Dr Steve Waygood is responsible for Aviva Investors' analysis, engagement and voting on environmental social and governance (ESG) issues across the £246bn of assets under management. He catalysed the Sustainable Stock Exchanges initiative and founded the Corporate Sustainability Reporting Coalition, which is aiming to create a UN Convention in this area. He was on the board of the UK Sustainable Investment & Finance association (UKSIF) from 2003 to 2010, serving as its Chairman from 2006. In 2004 and 2005, he was part of the expert group that wrote the United Nations Principles for Responsible Investment. His work was acknowledged within the Harvard Business School and became a case study in MBA and executive education courses on "Innovating for Sustainability." Steve is a member of the Chartered Financial Analyst institute, has a degree in Economics and a PhD in sustainable finance, and lectures at Cambridge University's Institute for Sustainability Leadership.

He is clearly one ethical leader who is championing and influencing the way towards mainstreaming responsible investment. I first met Steve at the end of 2014 at the Sustainable Leaders Forum in London. He caught my attention when he asked poignant questions to a room full of sustainability experts who he describes as 'demand generators'.

"How many of you have a pension?"

Every hand was up, the next question...

"How many of you know if your fund manager promotes sustainability through the way that it votes on your behalf at the AGM's?"

Not a single hand in sight! I found that this was a powerful statement showing us all how 'we' are not taking responsibility of where our pensions are going, while at the same time markets are continually being blamed for being too short term. I felt this really highlighted a key example where responsibility is being pushed away, the very nature of calling for change is that the 'first step always starts at home'.

Aviva hosted the United Nations Principles of Sustainable Insurance event on 27 June 2014. Aviva Group CEO, Mark Wilson, unveiled a new report from Aviva Investors.

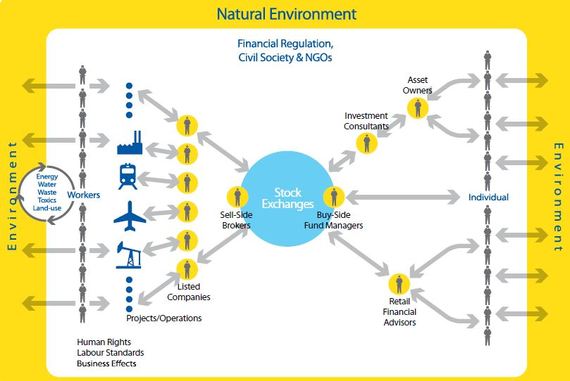

(A roadmap to Sustainable Capital Markets -Aviva Investors, 2014)

This figure broke down the complexities of the industry and highlighted the dysfunction of the current structure of the capital markets. As identified earlier 'we' collectively entrust our pensions to investment consultants, enabling them to gain considerable power. Investment consultants are highly influential to policy makers because they significantly influence an institutional investors' choice of fund manager. As a consequence, if investment consultants indicate that they believe that something is important (ethical or not), it sends a powerful market signal to fund Managers, who are more likely to invest more resources in that area as a result.

What has been the key turning point that has influenced ESG (environmental, social and governance) voting?

'One thing has to be the advent of the UN supporting the Principles of Responsible Investment (PRI). They have generated a lot more interest in and noise about ESG issues and contributed to substantive change. However, I think their opportunity for change lies mostly ahead of them rather than behind them and I really look forward to see the prospects of more substantive change to come from them. A second milestone is the better availability of good broker research on ESG issues. That said, I think the change to the broker industry is not anywhere near wide spread as it needs to be. Nevertheless, for the past few years, we have seen the incidence of good broker analysis on ISG issues grow significantly, and that has been fantastically useful to analysts and fund managers. But the most important ultimate influence has been client demand. There are now some very big institutional investors who take this stuff genuinely seriously. I would acknowledge that they are significantly in the minority, but they are sufficiently substantial in number and scale to represent good enough demand for mainstreaming some types of responsible investment within the industry.'

What are the key challenges that need to mainstream all types of responsible investment into the industry?

1. Growing Demand

'As I mentioned, we are seeing enough demand from a significant minority of institutions and shareholders to warrant the presence in the market of a modest number of engagement professionals or brokers now doing ESG analysis. However, this demand is by no means sufficiently routine to justify the scale of resources that I think are required. Ultimately, responsible investment needs to be demanded by most end investors and become a deal maker or breaker. This requires a much higher level of knowledge about how markets work - financial literacy - than is current common. Consumers struggle enough with how to understand basic banking let alone how a pension works, what might the likely return look like, let alone where it is invested and what key ethical issues they may need to think about when investing or how they should vote at AGMs.'

2. Financial Literacy

'To achieve this level of demand, the average person on the street needs to understand the rights and responsibilities of share ownership. Ultimately, this is not complicated stuff. However, to become commonly demanded by most investors, it does need to be taught and at an early stage. I believe this means we need to change the national curriculum at the secondary level. There is also a role for tertiary education, particularly within economics and MBA's. I also believe that the major MBA rankings such as the FT should partly depend on how well the business school informs business leaders and future financiers in good governance, responsible investment and sustainability. We have been asking for this to be included in the UN Sustainable Development Goals. We are also trying to advocate change around financial literacy among the end investors and NGO's who don't tend to be familiar with how the supply chain of capital is structured. This industry does not have a civil society ensuring what it does is a good thing. Many of the conversations I have had in Whitehall, Brussels and New York with various policy makers have shown me that outside of treasuries the level of financial literacy is very low, even amongst incredibly bright people and therefore they would not be able to begin to understand how to start asking how to put money into sustainable development because they don't understand the basic structure of the supply chain of capital, nor the incentives within it. In short, I think informed demand through better financial education is the only genuine long term solution to market short-termism. '

3. Trust

'I think the lack of trust in financial services is a profound problem for the industry. In order for any industry to operate it needs to maintain its licence to operate with society. Post financial crisis, the metaphorical social license to operate that finance receives from society has definitely been in question. Finance needs to be better understood by society, and this means being transparent and accountable to society and demonstrating that the institution is behaving responsibly and deserves trust, and this societal license to operate. I like to think that this is a significant part of what my team does at Aviva Investors. We insure that as a firm we invest with integrity. For example, it is my team's job to make our fund managers and analysts aware of controversial issues and then share any concerns with the company in question through the engagement. I am proud of our record in this area, but I am particularly proud to work for an insurance company. We are there at times of great need for individuals who have planned ahead. Insurance also has a naturally long term perspective. The insurance movement was created years ago because of things like the great fire of London. Indeed, Aviva has been around since 1696. '

With the UN Development Goals now under review, do you see finance becoming a more inclusive part of the solution to the world biggest societal issues?

'There is about £270 trillion in the capital markets, but just £130 billion a year in development assistance. My fear was that the SDGs would focus just on the money within official development assistance - aid - and say nothing about the much larger sums within finance in general. While the SDGs are not final, I am very pleased to say that is not currently the case. There is quite significant section called the 'means of implementation' that talks mainly about the role of finance. I do still fear, though, that they focus too much on how they will secure capital to finance the sustainable development goals - and not enough on how they will stop markets in general financing activities that undermine sustainable development. The question that they are still not asking enough is how do you stop the £270 trillion undermining sustainability development? How do you stop the markets financing things that have negative long term societal returns and should not be capitalised? For example, how do you stop the markets financing the companies that are causing problems like climate change? We need to make sure that the UN takes the opportunity to harness the creative force of the capital markets and ensure that they promote and to not undermine a more sustainable future. To my mind, the UN SDGs is still not focusing enough on that.'

*This interview was conducted by Deap Khambay (Founder of Ethical Value Ltd) on 6th January 2015.