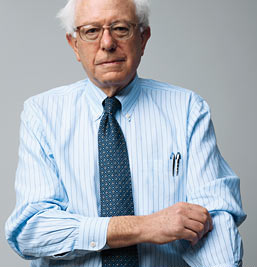

Last week U.S. Sen. Bernie Sanders (I-Vermont) introduced the Social Security Expansion Act, a thoughtful plan to both ensure greater retirement security for today's workers and retirees and strengthen Social Security's finances over the long term. It achieves these goals in large part by reforming Social Security to better come to terms with the much higher levels of inequality in the 21st-century economy.

Social Security's Revenue Structure Is Being Undermined by Inequality

Since the 1970s mutually reinforcing economic and political forces have allowed a larger share of our national income to flow to the owners of capital and to high-level managerial employees, while the wages of average workers have stagnated. The labor share of national income has declined by about 10 percent since 1980, while the share going to the owners of capital has increased by over a third. And within the labor share, the distribution has become more skewed toward the top, with greater inequality than at any time since the 1920s.

Not only has wage growth slowed and become highly unequal, but wealth inequality has grown as well. Today the top 1 percent receive a majority of all investment income in the United States.

Social Security payroll taxes are not due on earnings above the Social Security tax cap. Only 6 percent earn above the cap, which is $118,500 in 2015. Hence only the bottom 94 percent of earners pay Social Security contributions on all of their earnings. Higher earners pay no Social Security contributions whatsoever on their earnings above the cap, or on any of their investment income. Given these structural constraints on Social Security's revenue stream, it is unsurprising that slow and extremely unequal wage growth is causing significant harm to Social Security's finances.

Retirement Income Crisis Calls for Expanded, Not Reduced, Benefits

Just as inequality is hurting Social Security's finances, it is also hurting average Americans' ability to save for retirement. After three decades with no growth in the aggregate income of the bottom 90 percent of Americans, a new report by the National Institute on Retirement Security finds that the typical working-age household has been able to accumulate only $2,500 -- and the typical household nearing retirement only $14,500 -- in retirement savings, and that more than half (62 percent) of households nearing retirement have retirement savings lower than their annual income. Moreover, today only 14 percent of workers participate in a defined benefit pension, with a downward trend.

As a result of these dynamics, a majority (52 percent) of today's working-age households are expected to suffer a decline in their living standards in retirement. In fact, the total gap between what households aged 30 to 60 have actually saved and what they should have saved by today to maintain their living standards in retirement is estimated to be $7.7 trillion. In short, we have an enormous retirement income crisis in this country. It is arguably our most significant public policy challenge. Yet most of the Social Security talk in Congress today is about cutting, not expanding, benefits.

Sen. Sanders' Plan Tackles Both Policy Challenges Head On

The Social Security Expansion Act, introduced last week by Sen. Sanders, would kill two birds with one stone.

To shore up Social Security's finances, Sen. Sanders' plan would eliminate the cap on Social Security contributions for earnings above $250,000 a year. It would also expand the system's revenue base to include high-income households' unearned income. Together, these measures would simply ensure that high-income households contribute to Social Security on all of their income at the same rate as the typical worker does.

To ease the retirement income crisis, it would expand benefits by:

- Increasing Social Security benefits by about $65 a month for most recipients

Those Serious About Retirement Security Should Embrace This Plan Now

While Social Security benefits may have been adequate in the 1980s, slow and unequal wage growth, the failure of the private account system, and cuts to Social Security benefits make benefits inadequate today. This suggests a strong need to expand Social Security beyond the current average benefit of $15,970 a year, to provide for a minimum benefit, and to ensure that benefits are not eroded by inflation after retirement.

Social Security has been a rock-solid foundation of the middle class over the past 80 years -- always self-funded and never contributing to the debt. It has proven to be an effective, efficient means of providing economic security to the broad middle class. In order to pick up the slack in employer pension provision and individual savings, it should not only be restored to full solvency but expanded. Sen. Sanders' plan would expand benefits while also extending Social Security's solvency through 2060.

Many in Congress talk a great deal about retirement security and about the need to "strengthen Social Security," but few back up their words with thoughtful proposals. Sen. Sanders' Social Security Expansion Act offers a bold, comprehensive plan that would go far in addressing the nation's retirement security challenges by truly strengthening Social Security, the only leg of the retirement stool that has a proven track record of success.