Why is it so many pundits -- and some economists -- continue to be pessimistic about 2012 growth? Business and Wall Street economists in particular are predicting just 2 percent GDP growth for all of 2012, according to a recent CNBC report.

Why such pessimism? The reason cited is that "the improving data masks unsustainable fundamentals -- an unusual drop in the savings rate, a jump in auto purchases due mainly to a recovery from Japan's natural disasters last spring, and a surge in inventories".

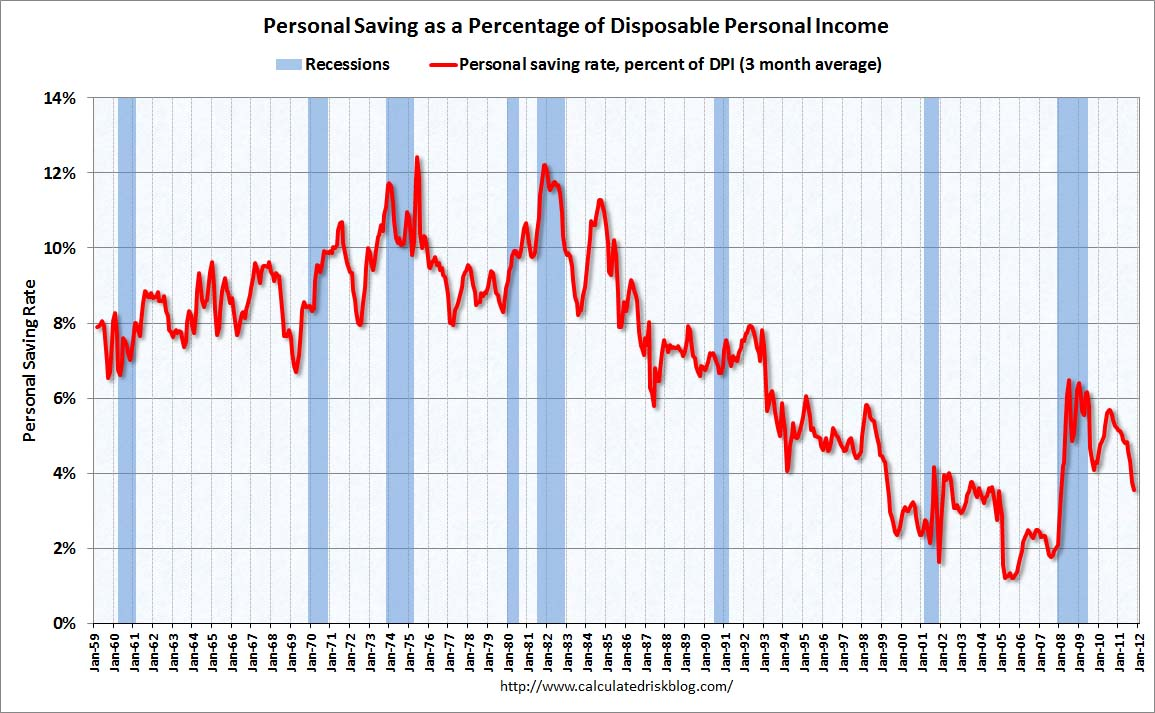

Firstly, there is not an "unusual" drop in the savings rate (which is really dependent on household incomes, let us not forget). It is slightly under 4 percent, and had dropped to 1 percent during the bubble years of early 2000, before rising to 6 percent during the Great Recession. Consumers are just beginning to spend again after paying down their debts for the past 3 years (2009-11), in other words. And consumer spending makes up 70 percent of economic activity.

Graph: Calculated Risk

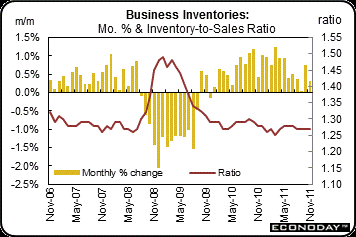

This is while the "jump' in auto purchases just brings it back to more historical levels of 13 million sold, but not to the bubble years of 16 million. And there is no surge in inventories. They are still at historically low levels, as businesses are still over cautious because aggregate demand for their products and services is still weak.

Graph: Econoday

So business inventories are anything but surging. Inventories rose 0.3 percent in November as did business sales, keeping the stock-to-sales ratio unchanged for a fifth straight month at a lean 1.27, said Econoday.

It is understandable that businesses are cautious, since they have just been through the greatest recession since the Great Depression -- which lasted 10 years, and took a world war to cure. But there are many more tools to stimulate growth since then. And we know what stimulates growth -- government spending; including for the safety nets (social security, unemployment benefits, Medicare), and investments in infrastructure and research -- in order that consumers can continue to spend and businesses invest.

Most economists know this, so there has to be another reason for their pessimism. Banks in particular are lobbying for more Federal Reserve stimulus, as in QE3, to boost the housing market. "Obama administration officials have come to realize that the ongoing dysfunction in the mortgage market is a key impediment to sustained expansion," Vincent Reinhart, chief U.S. economist at Morgan Stanley, said in the CNBC article.

