He says "Drill here, drill now!" to reduce the price of gas, but every time the price of oil goes up, more jobs return from China, and first to the basic heavy industries like steel. Why does he hate the rust belt states? Or, for that matter, Mexico?

All graphs from CIBC World Markets StrategEcon May 27, 2008, pdf here

Once the mills of US Steel and Bethlehem Steel employed thousands, producing the metal that was cast into the building materials and cars that were the engine of the American economy. Then they were silent, as new technology could produce new steel from scrap at a lower cost than virgin steel from ore. Soon it became cheaper to ship that scrap to China and ship it back to the US, and the North American steel industry almost shut down, and with it, many of the towns and cities that supplied the workers for it. The most productive cities in America became known as the "Rust Belt" as the economic engine of the country moved to Arizona, building houses and big box stores to sell the stuff that filled the houses.

Then, something happened. Jeff Rubin, chief economist for CIBC World Markets, writes:

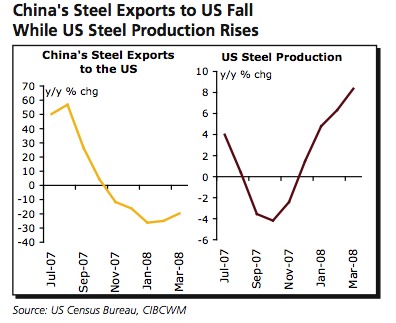

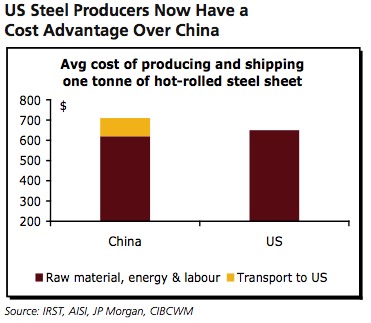

"Soaring transport costs, first on importing iron to China and then exporting finished steel overseas, have already more than eroded the wage advantage and suddenly rendered Chinese-made steel uncompetitive in the US market....China's steel exports to the US are now falling by more than 20% on a year-over year basis--the worst performance in almost a decade. While many might attribute this decline to the slowdown in the US economy, it is noteworthy that US domestic steel production has risen by almost 10% during the same period."

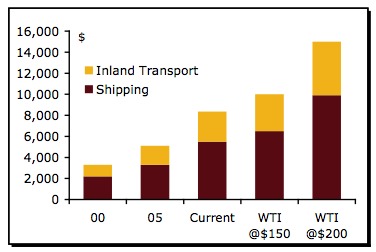

Rubin continues: "Shipping a standard 40-foot container from Shanghai to the US Eastern seaboard now costs $ 8,000. In 2000, when oil prices were $20 per barrel, it only cost $3,000 to ship the container. But at $ 200 per barrel, it will soon cost $ 15,000 in transport costs to ship from China to the US Eastern seaboard."

For heavy things with low labor input, like steel, the response has been immediate, American steel is again competitive and is increasing production, even in the face of a recession. Heavy or bulky manufactured goods, like furniture and industrial machinery, take a little longer, but are following.

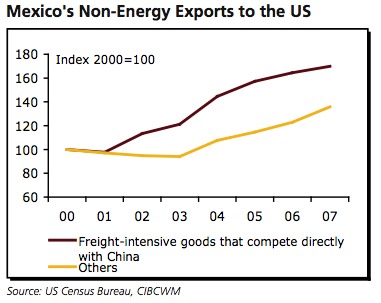

Rubin concludes "Instead of finding cheap labor half-way around the world, the key will be to find the cheapest labor force within reasonable shipping distance to your market....It seems that American importers are starting to do the math. While the pace of shipments from China to the US is slowing- mainly among freight-intensive goods, even non-energy Mexican imports to the US are still rising at a healthy annual rate of more than 7%. And interestingly, the goods that have seen the fastest growth are the ones that, on average, are more freight intensive and directly compete with China, such as furniture, iron and steel, rubber and paper products.

In a world of triple-digit oil prices, distance costs money. And while trade liberalization and technology have flattened the world, rising transport prices will once again make it rounder."

Now if you are from Arizona, your business experience, if any, is probably in real estate, and the declining value of the suburban real estate market is directly correlated to the price of gas to get there and the cost of electricity to run the AC. You want cheap energy if you live in Arizona.

But if you make steel in Pennsylvania, furniture in North Carolina, or work in the maquiladoras across the border, you may notice that jobs are coming back, that companies like IKEA are looking for factory sites, that stuff imported from China is not as cheap as it once was.

Rationally priced gas can put America back to work, but they don't see that down where the economy was built on cheap energy and real estate development rather than making things. They just say "drill here, drill now" and screw everyone else.

Read the PDF of Rubin's report from CIBC World Markets and a tip of the hat to ::Solve Climate

More on Jeff Rubin

Jeff Rubin Predicts "Mass Exodus" From Cars in US

Gas $7 Per Gallon in Four Years

The World Is No Longer Flat