As a young person, I have a great interest in understanding how the economy performs and what drives movements in the markets. Every year I outline my views on how the economy will pan out the following year.

As per tradition, below is my economic outlook for 2016. 2015 was certainly a lackluster year for the global economy, with many of the key themes relating to falling commodity and oil prices, unstable stock markets and jittering economic growth. As much as I would wish to remain optimistic, so far, early indicators suggest that a majority of these issues will endure or even be exacerbated.

So, let's delve deeper:

Broad-Market Corrections in U.S. Equities

This has a lot to do with interest rates. In 2016, upside in share prices will largely be limited by the Federal Reserve (Fed) and the risk of further tightening in monetary policy, effectively increasing the cost of borrowing capital and discouraging business spending and investment. Further, another important market metric, the P/E (Price to Earnings) ratio, has and will continue to see multiple contraction (signal of a bear market) as investors demand additional earnings for every dollar invested. In line with earnings, rising margins are set to result in slightly higher profitability in select corporations while decreasing energy prices will significantly hurt net income. Given companies continue share buyback programs (thanks to low rates), EPS (Earnings per Share) measures shouldn't see significant declines and could instead see rises by up to 5% in the S&P 500 based on the current pace of margin expansion.

Rising Defaults in High-Yield Bond Market

High-yields are a big one. Record-low interests rates have led to a massive allocation of capital by average investors to high yield bonds -- leveraged loans issued by non-investment grade businesses -- in the hopes of generating returns that will outpace inflation and make any investment worthwhile. Looking to the future, with downward pressure on commodity prices, namely oil, certain businesses that issued high-yield bonds will default on their debt as profitability decreases, making debt repayments onerous. As the Fed hikes interest rates, these companies will have a hard time raising capital to not only pay off previous debts but also to continue operating. This conundrum is reminiscent of the subprime mortgage crisis, when investors piled into risky mortgage bonds but fled at the first sign of faltering. This time, like the previous, there is a dearth of liquidity in the markets. Investors might not see this as an issue, but it is -- and a very big one. As soon as these risky businesses default on their debt, frantic financiers of the movement will attempt to run for the exits but will be unable to sell their bonds, contributing to widespread market panic. This issue is one all investors should be paying attention to.

Slowdown in China

Structural issues in China have led to a severe slowdown in the country, prompting worries among investors and sending ripples across the global markets. I've been warning about China since last year, when real estate in the country began to falter. Since then, prices have come stumbling down and show no signs of stopping anytime soon. The main issue in the country is the prevalence of credit, especially in the form of leverage in the stock market. As share prices have come crashing down, margin calls have been triggered, only exacerbating the agitation. Moving forward, the government will be forced to lower short-term interest rates and increase spending to merely support growth. China's slowdown will only get worst in 2016 and will likely impact the international financial markets to the negative side.

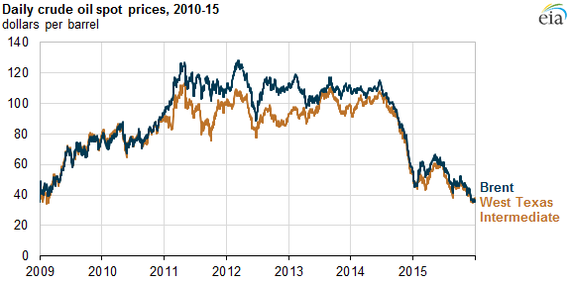

Falling Oil Prices

Oil has been a major source of distress for many investors in the past two years, with crude prices dropping over 50%, from $110 in 2014 to $40 at the end of 2015. This was mainly driven by rising supply and falling demand. Unfortunately, oil prices' relentless fall shows no signs of stopping (in the short run, at least) as inventories near storage capacity, demand continues to falter (mainly because of China) and supply remains resilient. This certainly has dire consequences for the energy sector and for the high-yield bond market, as mentioned earlier.