"Their problem is that there is no chance of coming to terms with the Congress to fix the mess," Reinhart added. "The result is that the administration is moving toward mortgage modification, but not decisively. Purchasing MBS is a way that the Fed can support that movement and signal the seriousness of the enterprise."

But Congress isn't the only reason for housing's problem. The Obama administration is still not serious about either their HAMP or HARP II loan modification programs. They had set aside some $11 trillion from the ARRA legislation back in 2009 that hasn't been spent! Why? We are not sure, but know Treasury Secretary Tim Geithner is a great friend of banks. Neither he, nor the Office of Thrift Supervision (OTS) that overseas banks are requiring the banks and loan servicers modify eligible mortgages on their books, when the Executive Branch has the power to do so.

So the banks and Wall Street have come begging to the Federal Reserve once again to provide stimulus by buying up to as much as $1 trillion more of mortgage-backed securities. But why not first get rid of the excess inventory of bad mortgages and foreclosed properties banks are holding on their books? There have been several suggestions on how to do this, including by the Fed in a recently published White Paper to Congress: "The U.S. Housing Market Current Conditions and Policy Considerations". That is, there are other solutions. But even with the huge TARP bailout and growing profits, the banks and Wall Street still want government to continue to pick up their tab.

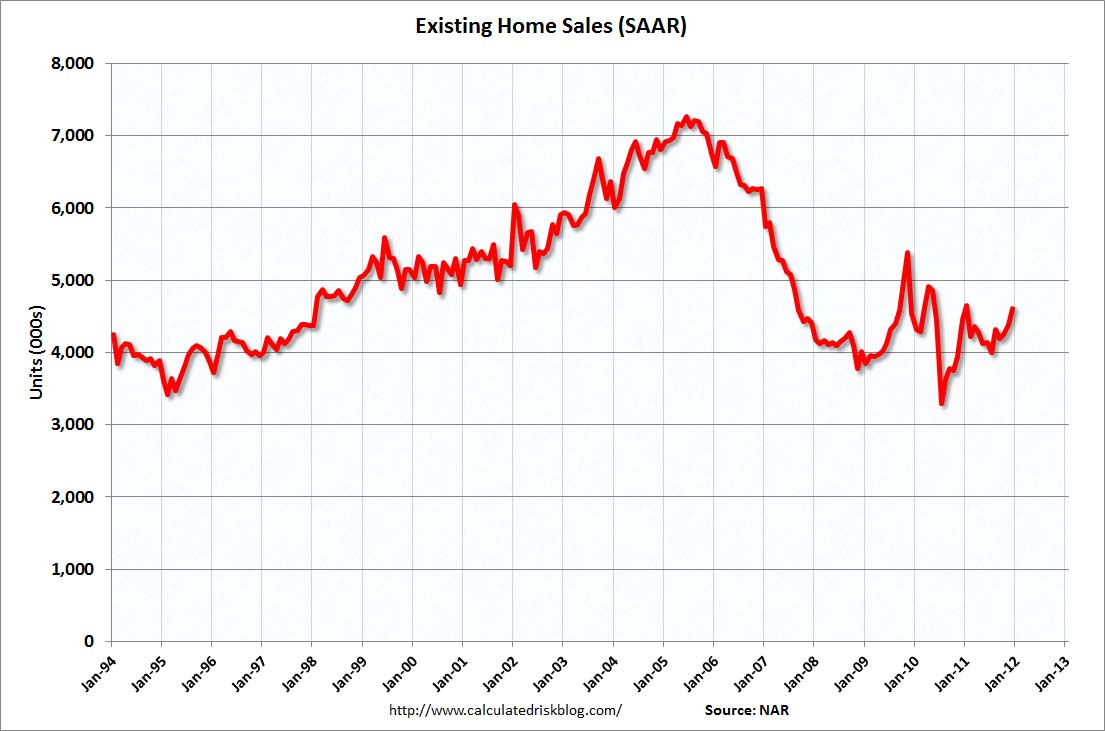

Existing-home sales have just jumped, by the way, which bodes well for housing in 2012. The latest monthly data shows total existing-home sales rose 5.0 percent to a seasonally adjusted annual rate of 4.61 million in December from a downwardly revised 4.39 million in November, and are 3.6 percent higher than the 4.45 million-unit level in December 2010.

Graph: Econoday

Total housing inventory at the end of December dropped 9.2 percent to 2.38 million existing homes available for sale, which represents a 6.2-month supply at the current sales pace, down from a 7.2-month supply in November. Home sales are now back to a 1998 sales level, before the housing bubble took off. Maybe that is where it will be for some time to come. This means the banks and Wall Street need to get over their hangover from the housing binge -- which profited them so handsomely.

Harlan Green © 2012