The Center for American Progress has a smart, simple, progressive, and politically plausible new fiscal plan out and it's worth a close look. Here are the main features that caught my eye:

- Raises significant revenue, and does so progressively.

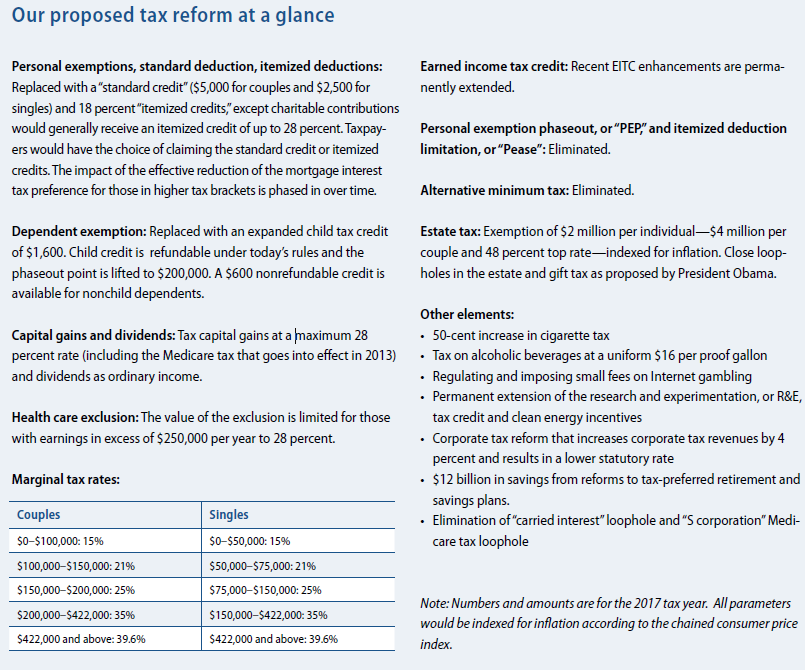

Here are the broad outlines of the plan:

Source: CAP

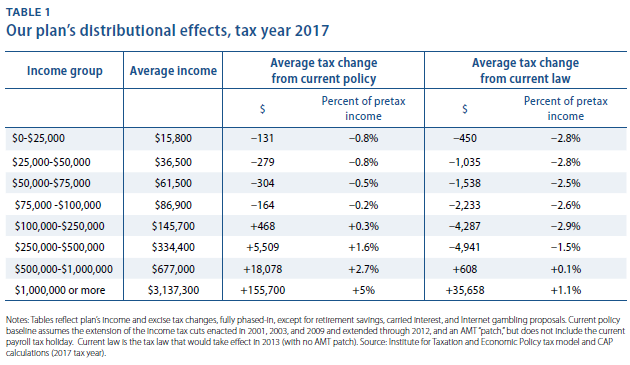

And here's a distributional table -- relative to current policy (i.e. what's in place now, not what's in place if we go over the cliff -- current policy is the relevant baseline) liabilities go up a bit for families above $100,000 but by less than half-a-percent of their income. And the progressive impacts are easy to see in the "percent change" column.

Source: CAP

I suggested above that it's politically plausible. It's actually pretty Clintonesque -- to be expected when you look at the list of authors -- and most people recognize that tax structure as compatible with strong growth, strong profitability, and fiscal rectitude. But it does call for higher tax rates for some (and not just the top 2 percent) including cap gains and dividends (compared to current policy, that is). Still, I don't see why this should be any less beloved than Simpson-Bowles, widely embraced by conservatives (though, truth be told, once they learn what's actually in SB, they usually love it less).

What's missing here? There's no tax on carbon -- a bit surprising, but maybe they left that out for political reasons. I'd add a financial transaction tax, but again, you'd lose some support. Also, they need to be specific about how they'd pay for lower corporate tax rates. It's easy to say "loophole closures to be named later" but as Rep Boehner's opening cliff offer reveals, that's not a useful formulation for real reform.

That said, the plan's simplicity -- not trotting out a bunch of new cats and dogs -- is another attractive feature. I know a lot of people want to see a VAT or some other major restructuring of the code, but conditional on simplifying what we have, enhancing progressivity, and raising needed revenue, I'm much more partial to working off of what we've got. I just think that's the most realistic way forward.

Once we get the cliff behind us, there's likely to be a move towards tax reform. I'll be touting this plan more in coming weeks as a solid candidate for that debate.

This post originally appeared at Jared Bernstein's On The Economy blog.