Shakeup in High-Technology Industry

Technology remains a key pillar of growth in the U.S. economy. A major issue in the past couple of years has been the funding of startup companies that do not sport rigid fundamentals, yet are valued at inordinately high multiples. Thanks in large part to low interest rates, venture capital firms have been able to provide favorable terms to a greater number of nascent businesses. This, in turn, has inflated private company valuations and prompted much disquiet in the tech world. As monetary policy normalizes and capital becomes harder to come by, the valuations of high-tech companies are sure to go through a period of readjustment as term sheets begin to reflect the intrinsic values of companies.

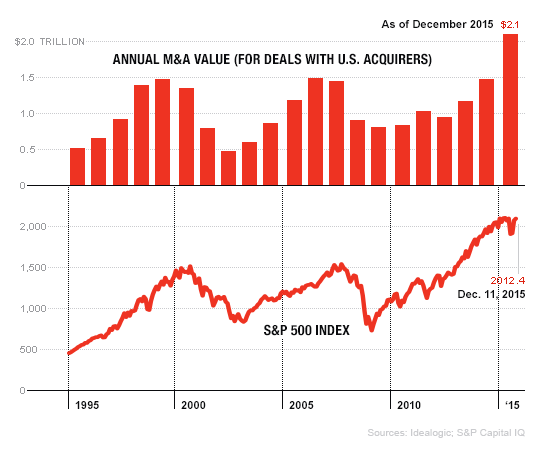

M&A Activity Will Stay Strong

2015 has been a breakthrough year for Mergers and Acquisitions, with over $4.26 trillion in global aggregate transactions. Some of the landmarks deals included mergers between Pfizer and Allergan as well as between Heinz and Kraft Foods.

M&A has boomed post-financial crisis largely prompted by record-low interest rates

M&A has historically been known to signal tops in stock prices, as witnessed by the chart on the left. This statement still holds true as Mergers in 2015 were largely driven by record-low interest rates and the want for corporations to increase stock valuations (in part due to rising shareholder activism, which will continue to prosper in 2016). With rates scheduled to tread at current levels in the coming year, there is little doubt that this surge in industry consolidation will continue.

Conclusion

From the above points, its easy to paint an ominous picture of the economy in 2016. While I certainly don't think we will plunge into economic abyss this year, I do believe there are some significant structural problems in the global markets. Most of these have come as a result of record-low interest rates. Although these rates have helped us stay out of a decade-long depression, they have also amplified the risk of further bubbles being created. The corporate world is the perfect example of this quandary which ties in many of the themes above. Low rates have led to unprecedented levels of M&A, sky-high company valuations and gargantuan amounts of capital in overly risky assets. These features are all tied by one factor: credit. Since the financial crisis, debt has been abundant and was the primary agent that fueled the massive run in stock prices. As such, even though I do not believe we will be seeing a bubble pop anytime soon, I would err on the side of caution as we approach seemingly bleak times.

Extras:

Throughout this report, I tried to focus on the key underlying themes in 2016, but here are a couple of additional points to help paint a holistic view of the economy.

- The European Economy Will Continue to Recover: Fiscal expansion, low oil prices, weak exchange rates and low interest rates will contribute to growth in the Euro-area remaining at 1.5%.

- Emerging Markets are a Mixed Bag: While China's economy continues to be precarious, India and Indonesia look to sustain their high-levels of growth.

- Commodity Prices are another Mixed Bag: An appreciating dollar, lower oil prices as well as decreasing demand from Emerging Markets (because of strength of USD) and from China will result in a relatively flat market (with chance of uptick).

- Declines in Real Estate Prices: Decreases will be most evident in the luxury property markets of major cities.

--- Originally written on January 7

Disclaimer: I am not a registered investment adviser and do not purport to tell or suggest which securities you should buy or sell. Please consult your own investment adviser before making any investment. The analysis and thoughts presented above are not investment advice and are only personal opinions.