As I write this, the CEO of Volkswagen has stepped down and three top executives of VW have been fired, with more still to come. By all accounts, including Volkswagen's, they intentionally created software to mask the large amounts of toxins emanating from cars that were sold to the public as clean diesel. No one yet knows who is responsible, but initial estimates by VW suggest that 11 million cars worldwide are likely affected. In the wake of these disclosures, the share price of the company lost more than a third of its value, and estimates of forthcoming fines run in the neighborhood of US $18 billion.

Those who see a silver lining no doubt will say this proves once again how important it is to protect a brand name and how critical it is for leaders to know and act on what is right. Business schools will shake their heads in agreement and add VW to an already robust case file on corporate ethical breaches. Everyone will search for rotten apples and identify human failure as the reason for the debacle. The result will be plenty of apple juice for the drinking, possibly labeled organic.

Whenever I encounter a systems problem dressed up as individual failing, I look for patterns in the collective situation. In this case, I browsed my library of Fortune magazines running back 30 years. But I didn't need to go back that far. Staring back at me from the front cover of Fortune's May 14, 2007, edition was an image of a fist punching through a white canvas background. Fortune was declaring that after years of corporate malfeasance, a positive change was taking place. Above the fist was the word "BUSINESS." Below the fist were the words "IS BACK." BUSINESS IS BACK.

You see, profits were once again soaring, and mea culpa's were in the rearview mirror. "The shaming is over," the article declared. "The 5 1/2 year humiliation of American business following the tech bubble burst and the Lay-Skilling-Festow-Ebbers-Kozlowski-Scrushy perp walks that will forever define an era has run its course."

For those who don't recall, the cavalcade of corporate transgressors included some of the biggest names and businesses. The American energy company Enron was dissolved amid corruption charges under the leadership of Ken Lay, Andrew Fastow, and Jeff Skilling. Dennis Kozlowski was charged with looting $600 million at Tyco and served time for, among other things, receiving $81 million in unauthorized bonuses. Bernie Ebbers was convicted of fraud and conspiracy at WorldCom. Richard Scrushy, CEO of HealthSouth, served prison time after being found guilty on political corruption charges for money laundering, obstruction, racketeering, and bribery.

Now, in the merry month of May, Fortune was announcing a turnaround. Business was rebuilding its reputation, declaring it could help solve intractable social problems and embracing relationship marketing, corporate language for telling everyone the good they were doing. With the simmering and mashing of the rotten apples, the public thirst for justice appeared satiated.

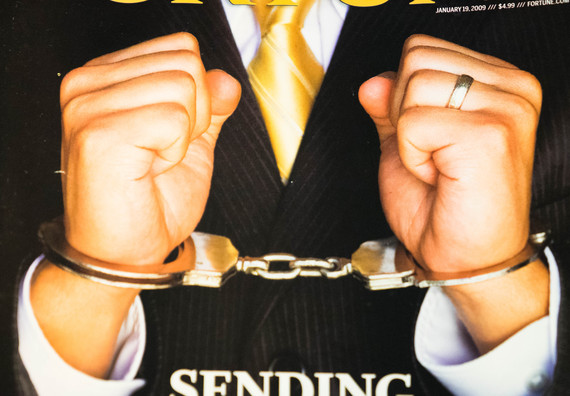

Oops. Twenty months later, the resurrection of corporate America was hit with a tsunami of deceit, the epicenter this time on Wall Street. Now the cover of Fortune's January 2009 edition featured two fists held up vertically, connected by handcuffs. And just below the handcuffs were the words "SENDING WALL STREET TO JAIL."

Seemingly out of the blue, global capitalism was hanging by a thread. Without the financial intervention of the federal government, the group that Wall Street wanted to keep at arm's length, companies as large as General Electric would not be able to keep their lights on. Investment firms like Bear Stearns and Lehman Brothers got screwed leveraging portfolios on financial instruments with names like CDO-squared. The insurance giant AIG, plunging toward bankruptcy, had to be bailed out by the Federal Reserve. Its controller urged the outgoing CEO to fire a dozen or more senior executives for "a clear pattern of ineptness that contributed to the destruction..."

The question of a few rotten apples now became a problem with orchards of ineptness, arrogance, and deceit. Freddie Mac, Fannie Mae, and maybe even Susie Q were all in on it. The Fortune cover story captured the dilemma. "Criminality is about deviance, so the more widespread undesirable conduct turns out to have been, the harder it is to treat as criminal." The question is, how can we assign blame or guilt when the situation is pervasively corrupt? But maybe that is the wrong question.

Is it possible that our belief in individual principled action is overmatched and overwhelmed by the collective situation? By this I mean a system that rewards success and financial reward at nearly any cost. Or as the pope pointed out in his UN speech this past week, "a selfish and boundless thirst for power and material prosperity."

The common factor that preceded the corporate scandals in 2001-2006, the Wall Street fiasco in 2008, and the Volkswagen scam in 2015 was their success. In the business and financial community, Enron was viewed as the darling of innovative disruption. Bear Stearns was recognized as the top securities firm in Fortune's "Most Admired Companies" survey. AIG's growth in the early 2000s was astronomical, and Martin Winterkorn, the CEO of Volkswagen, oversaw the doubling in sales and tripling of profits during his eight-year tenure. Whether these leaders were personally ethical or not, knew what was going on or not, is secondary to the power of the situation and roles they and thousands of others played in these disasters.

The psychologist Philip Zimbardo, professor emeritus at Stanford University, knows something about the power of the situation. He was the creator of the Stanford Prison Experiment, which highlighted the ease with which intelligent elite college students could become indifferent to suffering and unethical behavior. In his foreword to Ira Chaleff's recently released book Intelligent Disobedience, he notes how the individual dispositions of the students predicted nothing about how they would behave under demanding social conditions. "Even I was caught up in the power of that situation.... I became indifferent to the suffering of these young men..." Study after study appears to confirm what we intuitively suspect, that what individuals say they will do is divergent from what they actually do. Zimbardo notes, "The overall high rate of obedience to authority was... distressingly high."

The rigging of the VW emissions tests hid the reality of cars spewing 40 times the legal limit of nitrogen oxide, and pollution estimated to equal the UK's combined emissions for all power stations, vehicles, industry, and agriculture. This was no simple financial skulduggery but an assault on the planet and the health of all who live on it. And these actions are not isolated to one car company or the few within that company who may be found criminally deviant.

The disregard revealed by these deeds can be understood as representative of human behavior under intense conditions for securing profit, influencing enterprises as diverse as pharmaceuticals, chemicals, energy, food production, and financial services. What is calling for our attention is the need to speak directly to the power of our collective situation, including an economic system so singular in its pursuit of wealth that we become indifferent to both the soil and the soul of humanity. What is the true nature of business? How will it contribute to the restoration of the earth and the integrity of all people and living things? When we speak wisely to these questions, then we can say, Business is back.