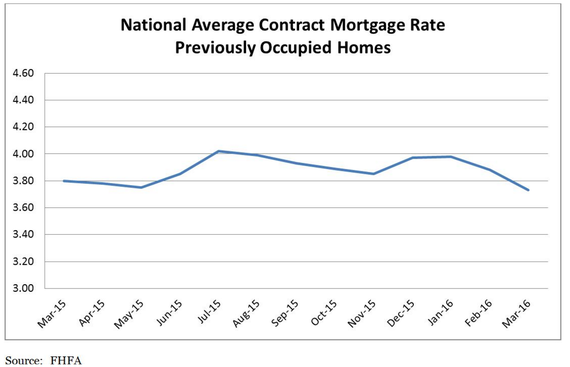

Considering that mortgage interest rates stayed between 6% and 8% between 1995 and 2005 and between 4% and 6% between 2008 and 2012, this chart looks pretty good. The Federal Housing Finance Agency's most recent interest rate report shows rates hovering between 2.75% and 3.95% for the past few months, with a downward trend.

This should be spurring home sales, but it's tough when prices are rising. Low inventory is the primary reason. Inventory has fallen by around 11% from highs over 2.2 million from May through August 2015 to 1.98 million in March 2016. There is competition for the best homes in many areas, and even mediocre properties are getting higher offers than a year ago.

I'm not suggesting we're in a bubble, but some see things differently. Notably, over at DRHousingBubble.com, a recent post is pretty blunt: "This is the current situation in the U.S. where crap shacks across the country suddenly appear better than they are because of a lack of inventory from a manipulated and distorted market."

Why is inventory down and not showing signs of picking up, even in the busy season? There are several contributing reasons:

•One recent report shows 3.2 million homeowners still underwater on their mortgages. They're not going to sell, other than a small percentage who can get a short sale through. They'll hold and hope prices keep rising.

•Baby Boomers aren't selling, at least not at historical levels. Many are keeping larger homes when in the past they would have downsized. It's because a record number of Millennials are living at home with their parents. Others are simply not finding any great pressure to move or buy another home at today's prices.

•Not just the boomers, but others with equity in their homes are simply content to wait and see if prices keep rising. Many have just come out of underwater status on their mortgages and are making up lost ground.

•Builders are responding to high demands for rentals, concentrating on building multi-family properties instead of single family homes.

So, now we're seeing the good news and the not-so-good news. What's the takeaway for real estate investors from the current situation? Again, it's good news and not-so-good news. Rental demand is huge, and rents are rising right along with it. However, buying and/or rehabbing a rental property that will meet your cash flow investment objectives is a challenge at today's prices.

For some investors, it's not really a problem, as they're ready, willing and able to look outside their home market areas, some investing thousands of miles from home. It's a little more challenging, but it works quite well if you find the right area. Other investors are simply sharpening their pencils and working harder at due diligence to dig out the bargains that are still out there in their local markets.