An Interview with Levi King, a veteran entrepreneur on a mission to reduce the small business death rate.

Levi King, cofounder and CEO of Nav

Years after the financial crisis of 2008 and the ensuing consumer credit crisis, Americans should remain cautious of using too much credit and of maintaining a strong record of credit and payments in particular. As the use of credit continues to rise despite some worrying forecasts for our economy, we know just how important it is to take hold of personal finance as a guard against future catastrophes.

But a strong credit score and clean credit history is just as integral to business ownership as it is to personal finance. In fact, bad credit can easily prohibit a business owner from starting up while it may not prevent individuals from gainful employment. And while many resources exist for individuals improving their credit, there are fewer out there for aspiring entrepreneurs (but here are some great tips).

That's where Levi King comes in. Levi cofounded and is the current CEO of Nav, a free resource for business owners looking to keep track of their credit. Having started and run numerous businesses in the past, Levi knows firsthand about the issues faced by small business owners--namely, struggling to access capital, understanding financing, and gaining marketplace credibility. After getting a handle on just how business credit works, King applied for and was awarded business loans and financing over thirty times!

I was scared to death all the time. I didn't know what I was doing, but I just figured it out as I went.

-Levi King on starting his first business

Today Levi shares with us some of this expertise as well as his own story.

Steve Mariotti: When did you become an entrepreneur?

Levi King: I grew up on a rural Idaho farm in humble circumstances. I couldn't get a regular job so I had to look for hack opportunities to make money, whether that was mowing lawns or hauling hay.

At 22, I wanted to start a manufacturing company. I was super naive and went to the closest SBA office to how to get a loan. I didn't have any credit or meet any of the requirements, so of course I realized fast it wasn't an option.

King Electric Signs

But I had a pickup truck, a set of tools, and an extension ladder. So I would look for signs that were burned out and I'd call the owners and offer to fix them for $45/hour plus materials. The first month I made $8,000. My dad lent me $15,000 and I bought a crappy boom truck that broke down all the time. But it let me reach higher signs and even install them. My first year I profited $200,000 and sunk it all back into equipment for my business. Within another year I had 15 employees.

SM: What was your biggest failure and what did you learn from it?

LK: More than once I picked the wrong business partner. Not that I was better than them, but we had different commitment levels and that eventually led to a "divorce."

Another mistake was when I passed up the opportunity to sell my manufacturing business for five times what I ended up selling it for. My accountant told me it was worth much more (even though he really didn't know). I had already started another business, and a manager was running the manufacturing business. It became less profitable, so when I did sell it I got much less.

The free Nav app is available for iphone or android

Both of these lessons taught me just how important it is to pick the right partners and advisors.

SM: What is the story behind Nav?

LK: I've learned firsthand how a solid business credit history can help--or hinder--your business growth. For example, I missed out on a large job for the sign company because it didn't have a strong business credit rating. (Fact: Many business owners don't know this but their prospects, clients and competitors can check their credit too.) I became intensely interested in business credit and financing, and the knowledge I gained as a result eventually allowed me to access financing for my businesses more than thirty times.

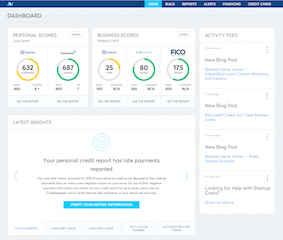

Inside the Nav dashboard

I co-founded Nav to to dramatically reduce the small business death rate by helping business owners access and understand their personal and business credit data and streamline access to the right credit products and services at the right time.

SM: What do you wish entrepreneurs understood better about credit?

LK: I wish they understood that credit is their credibility and their currency, so it either limits the customers, contracts, and financing you can get, or it can open up big doors for you.

Also it's risky to rely on your personal credit for funding but that's often what entrepreneurs do. Using personal credit cards or a home equity line for business can hurt your personal credit scores (even if you pay on time), making it that much harder to get more funding. It can become a vicious cycle.

Nav staff members

SM: What advice do you have for young people who want to go into an online business?

LK: Devour every book and article you can on how to make it work before you put your first dollar at risk. The biggest unconsumed asset is the record of people who have gone before you. There's almost nothing new. Every business is a mix of what has gone before. You can learn a lot by studying that history--why businesses have worked and why the have failed, and so on.