There has been a lot of talk about a double-dip recession recently by people like Paul Krugman and Nouriel Roubini: how to define it, and what it means. What is missing from these discussions is the most obvious question of all: why won't the economy recover?

Capitalism is supposed to be self-correcting - or so we've been told - and a recession like the one we've had is supposed to be that reset button. So why aren't businesses hiring? I'm going to try to answer that question in the simplest way possible.

There are two primary reasons why the economy isn't recovering: One reason is cyclical, the other is secular.

The Cyclical Problem

The curious inability of politicians to use the term "credit cycle" when discussing fixes to our economic problems is a disturbing condition. It not only reveals that our political leaders have no intention of attacking the problems head-on, but also that we can't look to them for solutions. What's more, it also distracts the public away from what is actually wrong with the economy, and instead gets them arguing over useless trivialities and tangents, like the size of a new stimulus package.

Forget the political spin. Forget the happy-talk, bullsh*t from talking heads on financial news shows. Forget all the distractions and focus on the most important point about our economy: how we got here. Plain and simple, what got us here was the credit cycle, and until that credit cycle is played out we are not going to have a recovery no matter how many tax cuts and stimulus packages are created. Period. End of story. The sooner we face up to that fact the better off we will be.

So what is the credit cycle? Consider for yourself the Minsky Moment.

When a market fails or falls into crisis after an extended period of market speculation or unsustainable growth. A Minsky moment is based on the idea that periods of speculation, if they last long enough, will eventually lead to crises; the longer speculation occurs the worse the crisis will be. This crisis is named after Hyman Minsky, an economist and professor famous for arguing the inherent instability of markets, especially bull markets.

What Hyman Minsky described is exactly what happened to the American economy. In fact, Minsky described it almost too well, as if he was an economic Cassandra writing the future that everyone refuses to believe.

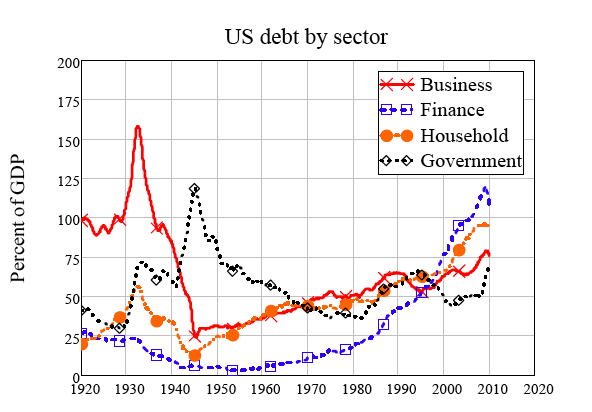

The economy from the mid-90's to August 2007 was defined by cheap money and easy credit. Everyone took on more and more debt in order to speculate on asset values, first stocks, then housing. As asset prices kept going up, credit based on those overvalued assets got easier to obtain.

Once everyone is "in", when the number of new speculators runs dry, prices begin to fall. "Weak hands", such as subprime borrows, begin to default. Speculators try to dump assets, but the number of suckers aren't enough to buy up all the excess supply. Prices collapse. As asset values drop, so does liquidity, because everyone runs to cash in order to cover their bad debts. That includes the banking system.

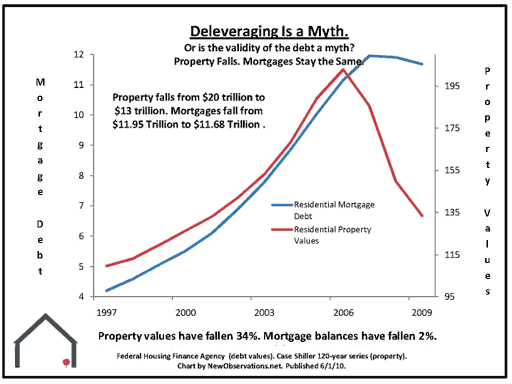

This is where we are now. Note how housing prices have fallen, but the debt behind those houses remains despite an avalanche of bankruptcies and foreclosures. The economy is overloaded with bad debts that will never be paid. The government stepped in to stop the collapse of these asset values in order to save the banking system that made the stupid loans. This transferred some of the bad private debt to public pockets. The bad debt didn't go away, it merely changed locations. The economy is still burdened with it.

It is for this reason why the Cash4Klunkers program and the Federal Home Tax Credit were so ineffective as stimulus. The programs merely induced consumers to go more heavily into debt by buying overpriced assets.

