The following is an excerpt from the recently released e-book, A Modest Proposal for America: Taxes, Entitlements, and the Manufactured Crisis of Federal Finance

America's social safety net is far less generous than most other wealthy nations'. As a percent of GDP, the U.S.'s rate of social spending was less than all but nine of the 34 OECD countries in 2007. And if the U.S. lags in the area of old-age benefits, it is almost dead last when it comes to public spending on family benefits (child payments and allowances, parental leave benefits and childcare support, etc.) as a percent of GDP.

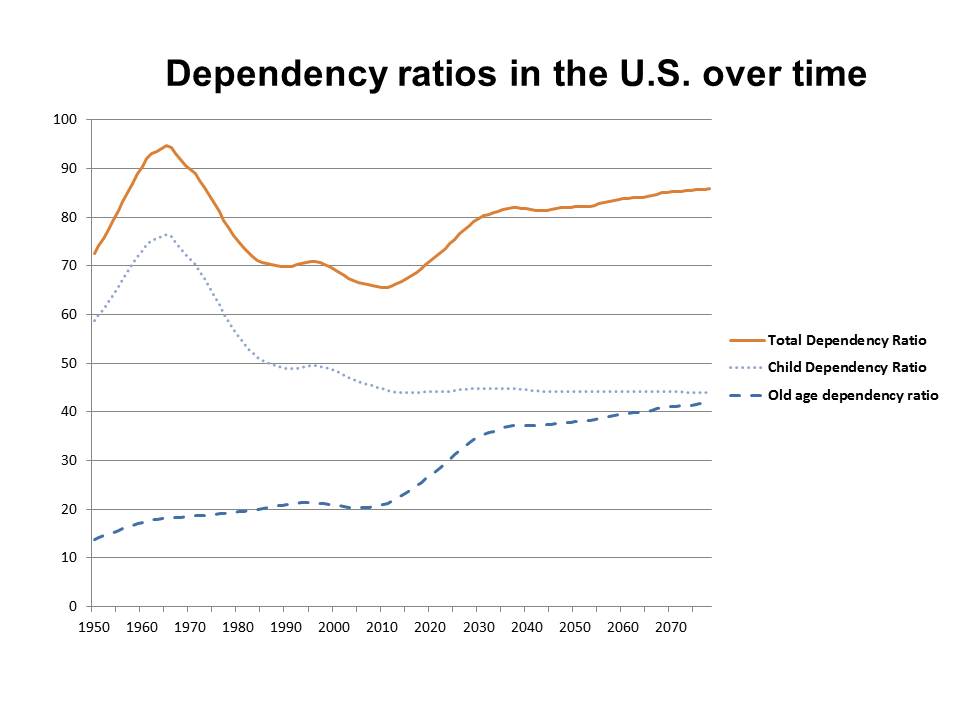

The key driver of the upcoming challenges for the federal government is America's changing demographics. Using the definitions of "youth" as less than 20 years old, "prime working age" as between 20 to 64 years, and "old age" as 65 and up, we can calculate the dependency ratio as the number of dependents (both the young and old) divided by the number of people of prime working age. If the country has a very young population, then the dependency ratio will be high. If the country skews older, then the dependency ratio will also be high. Often the dependency ratios are separated out so that the youth dependency ratio is examined separately from the old-age dependency ratio.

No matter which we use, dependency ratios reveal a critical trend: the aging of America as the Baby Boomer population pushes through the cycles of life. During the 1960s, the total dependency ratio peaked at nearly 95, meaning that for every 100 people of working age, there were 95 people who were either in the youth or old-age group (at that time about 80 percent of the dependents were youths). This youth bulge is the Baby Boom generation.

In the late 1950s, the total U.S. fertility rate, defined as the average number of children that would be born to a woman over her lifetime, reached almost four, but it has hovered around two since the 1970's, as women began staying longer in school, pursuing careers, having children later in life and making increased use of family planning methods. The fertility rate decline following the peak Baby Boomer years will cause the dependency ratio to rise from its current rate of about 65 dependents per 100 working age Americans to a dependency ratio of over 80 by 2030. In the mid 1970's, when America last had a dependency ratio that high, 75 percent of the dependents were youth. By 2030, almost half of dependents will be elderly.

This shift to increasing dependency ratios is happening all over the world, in both developing and developed countries. America's old-age dependency rate is actually comparatively low among the OECD nations (it ranks 25th ); moreover it is projected to stay that way due to its comparatively higher rates of fertility and immigration. Japan, Germany, Italy and France have more to worry about on this score than the US does.

Which is not to say that the U.S. has dodged a bullet; far from it. Social Security is largely a pay-as-you-go program, meaning that most of the payroll taxes collected from today's workers are used to pay benefits to today's recipients. As the old age dependency ratio increases, there are less people paying into the fund. The ratio of workers paying Social Security taxes to people collecting benefits is projected to fall from 2.9 to 1 in 2010 to 2.1 to 1 in 2029. During the early years of the Social Security trust fund, income received exceeded payouts, so assets accumulated. Congress used the annual surplus to pay for other expenses, leaving the trust fund with an IOU. Now that the trust fund has to pay out more than it receives, it has to call in all those IOUs.

Social Security is on an unsustainable course, but it is not in any imminent danger. Social Security Trust Fund assets are substantial enough to pay the currently guaranteed benefits for the next few decades, assuming that payroll taxes don't continue to get slashed and that the government pays itself back its loans. Medicare will feel a cash crunch sooner since health care expenses are climbing at such a steep rate. Exhausting the trust fund assets won't mean the end of either program, but they will be limited to spending only the money they collect. Regardless of what happens, adjustments in both their funding and their benefits will clearly have to be made.