Inflation has fallen so low that it threatens this economic recovery, yet some Fed Governors are talking about ending the QE3 securities' purchases. Why, when there is little evidence of sustained employment or growth?

Fed Chairman Bernanke basically inherited an almost deflationary economic environment in 2006, with the Great Recession that began December 2007 and ended June 2009. That is why the Fed has been keeping interest rates so low, and why the Fed Governors aren't yet ready to end the QE3 purchase of securities. Without QE3, we could be in deep trouble with real estate still in the doldrums.

What those Fed Governors and other deficit hawks don't' seem to understand is that pushing for higher interest rates in this climate means more deflation and slower growth. That is what both the bond and stock markets are telling us. Such markets don't drop in tandem if the expectation is for faster growth.

Nor can government budget deficits be the problem when the deficit is dropping faster than at any time since WWII. In fact, we ended World War II with a 120 percent debt-to-GDP ratio, yet it didn't damage subsequent growth. Instead, continued government spending combined with higher tax rates enabled us to create a lasting post-war prosperity

Whereas, government spending cuts from the 2011 debt ceiling agreement that caused the U.S. debt downgrade and led to the current sequester spending cuts are endangering this recovery.

Such low inflation means producers can't charge more for their products, therefore can't increase profits unless they use fewer workers and greater automation to replace them. So there is no incentive to hire more workers, which would increase the demand for their products, and so increase economic growth.

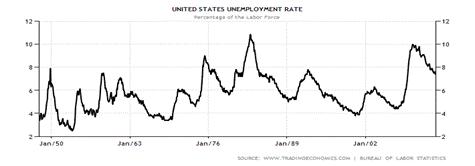

We know the median household income declined some 10 percent from 2000, after inflation in part because of less demand for highly paid workers. And the unemployment rate is still above 7 percent, some 4 years after the end of the Great Recession.

In fact, it is remarkable how closely disinflation (falling inflation) has tracked historical unemployment rates in these charts that begin in 1948, the beginning of the modern consumer economy. For instance, inflation began its steep decline after 1980 when Fed Chairman Volcker pushed interest rates as high as 16 percent, causing the 1981 and 1983 recessions, and a jobless rate of more than 10 percent. The result of the Great Recession has been the same--high joblessness with too low inflation, signaling there is little demand to ramp up production.

The good news is that July existing-home sales rose to the highest level in 4 years, since the end of the Great Recession. The consensus is that most of these homes were put into contract before the recent rise in interest rates, and that the current rise in mortgage rates since then will slow down sales.

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, increased 6.5 percent to a seasonally adjusted annual rate of 5.39 million in July from a downwardly revised 5.06 million in June, and are 17.2 percent above the 4.60 million-unit pace in July 2012, said the National Association of Realtors.

But with just a 5.1-month supply, inventory levels are historically low during this sales season. That means values haven't increased enough to bring more homes with positive equity on the market that would create a sustained recovery. With such a low inventory level there is the danger of housing values falling again, when and if the Fed begins to reduce its QE3 securities' purchases prematurely.

If we survived and prospered after World War II with such a record budget deficit, why are we not applying such lessons from history today?

Harlan Green © 2013

Follow Harlan Green on Twitter: www.twitter.com/HarlanGreen