One thing about stimulus -- and not just economic stimulus: you're often sad to see it go.

Don't worry, I won't get into to anything salacious here. And obviously, painful stimulus is a different story. But in economics, it is well understood that as stimulus winds down, policy makers by definition create what's called negative fiscal or monetary impulse.

All that means is if you tote up the impact of stimulus on growth, when you do less of it, it scores as a negative. If the government was spending $100 billion in year one or fiscal stimulus, and $75 billion in year two, the negative fiscal impulse is $25 billion, and the impact of stimulus on GDP growth shows up as a minus sign, the same way a car's speedometer falls when you take your foot off of the gas.

To be clear, that little example does not reflect what's going on in the U.S. case re fiscal policy, where we're no longer letting up on the accelerator; we're now hitting the brake. In the example I gave above, the budget deficit would be growing more slowly. Ours is, of course, falling, and that goes beyond "negative fiscal impulse" over into the dreaded austerity.

But it does -- or it will -- describe monetary stimulus, as Fed chair Ben Bernanke said last week that if the economy continues to improve, he and his monetary posse will first slow the rate of the bond-buying program (negative monetary impulse) and then eventually raise interest rates up off the floor (the unemployment rates, he said, will need to be around 7 percent for them to end the QE part and 6.5 percent re the interest rate part).

This led to the well-documented market havoc last week, even though he's just jaw-boning at this point -- not actually changing any policy yet. Certainly markets knew this was coming -- stimulus is temporary by definition. But the uncertainty -- to use an overused word -- led to large selloffs in equities and sharp spikes in bond yields. (The reason "uncertainty" complaints drive me a little nuts is because it implies there usually certainty in the movements of economic variables. Wrong. There's always uncertainty -- sure, sometime more than others... but if you can't take that heat get the h-e-double-toothpicks out of the market.)

Three points about this:

First, the fact that there's negative impulse when stimulus pulls back is to be expected. It doesn't mean it wasn't worth it. We needed to speed up over the rough patch and we need to slow when the rough patch is behind us.

The problem is -- second point -- we're not yet over damn rough patch. As I suggested last week and Krugman seconds this AM, the Fed is talking about turning (which, in the expectations game is much the same as turning itself) too soon. True, they held on a lot longer than Congress, but I fear they're making the same mistake (in this regard, I disagree with the BIS critique of too-much monetary stimulus that's making the rounds today).

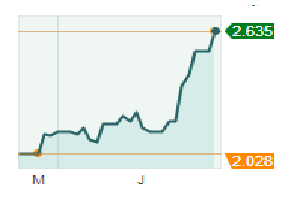

Third, while it's fashionable to say that the market volatility is a sideshow to the real economy -- I've said so myself and as far as equity spikes and dips, that's true -- the interest rate is a key variable in the growth outlook of the economy (review your IS curve if you don't believe me). And the spikes I've seen in T-bills (see figure) and mortgage rates in just the last few days are really (as in "real" growth) quite troubling.

Stimulus comes and goes, as it should. The fact that it creates some drag when it departs is fine, as long as we get the timing right. The problem is when you screw up the timing, and that's what it looks like we're doing -- again.

Ten Year Treasury Bond Yields over the Past Two Months

This post originally appeared at Jared Bernstein's On The Economy blog.