Sixteenth birthdays can be momentous occasions. A coming of age of sorts. Well, New Year's Day 2015 the European Central Bank turned 16. It is a momentous birthday, but not all that sweet.

To be sure, there is notable good news. The new headquarters in Frankfurt recently opened. Lithuania has entered the euro area. The frequency of ECB monetary policy meetings is about to decline. And there will soon be timely publication of minutes of these meetings.

But the risk of sustained deflation amid continued economic weakness makes for a very anxious birthday. Accordingly, policymakers already have signaled plans to initiate the kind of quantitative easing - large-scale purchases of government debt - that have become common practice in Britain, Japan, and the United States. In the euro area, however, these purchases are even more controversial because there exists no euro-area government debt free of default risk.

Start with the good news. We have not yet visited the new twin towers, but they appear awesome. They also serve a pressing space requirement: with the creation of the single supervisory mechanism (SSM) to oversee the region's largest banks, the staff of the ECB may soon may reach 3,000 people.

The buildings won't alter policy, but how about the other structural changes? First, there is the additional of the 19th euro-area member state. Lithuania is a small country, but its accession triggers the start of a rotational voting system at the Governing Council. The six members of the Executive Board will always vote, just as before, but the heads of the national central banks will now rotate voting rights, similar to the Reserve Bank chiefs at the U.S. Federal Open Market Committee (FOMC).

In addition to rotation, the number of monetary policy meetings will drop from 12 to 8 per year. The new meeting frequency makes the Governing Council's practice similar to that of the FOMC, which has had 8 meetings per year since 1980.

Interestingly, the Council's voting rotation is based on months, not meetings, so a rotating voter still may get to vote at all of the scheduled meetings in a given year. (This happens to be the case for the Bundesbank President in 2015.)

Next, starting this month, the ECB will publish Council minutes shortly following their policy meetings. These "[a]ccounts will offer a fair and balanced reflection of policy deliberations." But, they will not report votes - neither the total nor the composition of those for and against a decision.

What should we make of all of this? Well, the rotation seems unlikely to have much of an impact. In the context of the FOMC, the only thing rotation does is give members the option to dissent formally and publicly. Non-voting FOMC members can't do so formally, but they frequently discuss their concerns publicly anyway. Since Council votes will not be made public, and no Governing Council member is out of the voting rotation for more than three months at a time, the impact of ECB voting rotation is likely to be very small.

The meeting frequency itself is a move toward a more reasonable schedule. The case for convening monthly has never been strong: knowledge of the economic environment doesn't change that quickly, so forecasts can't be completely updated every month. Should policymakers really need to meet between scheduled gatherings, they always find a way to do it.

The most important structural change is the decision to publish minutes of one meeting during the interval prior to the next meeting. For the past 16 years, following the standard set by the Bundesbank, the ECB had agreed to publish minutes only after a 30-year lag (we're still waiting for the initial 1999 minutes!). Starting this month, the lag will be four weeks. (The FOMC publishes minutes three weeks after its meeting.) This enormous change converts the minutes from an archival tool for historians to one for timely communication with financial markets and the public. Since the ECB President will still hold a press conference following every meeting, we will have to see how much additional information is really contained in the minutes. Most of the time, the press conference and minutes are likely to be fully consistent, if for no other reason than the minutes will be written after the press conference. That said, the minutes may add occasionally to the press conference picture of what is driving Governing Council decisions, just as the FOMC minutes do.

As we wrote last year, the ECB and the Fed are converging in many ways, but so far, quantitative easing has not been one of them. At this writing, the ECB balance sheet stands at roughly €2 trillion, more than €1 trillion below its mid-2012 peak. By the end of February, more than €200 billion in long-term refinancing currently outstanding will mature. That is, without a change in policy, we can expect the consolidated balance sheet of the Eurosystem to fall to roughly €1.8 trillion. The ECB's new structural reconfiguration does not alter this prospect.

At the same time, euro-area inflation continues to fall, clocking in at -0.2% for the 12 months ending December 2014. And there is virtually no growth - real GDP today is roughly the same as it was at the onset of the global financial crisis, while investment remains 20% below its 2007 peak, or about the level it reached shortly after the euro was created.

Can monetary policy, conventional or otherwise, alter this prospect substantially? If the ECB is willing to use all its available tools without limit, there is little reason to doubt that it can hit its inflation target of close to 2%. However, making that policy commitment credible remains a great challenge because of the controversy and dissent about acquiring risky government debt. Even if the ECB makes good on its price stability mandate, the euro-area's long-run performance provides plenty of scope for skepticism about economic growth.

To understand why, recall that monetary policy influences the real economy by altering financial conditions, broadly defined. The emphasis of conventional policy is on short- and medium-term interest rates, while for unconventional policy the focus is usually on long-term yields. But, in each case, the monetary transmission mechanism has many possible channels, such as influencing lenders' willingness to lend, borrowers' capacity to borrow, asset prices, and exchange rates.

With monetary policy at the zero lower bound (ZLB) for nominal interest rates, further ECB easing can only be unconventional. When the U.S. hit the ZLB, the Fed began buying long-term Treasuries and federally guaranteed mortgage-backed securities. Today, The Fed owns $2.35 trillion worth of the former and $1.75 trillion of the latter. While the verdict is far from unanimous, research suggests that these balance-sheet moves improved financial conditions that, in turn, stimulated U.S. consumption and investment. As such, Fed actions helped the economy avoid deflation and jump-start economic growth.

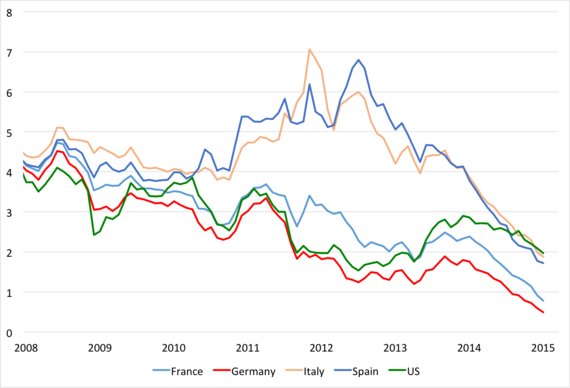

Would an ECB bond purchase program succeed in the same way? The channels for policy transmission seem considerably narrower than in the United States. Long-term yields already are very low (see chart below). For the most part, European yields are now below those in the United States (the green line), while Italian and Spanish yields are less than 150 basis points above those on German debt (the red line). Many investors already anticipate a significant ECB balance sheet expansion, so it is unclear how much further these yields will decline when the ECB acts.

With the exception of the exchange rate, other potential avenues of policy transmission - say, through higher asset prices and collateral values - also are likely to be less powerful than they were in the United States. For example, market-based finance remains substantially less important in the euro area, while the widespread desire to deleverage limits the benefits of improving collateral. As ECB officials are fond of saying, roughly 80 percent of financing in the United States is through capital markets and 20 percent through banks. In Europe, the structure of finance is nearly the reverse. These considerations help explain why many observers view structural policies and - where feasible - fiscal initiatives as key parts of the growth solution. In the long run, it will be the structural changes that determine euro-area productive potential and living standards.

So, as we wish the ECB a happy birthday, we compliment the Frankfurt policymakers on their extraordinary achievements and applaud their willingness to change. We also hope they can recruit member governments to help solve the daunting problems the euro area faces.

An earlier version of this post appeared on our website at www.moneyandbanking.com.