In much recent writing on fiscal policy, I've faced the hard fact that while it's hard to imagine Congress doing much to help the economy, perhaps it's not too crazy an ask to get them to do less to hurt it.

A few recent data points suggest pretty strongly that my ask has been granted in the following sense: there will be a lot less fiscal drag this year than last year. And a big part of that results from how freakin' much fiscal drag there was in 2013.

A brief refresher: a summary measure of fiscal impulse (the extent to which fiscal policy is boosting or reducing GDP growth from one year to the next) is the difference between the deficit (or surplus) one year and the next. Since cuts in government spending reduce near-term growth, if the deficit-to-GDP ratio falls from 5 perent to 3 percent, that's 2 percent fiscal drag. If the def/GDP ratio is unchanged year-to-year, there's no change in fiscal impulse, neither drag nor boost.

Since fiscal drag sounds like... you know... a drag, why would you ever want it? In a recession (or weak recovery from one), unless you're Wolfgang Schauble -- German finance minister and major austerion -- the answer is you wouldn't. But as the private economy hits its stride, in the interest of deficit reduction in good times, you don't mind the drag. (OTEers will recognize this as the CDSH approach.)

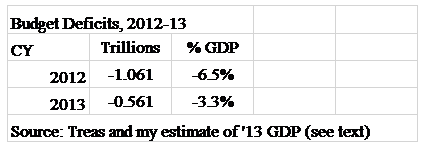

Treasury released the data yesterday that allows us to look at preliminary numbers for the calendar year 2013 budget deficit and I've plugged them into the table below. The deficit fell 47 percent in nominal terms, from $1.1 trillion to $561 billion, or more than 3 percent of GDP, an historically very large annual decline. About 60 percent of the reduced deficit came from higher tax receipts; 40 percent from lower outlays. This latter figure, however, is somewhat overstated due to transfers to the Treasury from Fannie and Freddie, counted as reduced outlays, but not really fiscal drag in the sense of less spending on activities that would promote growth; still, even without those remittances, we'd be looking at an unusually austere year (I also had to estimate 2013q4 GDP since it's not out yet).

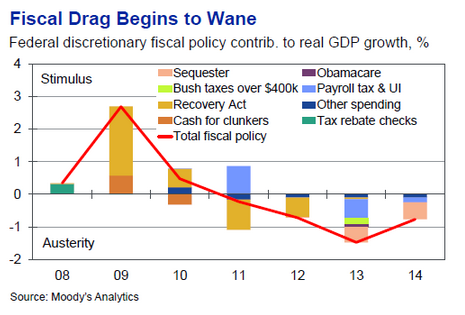

The figure below, from Moody's.com, gives you a flavor of how much this drag has reduced real GDP growth, and thus jobs and incomes, in recent years. You can see both how 2013 was the worst and 2014 looks better. In fact, since the Moody's chart was put together before the recent fiscal deal, you can cut that 2014 sequestration contribution to the drag by about half. My guess is that the deficit as a share of GDP will be around the same this year as last year, meaning little or no "negative fiscal impulse."

So, granted that a lot can still go wrong -- debt ceiling! -- and that the failure to extend UI benefits would counteract some of the pro-growth results I show here, we may have reached a do-less-harm moment from our elected officials. Woohoo!

This post originally appeared at Jared Bernstein's On The Economy blog.