In the latest consumer complaints snapshot, a monthly report detailing consumer sentiments across all credit products, the CFPB observed a 12 percent decrease in the number of payday lending complaints. This finding reignited a debate stemming from earlier this year when the CFPB announced it was considering a proposal to place new rules on payday lending - regulation many say would effectively outlaw the industry.

In a recent op-ed on the topic, Columbia Law School Professor, Ronald Mann, rightly points out the flaws with justifying regulatory action under the pretense that payday lenders "force" or deceive borrowers into paying high rates. But that's not the entire story.

I think criticism that the regulation is at fault because it takes away options and does not allow "borrowers to make decisions for themselves" is ultimately misguided. It may sound like good free market advice, but the theory carries little weight.

Why do so many consumers still turn to lenders who are known to brazenly advertise their ridiculous usurious interest rates? The answer is both obvious and disturbing -- payday lenders are often the only option available.

Let's face it: no amount of CFPB regulation is going to increase the hourly wages, reduce the number of medical emergencies, lower the cost of unanticipated car repairs, or keep couples from divorcing. These are all serious issues that befall millions of subprime borrowers every day and have a real impact on their lives.

For the 95 million working age Americans with a FICO score below 700, unexpected cash shortfalls are unavoidable. Invariably, there will come a time when an employer does not assign enough hours to cover the month's expenses. There will be times when unexpected expenses crop up, demanding more cash than a person has immediately on hand. It's exactly at these moments when folks below 700 FICO find out that it's really hard to find banks or credit unions who will lend to them. As subprime borrowers they are deemed too risky or unlendable.

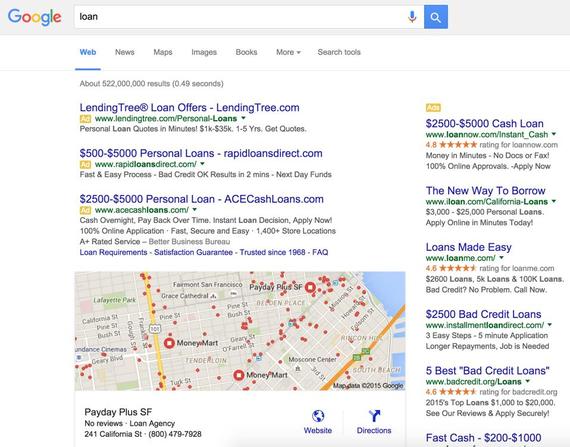

Eventually, after these borrowers have been told "no" by bankers and traditional lenders, they look elsewhere. Perhaps, they search online for a "loan."

Within seconds, these borrowers find search results comprised only of payday lenders. They may start to believe a triple-digit APR is the best they can get. Banks have said no a dozen times, so this must be the only solution. Right?

Making the situation worse is the psychological damage a person can experience after having run their personal finances into the ground and dealing with lengthy rejection notices. They may even start to believe they deserve a really high interest rate. That's the worst of all!

And that is the core of the issue here -- it's not that subprime consumers should make better financial choices, it's that they, quite frankly, have no good options to choose from. They "choose" the only option available to them.

This, more than anything else, is why innovation is needed in the US credit sector. It's exactly why I founded Vouch.

Find this and more from Yee Lee at Vouch.com.