The only way the economy can move on and start growing again is if: a) the debt is paid off, or b) the debt is defaulted on.

It is this choice that is being decided now. The sudden concern about public deficits is a reflection of the power of the holders of that bad debt - the wealthy class.

The top 1% owns nearly half of all the financial wealth of this country. The bottom 90% of the population owns less than 7% of business equity, less than 19% of stocks, and less than 2% of all the bonds. On the other hand, the bottom 90% owes 73% of all the debt, most of it in the form of unproductive mortgage debt.

It is the rich of the world that own those overvalued debt obligations and they want their pound of flesh, even if it means that the real economy is stripped bare and tens of millions of working class people suffer to accomplish this.

The thing is, even if all the social services of the industrialized world are gutted, even if taxes on the poor are raised to crushing levels, the bad debt is simply too large to ever be paid. The loans should never have been made in the first place. In a country with real capitalism the wealthy people who made the loans should have to take their losses.

But instead, the rich are trying to suspend capitalism and using the government to force the working class to bail them out.

One way or another, it isn't going to work. Just look at what happened with Japan for the last 20 years. Very few of those bad debts will ever be paid off. Efforts to avoid this eventual outcome will only prolong the hardship. Banks, burdened with these toxic loans, will suck every last dollar out of the economy that they can while trying to stay solvent. The point that economist Michael Hudson has made so often: "Debts that can't be repaid, won't be repaid".

Japan repeatedly tried to stimulate their way out of the bad debt burden and it failed. All it did was raise the national debt levels to 200% of GDP. Yet we seem determined to try the exact same methods. Stimulus is not, and never will be, a real solution.

When I say stimulus is not a real solution, I only mean that it is not a permanent solution. It's only designed to get us from point A to point B. If you need to keep trying stimulus (like Japan since 1990) then you obviously are overlooking a structural problem.

Secondly, not all stimulus is the same. For example, I back a WPA-style endeavor to rebuild our rail system and electrical grid. It's the stimulus designed to get people to spend more money that I don't endorse. Our savings rate is already too low, and we already consume too much stuff we don't need.

To put it another way: we need stimulus for direct job creation, not to get us to consume more.

Let's not kid ourselves, we've deployed an enormous amount of stimulus. TARP was only a small percentage of the bailouts. Trillions of dollars of bailouts was funneled through the Federal Reserve. Hundreds of billions more was needed to bailout Fannie Mae and Freddie Mac. Then there was all sorts of tax breaks on both the federal and state level to prop up the housing market.

All of this, every part of it, was done to prop up the unrealistically over-inflated prices of assets that are almost entirely owned by the top 10% of society.

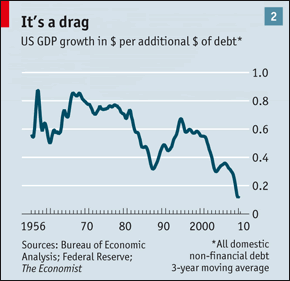

What the stimulus does is burden the economy with more and more debt, which has become increasingly less effective in stimulating anything. The more debt society takes on the more productive capacity it takes just to pay interest on the debt, the less the real economy can grow. Once the debt/GDP growth ratio falls below long-term interest rates the game is over.

As economist Steve Keen puts it:

Debt-financed growth is also highly unlikely, since the transference of the bubble from one asset class to another that has been the by-product of the Fed's too-successful rescues in the past ((Minsky 1982, pp. 152-153.)) means that all private sectors are now debt-saturated: there is no-one in the private sector left to lend to.

Instead of a sign of economic success, the "Great Moderation" was a sign of failure. It was the lull before the storm of the Great Recession, where the lull was driven by the same force that caused the storm: rising debt relative to GDP in an economy that had become beholden to Ponzi finance.

The real solution is to write off the bad debts. Yes, pension funds will get hit. 401k's will get hit. Banks will be closed down. Foreclosures will increase for a while. Things might get real bad for a while.

All the surplus capital dedicated to servicing bad, unproductive debt would be released to create jobs and make working people's lives better once a default happens. When it is done both businesses and consumers could function without the legacy weight of all that debt. Jobs would finally come back.

When I mention default I mean on every level, including on the municipal level. Contrary to what you may have read in the news, this country has a history of states defaulting on their debts. The world didn't end.

Politicians don't talk about this inevitable outcome and how we got here because it would expose their complicity.

