What is holding up agreement of a debt ceiling increase is obvious. Republicans want to continue to shrink the middle class when they won't allow repeal of the Bush tax breaks. That means they do not understand the most basic economic Law of Supply and Demand applied to macro economic growth. One cannot both shrink the incomes of middle class wage and salary earners (i.e., reduce money in circulation), and require them to pay for the resulting budget deficit (shrinking demand), in other words.

When most wealth is shifted to the highest income brackets via a lower maximum income tax rate for the wealthiest, capital gains, and business tax breaks for investors, while depressing the incomes of ordinary wage and salary earners who generate most economic activity, they take away the main source of deficit reduction, as I have said in past blogs.

Republicans have directly attacked the incomes of ordinary workers in several ways -- by attacking their collective bargaining rights (in Wisconsin and Indiana for starters) and shifting the tax burden to payroll tax payers who are mainly wage and salary earners. The result has been our record budget deficit, which is endangering the U.S. credit rating, and worldwide growth. The Republican stance is fiscally irresponsible, in other words.

There is no legitimate policy or economic theory that excuses such behavior. The Republican mantra that lower taxes puts more money into private pockets didn't put those monies into the pockets of the middle class who has to pay for the result. That is because GW Bush's tax breaks were paid with borrowed money.

The record is clear. Republican have been responsible for most of the historical, as well as the current federal debt, because of their tax cutting obsession. The results of a recent paper by St Louis Fed econs Kevin L. Kliesen and Daniel L. Thornton on the long term federal budget deficit show that U.S. debt initially declined relative to the nation's output from about 94 percent of GDP in 1950 (i.e., WWII) to a trough of about 32 percent of GDP in 1981.

In the early 1980s (during Reagan presidency), however, both actual debt and debt relative to GDP began to rise sharply, reaching 64 percent of GDP in 2007. Then there was a very large increase in the debt as a result of the Great Recession. In just three years (2008-10),the nation's debt increased by about $4.5 trillion to $14 trillion, a 50 percent increase over its 2007 level. The debt relative to GDP rose to 93.2 percent.

The non-partisan Center for Budget & Policy Priorities estimates that just two policies dating from the Bush Administration -- tax cuts and the wars in Iraq and Afghanistan -- accounted for over $500 billion of the $1.4 trillion deficit in 2009 and will account for $7 trillion in deficits in 2009 through 2019, including the associated debt-service costs.

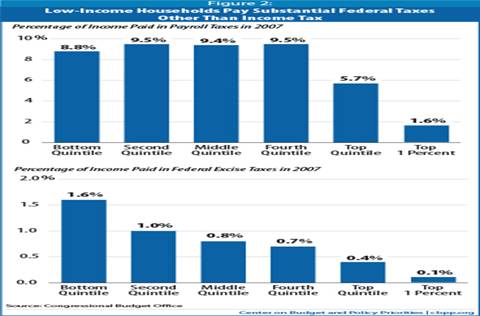

Some 86 percent of working households pay more in payroll taxes than in federal income taxes, says CBPP economists Chuck Marr and Brian Highsmith. In fact, low- and moderate-income (i.e., middle class) people pay a much larger share of their incomes in federal payroll taxes than high-income people do: taxpayers in the bottom 20 percent of the income scale paid an average of 8.8 percent of their incomes in payroll taxes in 2007, compared to just 1.6 percent for taxpayers in the top 1 percent of the income distribution (see Figure 2).

In addition, Congressional Budget Office data show that lower-income households pay a significantly larger share of their incomes in federal excise taxes (levied on goods such as gasoline) than middle- and upper-income households do, according to the CBPP. Diminishing the buying power of working households makes neither economic nor moral sense. It is time to call Republicans on the budget chicanery, before they bring a repeat of 1928.