When I first divorced, I, like most people, was overwhelmed with financial crises. With two houses to support (my ex's and mine), our expenses had doubled without any increase in income. And I only had a few years of alimony to figure all this out - while still juggling school, family dinner, soccer, test scores, skinned knees, taxes, investments and a new (I hoped) dating life. Acckk!

I knew that if my assets (home, retirement plan, savings, etc.) could start earning money for me, everything would become easier. You can read how I squeezed out of almost losing my home to a dream come true lifestyle in my book, You Vs. Wall Street, but the springboard was actually quite simple.

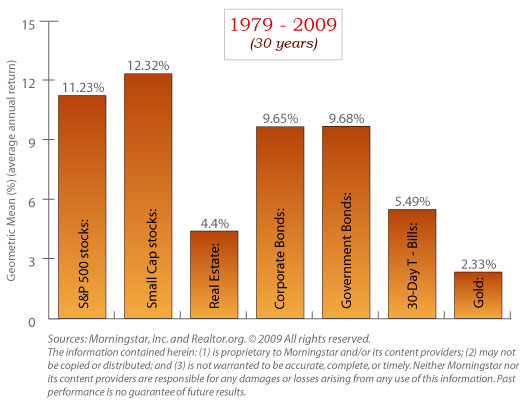

If you earn $100,000 a year and you put 10% of your take-home in a 401K, IRA and/or health savings account, and that money earns 10% annually (what stocks and bonds have done over the last 30 years, on average), then you'll have $50,000 in your nest egg within four years, over $100,000 in seven years and by year 25, your money will earn as much as you do in your annual salary. That alone will make you a millionaire before you're 50 (if you start at 25). Investing yields four times the money you make if you were just saving it. (25 years of $10,000 annual deposits with zero interest is $250,000.)

Now, you might say, "I don't earn $100,000 a year!" But the ratios work the same, even if you earn minimum wage. If you deposit 10% and that earns 10% returns, then your nest egg will equal your salary in just seven years, and by year 25, your nest egg will earn as much as you do. By comparison, if you are just saving, you only earn a fraction of that - missing out on all of the gains that compound year after year. And if you're not saving at all, you're overspending and trapped in the vicious cycle of debt and debt consciousness.

Over the last decade, stocks have been pretty rough sailing--for buy and hold investors. However, investors that diversify properly and use annual or quarterly rebalancing, are earning more than 10% annually over that same period. (That simple system is outlined in You Vs. Wall Street, too.)

Another beautiful benefit of the tax-protected retirement plan (IRAs, 401Ks, Health Savings Accounts, etc.) is that your investment gains are yours to keep, and are not subject to capital gains taxes. These accounts are also the best strategy to keep your money safe from debt collectors, lawsuits and other financial predators because in the worst-case scenario (legal judgment, bankruptcy or debt collection) they cannot be confiscated by lien.

The most important first steps to take are to open the account, put 10% of your income on auto-deposit and to switch your thinking about money. Which is why I'm encouraging you to toss out the phrase "retirement plan" and select a sexier name for your personalized "Buy My Own Island Plan" or "Send My Kid to College Fund" or "Trip Around the World Dream." Why? Because you'll want to grow the gains of the fund that is working toward a goal, whereas, odds are, you're filing the "retirement plan" statements directly in some drawer without looking at them, hoping they'll surprise you one day --pleasantly. That is, if you have even bothered to sign up for the 401 (k), Individual Retirement Account or Health Savings Account in the first place.

From changing diapers to easy street, on the beach! Get started now, and before you know it, you'll arrive.

For more information on easy-as-a-pie chart investing, read You Vs. Wall Street. To learn these nest egg strategies firsthand in a boardroom setting, come to a Get Rich and Enrich Retreat. Get more information on the home page at NataliePace.com.

About Natalie Pace:

Natalie Pace is the author of You Vs. Wall Street and host of the Pace and Prosperity radio show on BlogTalkRadio.com/NataliePace. She is a repeat guest on Fox News, CNBC, ABC-TV and a contributor to HuffingtonPost.com, Forbes.com, Sohu.com and BestEverYou.com. As a philanthropist, she has helped to raise more than two million for Los Angeles public schools and financial literacy. Follow her on http://www.facebook.com/pages/NWPace, and on YouTube.com/NataliePaceDOTCOM. For more information please visit, http://www.nataliepace.com.

Please note: Tax laws change each year, so be sure to get the assistance of a qualified tax specialist when setting up your retirement and health savings accounts.