An Analysis of Institutional Activity in October 2016

Adapted from Real-Time Risk: What Investors Should Know About FinTech, High-Frequency Trading and Flash Crashes (forthcoming, Wiley, NJ). Pre-order on Amazon.com.

"Money talks, bull*%$# walks", says a classic Wall Street proverb. The expression has a lot of merit: nothing reflects one's beliefs more than a financial bet on the markets. The larger is the bet, the stronger is the belief.

AbleMarkets research indicates that institutional money sold off when negative news affected Donald Trump in October 2016, but when Hillary Clinton's negative news emerged later in the same month, there was very little reaction from institutional money. The results suggest that many institutions were betting on Donald Trump win all along, discounting news about Hillary Clinton.

AbleMarkets Institutional Activity Index analyzes order-level data across the U.S. markets in real-time to determine what institutional investors are betting on at the moment. Institutional money managers commonly rely on variations of VWAP and TWAP computer algorithms to break down their large orders into small chunks. The chunks are then indistinguishable from the rest of the order flow to the naked eye of a human trader. However, they stand out when examined by machine intelligence. By deploying sophisticated proprietary artificial intelligence several years in the making, AbleMarkets is able to extract VWAP and TWAP-based patterns from anonymous order flow and pinpoint that institutions are trading. The identity of trading institutions remains anonymous as long as their orders do not include their own identification.

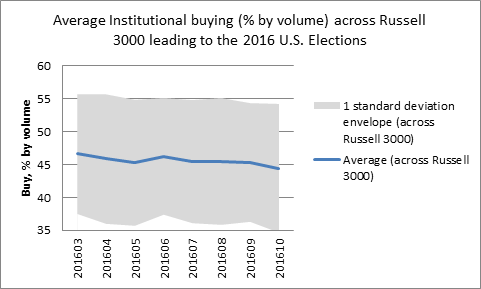

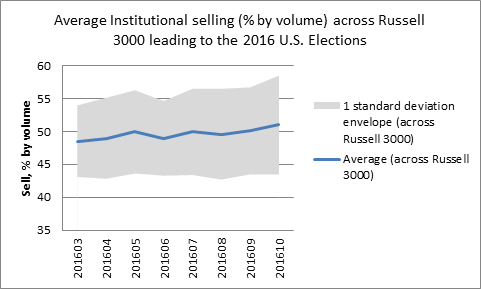

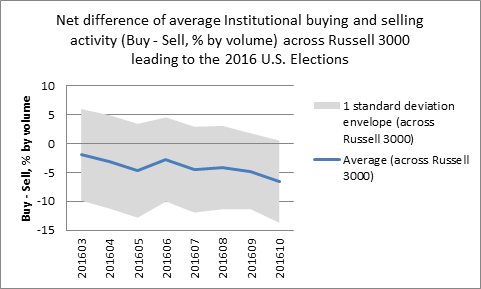

For several months leading up to the 2016 U.S. Presidential elections, institutional money managers made headlines by aligning with one candidate or another. George Soros and Donald Sussman, for instance, unambiguously stepped into Hillary Clinton's camp, while John Paulson announced his support for Donald Trump. Less publicly and very gradually, however, large institutions have been quietly selling U.S. equities across the entire Russell 3000 range in the months leading to the U.S. elections. As the elections approached, institutional investors overall felt increasingly pretty pessimistic about the U.S. future, as shown in Figures 1-3.

Figure 1. Average Institutional buying activity as a % of buyer-initiated volume across Russell 3000 stocks by month.

Figure 2. Average Institutional selling activity as a % of buyer-initiated volume across Russell 3000 stocks by month. Dispersion of selling activity across Russell 3000 stocks increased closer to the election, while the average kept rising.

Figure 3. Average net Institutional activity as a % of buyer-initiated volume less that as a % of seller-initiated volume across Russell 3000 stocks by month.

The October 2016 data is particularly interesting as it provides two distinct case studies for the impact of news affecting both leading presidential candidates at the time: Donald Trump and Hillary Clinton. On October 7, 2016, news leaked out featuring Mr. Trump making unsavory comments about his power to grab women. On October 25, 2016, FBI announced that it was reopening the agency's investigation into the case of Hillary Clinton, given new evidence. The reaction of institutional investors in both cases is telling about their predisposition to one candidate versus the other.

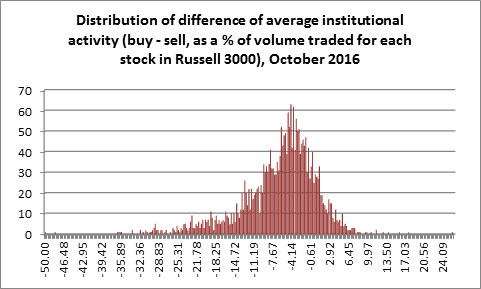

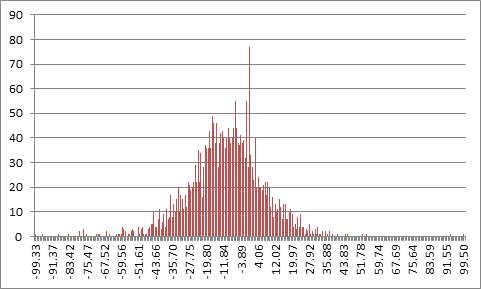

Figure 4. Distribution of difference of average institutional activity (buy - sell, as a % of volume traded for each stock in Russell 3000), October 2016. Average: -6.58%, 1 standard deviation of 7.10%.

On October 7, 2016, the day of the infamous Donald Trump news leak, institutional investors opted to sell Russell 3000 equities, more so than usual, with the average of 42% of buyer-initiated trades driven by institutions, and the average of 53% of seller-initiated trades made by institutional investors, for the average net institutional participation of -10% by volume (buy - sell), considerably below the October average of -6% by volume. Respective institutional participation figures in buying and selling across October 2016 were 44% for buyer-initiated trades, 51% for seller-initiated trades.

Figure 5. Net Institutional Activity (Buy-Sell, as a % of volume traded) on October 7, 2016. Institutional sellers significantly skew the distribution.

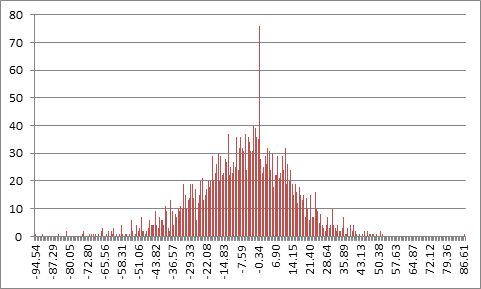

In contrast, on October 25, 2016, the day the FBI reported reopening the case against Hillary Clinton, institutional buying and selling activity was in line with that of the rest of October. Institutions accounted for 45% of all buyer-initiated trades across Russell 3000 (as compared to 44% across October). Institutions also represented 51% of all seller-initiated trades, matching the 51% October average.

Figure 6. Net Institutional Activity (Buy-Sell, as a % of volume traded) on October 25, 2016. The figures are comparable with the overall October distribution.

According to the data and AbleMarkets research, the degree of disappointment with Donald Trump's leaked video tape was considerably higher for the institutional players than the subsequent Hillary Clinton fiasco. Was Donald Trump the darling of institutional money all along?