By Steven Kelly, University of Wisconsin. Contributor at The International Political Economy Hub blog.

While the United States began raising interest rates at the end of last year for the first time since before the financial crisis, economic output in the European Union (EU) has yet to reach its pre-crisis level. It's no secret that an unwillingness to cooperate on coordinated government spending and an obsession with austerity and structural reforms have kept fiscal policy off the table and delayed recovery in the eurozone and the EU. Indeed, influential economic organizations, the International Monetary Fund (IMF) and the Organization for Economic Cooperation and Development (OECD), have recently called for an elevated level of fiscal spending in the near-term to prevent advanced economies and the world economy as a whole from slipping into recession. Despite negative borrowing costs across Europe, this advice will almost certainly go unheeded. This inaction has left the responsibility on the shoulders of central bankers to lift growth in Europe--though many are running out of options. The monetary policy rate has hit the zero lower bound (ZLB) across Europe and rates on excess reserves held by banks with their central banks have even gone negative--and will likely continue to test where the floor is on those rates as central bankers run out of options to stimulate the economy without help from elected officials. However, the situation is worse than just political inaction amongst European policymakers. Policymakers aren't just leaving governments idle, they're actively creating more risk.

While demand for safe assets (typically, government Treasury bonds) has been increasing for decades for a variety of reasons--demographics, excess savings abroad, and (after the crisis) increased regulation and risk aversion--the politics of Europe have also reduced the safe asset supply. A reduction in safe asset supply relative to demand means that risk-free yields are lower, all else equal. This means that central banks will have to target a lower rate than they have historically to achieve their output and price growth goals. Thus, they are also more likely to encounter the ZLB when attempting to achieve such goals in the face of a recession and be left with limited options without the assistance of fiscal policy.

Prior to the financial crisis, the integration of Europe and the creation of the eurozone helped many more governments' debt be perceived as risk-free, safe assets. Due to level of integration, market participants thought that financial trouble for one eurozone government would mean support from other members--to prevent the collapse of the monetary union. Despite claims from policymakers that this was not the case, this intuition proved to be largely correct. However, the political turmoil that follows economic crises has still not ended in Europe. Greece has yet to implement key bailout conditions, Spain has yet to form a government since its inconclusive December elections, Portugal and Italy are in budget standoffs with the European Commission as they attempt to turn their back on austerity despite high debt levels, and so on. Political risk across Europe has prevented government bonds--especially in the eurozone--from returning to their status as part of safe asset supply.

Indeed, the price (premiums) of credit default swaps (CDSs) on government bonds--insurance contracts that pay out if governments default on their debt--have been rising across Europe as governments continue to fail at cooperating and stabilizing. As weak economies and high unemployment were the story of end-of-2015 elections in Portugal and Spain, Portugal elected a Socialist whose fiscal views differ markedly from those of the European Commission, and Spain has yet to form a government as no party or coalition came away with a majority. Accordingly, the price for insurance on their bonds has risen as their political futures become more uncertain (Figure 1).

Figure 1 - The price of credit default swaps on Spain (red) and Portugal (green) 10-year bonds since December 2015.

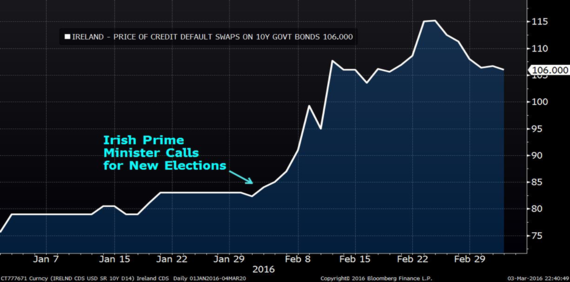

Similarly in Ireland, on February 3 of this year the government called for new elections to be held on Feb. 26. Despite being held up as a model of successful austerity by the European Commission due to its 7% growth rate of GDP in 2015, the still low level of GDP combined with a weak labor market meant Ireland's election was highly contested. Again, results were inconclusive, and the formation of a stable government is likely a long way's away (Figure 2).

Figure 2 - The price of credit default swaps on Ireland 10-year bonds have risen precipitously since the election date was announced and has remained high due to inconclusive results.

Meanwhile, Ireland's neighbor, the United Kingdom, which is not a member of the eurozone and therefore was recovering much better from the financial crisis, is contemplating an exit from the EU and thus its single market. While the UK's history and relatively solid recovery had meant its government's debt has typically been viewed as one of the world's safest assets, the possibility of a "Brexit" could leave the UK in a balance of payments crisis as its investment ties are cut with the rest of the EU and it is no longer able to fund its 5% of GDP trade deficit--a risk increasingly reflected in the CDS prices on British debt. Even Germany, the Eurozone's main creditor nation and political enforcer of austerity, has had its government perceived as increasingly risky in recent weeks as political uncertainty surrounding new rules preventing bank bailouts combined with questions over Deutsche Bank's capital levels have created a massive contingent liability for the German government.

As the European economy continues to stall and as there is still a lack of active, coordinated fiscal policy in Europe and the Eurozone, political turmoil will continue at the polls and in government bond markets. Policymakers in Europe have not only placed the burden of economic recovery solely on central banks--most notably the European Central Bank (ECB)--but have also made their task significantly harder by actively reducing the supply of safe assets relative to safe asset demand, and thus pushing the natural interest rate (the rate at which central banks' output and price growth goals are achieved) further and further below zero. The ECB and others are thus increasingly dependent upon unconventional measures such as quantitative easing and negative deposit rates that harm the profitability of financial institutions and reduce returns for investor, savers, and pension funds alike--while the increasing political volatility makes such policies increasingly ineffective. While debt-financed government spending remains politically unpalatable in Europe (though it is in dire need) and thus will not contribute to the supply of safe assets, governments' political recklessness and creation of political uncertainty is actively reducing the existing supply of such assets--ensuring that economic recovery in Europe is still a long way's off.