The Secular Problem

Most Americans aren't aware that America once had a national economic plan, and it existed from the days of President Lincoln to President Nixon in one form or another. During that 112 year period America grew from an agrarian, frontier nation, to the most mighty economic power the world had ever seen.

Obviously there had to be something good in that economic plan.

The roots of the American School of Economics go back to Alexander Hamilton, Friedrich List, and Henry Clay of the Whig Party. The American School of Economics was far different from the dominant economic thought of today.

The key components of the American School directly confront, deny and refute the economic imperialism that the so-called "Free Trade" school championed then by England and imposed by means mostly foul upon Europe over the years. It rejects free trade by imposing a system of duties, tariffs and other measures designed to defend the nation against economic threats by foreign predators. It uses government-directed spending projects meant to provide the infrastructure necessary for individuals to develop into the highly-educated and highly-trained people capable of being the ambitious and enterprising productive people we are famous for being. It chartered a national bank, owned wholly by the government, that administered the lines of credit necessary to get all of this done and otherwise oversaw the monetary policy of the state- and thus remained utterly accountable to the people by way of Congress and the Presidency.

The American School of Economics also involved government support for the development of science and a public school system. Through this economic philosophy America set the standard in manufacturing, higher education, scientific research and development, finance, and general standard of living.

So what happened? Under President Nixon the decision was made to remove protective trade barrier and go to a Free Trade model in 1973.

According to The Myth of Free Trade by Dr. Ravi Batra:

"Unlike most of its trading partners, real wages in the United States have been tumbling since 1973, the first year of the country's switch to laissez-faire...Before 1973, the U.S. economy was more or less closed and self-reliant, so that efficiency gains in industry generated only a modest price fall, and real earnings soared for all Americans... Moreover, it turns out that 1973 was the first year in its entire history when the United States became an open economy with free trade.

"Since 1973 and free trade, the link between real wages and productivity was severed, where its commitment to free trade soared faster than domestic economic activity. Real wages for 80% of the labor force have been steadily shrinking in spite of rising productivity. Free trade skews the real value of manufactured goods, through cheaper foreign labor or weaker foreign currencies in relative prices, despite increased productivity and innovation, in turn creating a shrinking consumer base."

A good example is NAFTA. Despite predictions that NAFTA would create 170,000 American jobs in just the first two years, Congress set up the NAFTA-TAA (Trade Adjustment Assistance) program for displaced workers. Between 1994 and the end of 2002, 525,094 specific U.S. workers were certified for assistance under this program. Because the program only applied to certain industries, only a small fraction of the total job losses were covered by this program.

Remember those car companies that the American taxpayer saved so we could keep some well-paying manufacturing jobs in America? Well, guess what?

General Motors and Volkswagen have invested billions in China, starting more than a decade ago. Ford is rushing to catch up by adding production capacity and expanding its dealer network in China. Ford and its joint-venture partner, Chang'an Ford Mazda Automobile, plan to start producing next-generation Ford Focus models at a new, $490 million plant in Chongqing in 2012.

How can American workers compete with Chinese workers making $5 a day? You can't live on that in America. You literally couldn't keep a roof over your head on that wage. Our "free trade" philosophy is killing the working class of this country.

Any serious national economist who objectively reviews the reality of free trade must eventually come to the conclusion that it is ruinous to a nation. Granted it may seem to work short term in providing "cheap goods" but in the longer perspective it destroys the productive wealth-creating base of a community.

The only ones who benefit from the free trade policy are multi-national corporations and the the wealthy who own them. The workers of this country were never meant to benefit from the free trade policies, but there is an entire industry of talking heads who try to convince you not to believe your own "lying eyes".

The free trade model is a fallacy and every thinking person knows it. However, our corrupt and compromised politicians can't admit it because they are owned by the very people who benefit the most from it.

Besides adopting a free trade model, America has turned away from the other tenets of the American School of Economics. Specifically, it has neglected public infrastructure projects in the hope that privatization of public assets would do a more capable and efficient job. This strategy has also failed miserably.

The third leg of the American School of Economics was to create a financial infrastructure that would "use of sovereign powers for the regulation of credit to encourage the development of the economy, and to deter speculation."

In a trifecta, our rejection of this principle has been an utter failure.

Even after the credit cycle finally runs its course, the country has to overcome its more intractable systemic problems. Fortunately, we have a working model with 112 years of success to operate from.

The primary obstacles between our present situation and a return to wealth-producing prosperity is our politicians and the wealthy class who own them.