgage rates, climbing tuition costs give them one more reason to put off buying a home. The National Association of Realtors said last week that the share of home purchases by first-time buyers slipped to 26 percent of sales, down from 30 percent last year. For the economy as a whole, this means that rising student debt loads -- which should, in theory, be a positive sign for the economy -- may be a short-term hindrance to the housing recovery.

Video Powered by Bank of America: