Michael Linden of the Center for American Progress has an excellent piece out this morning which simply collects a bunch of facts about trends in fiscal and economic variables that have moved in ways that should inform the DC debate. But that debate is impenetrable to such changes for the simple reason that the ideologues driving the debate use facts the way a drunk uses a streetlamp: not for illumination, but for support.

To be less opaque, those obsessing about deficits never cared so much about deficits. If so, they would have accepted a balanced plan to reduce them. They use deficits and debt (and squirrelly research) to further their shrink-the-government agenda. In that context, the fact that the deficit numbers no longer support their four-alarm-fire messaging strategy is but a minor inconvenience.

Here's is Linden's argument, in charts (the pretty ones are his, of course):

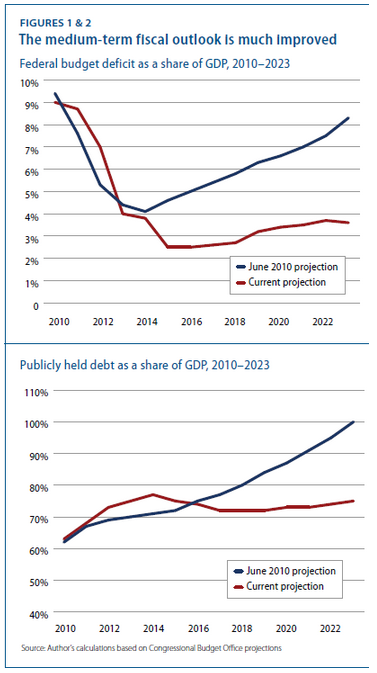

-Most importantly, as the great recession -- and all the temporary spending that ramped up to offset it -- fades and growth returns, the near-term deficit and debt recede. This was never in doubt, as Krugman and others have tirelessly (ok, tiresomely if you're on the other side, I guess) explained.

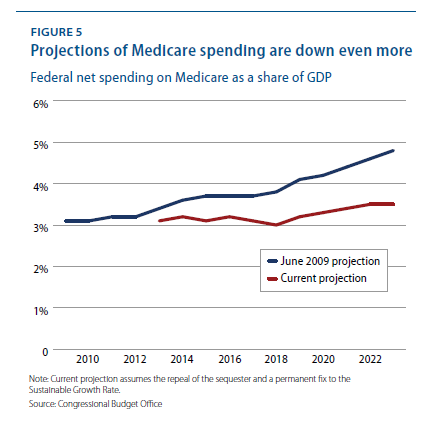

-- One very important reason for this improvement is the slower growth of health care spending. I've blogged about this a lot: we can't be certain these more favorable trends will stick, but there are good reasons to believe that some efficiency-enhancing changes to the delivery system are entering that system in ways that will yield longer-term savings.

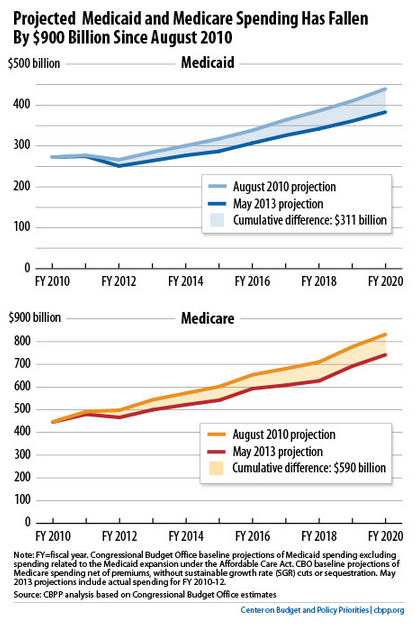

[This next slide is from CBPP's Paul Van de Water, showing the projected savings in billions from both Mcare and Mcaid:]

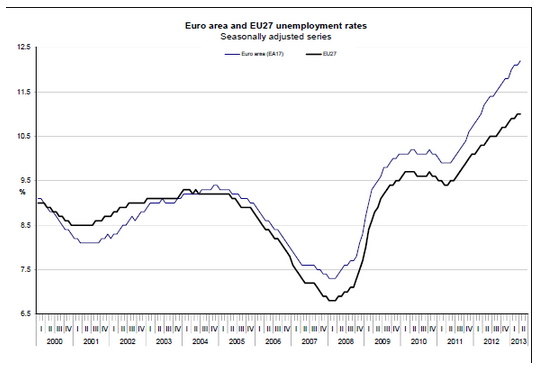

-- Austerity bites: I mean, really... just look at this and mentally draw a vertical line when European policy went awry. I'm certain that if our species survives long enough for historians to look back on this period, they'll be forced to come up with extremely esoteric theories to explain what's happening here: "Clearly, gravity reversed for a period such that policy makers were standing on their heads, thus making negative trends in unemployment appear to be positive ones!"

Source: Eurostat

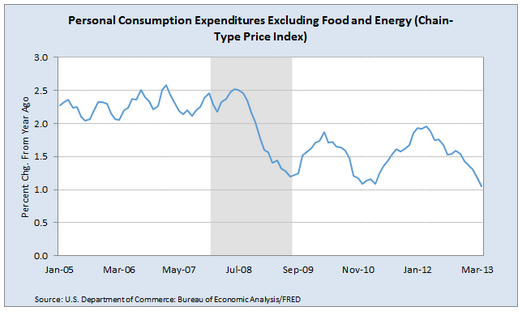

-- Inflation remains a phantom menace. Calls for eliminating fiscal and especially monetary stimulus have often been made with great urgency as those those policies are sure to stoke inflationary pressures. Except there are none, i.e., inflationary pressures. The figure shows the core PCE price index, which is clearly decelerating and most recently clocked in at a dis-inflationary 1%.

This should not surprise anyone. With labor demand only slowly ramping up and unemployment still high, there's no pressure on labor costs. Averaging (noisy) annual growth rates in unit labor costs, which measure employers' real compensation costs per unit of output, since 2012 gets you 1.1%.

Anyway, I could go on, but you get it. The facts, especially on the budget, point in a direction that would lead rational policy makers to a) continue to evaluate and implement measures that appear to be slowing the growth of health costs, as this is the most important fiscal development, as well as the steepest challenge, and b) employ anti-austerity measures to help boost the job market and steer some growth towards middle and lower-income households. Linden, in fact, ends his piece with a neat plan in that spirit.

The figures above should be streetlamps that illuminate a change in direction. But, alas, rational policy makers who are moved by facts are in short supply but that's actually just part of the problem. The other part is weak demand.

This post originally appeared at Jared Bernstein's On The Economy blog.