This question originally appeared on Quora.

Michael McGraw-Herdeg, Microsoft PM (Excel Services).

Yes, the legacy US airline model of "if you you take a 500-mile journey, you earn 500 frequent-flyer miles" is waning in popularity.

This model was attractive because it created inefficiency. Customers trade dollars for miles at obfuscated rates and redeem them at opaque rates. In an inefficient system, uninformed consumers have little idea how much their rewards are worth. Well-informed consumers in an inefficient system can get some insanely great deals that make them big fans of the system.

Getting concrete: It seems so simple to say "you will get 10% of your ticket purchase back as cash". Yet perhaps this is too simple. I don't want 10% of my ticket back -- my tickets aren't that expensive, anyway -- I want a free trip to Europe!

- I just need 1,500 more miles to get a round-trip ticket, so I'll fly on United instead of Southwest.

- I just need 1,500 more miles to get to Europe this winter, so I'll buy a revenue ticket instead of redeeming my frequent-flyer miles for Thanksgiving.

- I need to spend $100 more before I can earn a $500 ticket

Back when I had lots of reimbursable business expenses, I did this with credit cards. I bought meals with my 5%-back-on-restaurants card. I bought gas and groceries with my 5%-back-on-gas-drugs-and-groceries card. I bought everything else with my 2%-on-everything card. This was not great for the credit card companies (5% is a loss leader, and so for that matter is 2%). It certainly didn't build loyalty.

Legacy carriers have me earn "miles" because they're more unpredictable. It's hard for me to predict what trips I'm going to take, how many miles they'll earn, and how much they'll cost relative to the alternatives.

When booking a trip, I know how to find the cheapest flight, but it is very hard for me to compare them based on price and on the value of the miles they'll earn. I can compare two numbers unconsciously, but it takes conscious thought to decide "well, this LAX-JFK flight is 3 cents per mile on United and 1.5 cents per mile on Southwest; my threshold is 1 cent per mile, so I'll buy Southwest".

By clouding my calculations, the legacy earn-miles-based-on-flown-miles carriers make me more likely to stockpile miles on a particular carrier.

There is a middle ground

Modern frequent-flyer programs can get the best of both worlds -- combine the obfuscatory power of miles with the revenue incentives that executives want. Check out three modern examples of programs that are ALMOST straightforward revenue-based, but then veer ninety degrees into obscure at the last minute:

Southwest Rapid Rewards (buy tickets: 16.7 cents per point; redeem points: 1.67 cents per point),

Virgin America Elevate points (buy tickets: 20 cents per point; redeem points: 1.6-2.3 cents per point)

JetBlue TrueBlue (buy tickets: 16.7 cents per point; redeem points: at 1-1.5 cents per point).

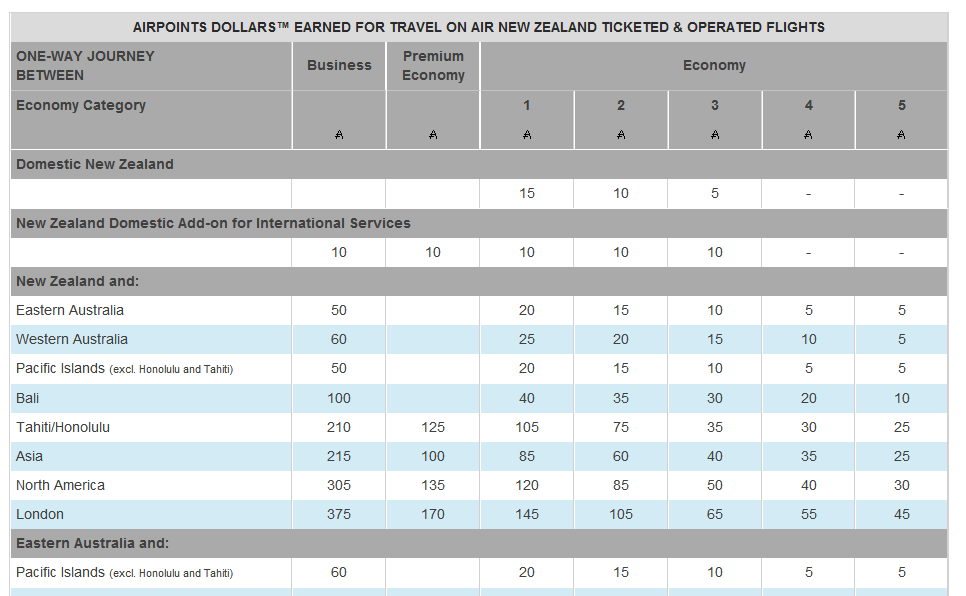

To see the logical conclusion of this obfuscation, check out the insanely obscure hybrid approach of the Air New Zealand earning chart, based on travel zones and fare class:

Surely you can't be serious, Kiwis! (http://www.airnewzealand.com/airpoints-dollars-earned-on-airnz-from-1-february-2012)

It is clear that the modern revenue-based carriers all obviously read a report where a consultant said, "YOU WANT: to maximize revenue." "CUSTOMERS WANT: to be rewarded." "PSYCHOLOGY SAYS: tie rewards to revenue!" How could anyone disagree? And how could anyone fail to provide a straightforward reward-the-spending approach to travel?

The best explanation I have heard as to why not every carrier has adopted this model is that if you provide rewards very efficiently, you cannot afford to provide very good rewards.

- If I buy a $350 round trip from Los Angeles to New York JFK, as a United 1K member, I'll earn about 10,000 frequent-flyer miles based on distance flown. This is worth anywhere from $100 to $200 to me, because I tend to redeem miles in places where I would otherwise have spent 1-2 cents per mile.

- If I buy a $350 round trip from Southwest and I'm a top-tier "A-List Preferred" member I'll earn 4200 frequent-flyer points based on spent. This is worth at most $70 towards Southwest purchases.

Southwest isn't trying to be stingy here. They just can't, despite their attempts to obscure the value of their rewards by converting them to an alternate "points" currency, evade the fact that you always get at least a 10% discount. United's more complicated system is great for someone with a lot of miles and a lot of patience because they offer redemption options that can be worth anywhere from 0.5 cpm ("Buy goods with miles at the Mileage Plus Shopping Mall!") to 10+ cpm (round-trip business-class tickets with free stopovers).

For business travelers who buy high-margin tickets at the last minute or in premium cabins, mileage earning does affect their choice of carrier. They'll notice that one carrier offers much better options and they'll pick that one. Straightforward, revenue-based programs can be too simple to offer a good deal to the kind of business travelers who make up an enormous fraction of legacy carriers' revenue.

If there ever comes a time when the Southwest trip's rewards are the best deal available, sure, I'll buy a Southwest ticket. But because their product is so easy to use, I've got no incentive to buy another one at another time -- the program's not sticky at all.