Update, 10:34, 4/6/2012:

As mentioned earlier, we may be at the beginning of another downshift in job growth or March's disappointing report could be an anomalous blip down in a better underlying trend. There's some reason to hope for the latter -- I noted the seasonality issues caused by the mild winter -- but we could also be seeing the impact of higher gas prices on growth, real incomes, and consumption.

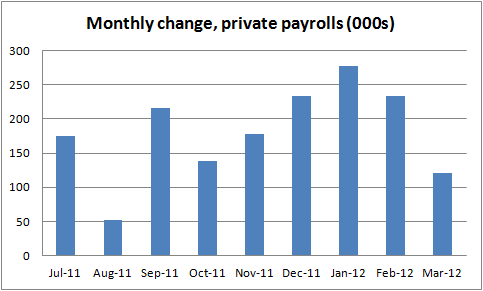

Still, you really don't want to build too big a story out of one month, especially when it's off trend. Look at it this way. If you plot the monthly gains in the private sector, as I do in Figure 1 below, you clearly see the March deceleration.

Source: BLS

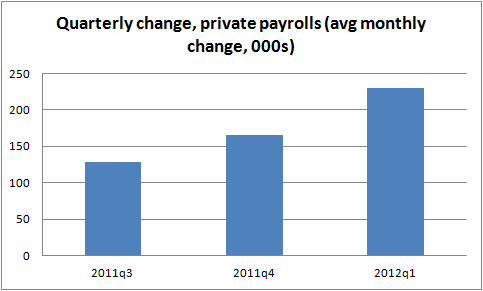

But if you smooth out some of the possible monthly anomalies by taking quarterly averages, and then plot average monthly gains over the past three quarters, you get the clear step function below.

Source: BLS

We don't know which is correct. I'd remain about as nervous as I was before. We're adding jobs, but at too slow a clip. We have tools to do something about it, but I'm afraid they come under the rubric of fiscal stimulus, and those of us who would take advantage of low borrowing rates to apply such stimulus right now are in a distinct minority around here.

All's I'm saying is that if it were me, I'd be out there saying:

You know what, America? This monthly jobs report may be a one-off disappointment or it could signal that the job market is doing worse than we thought. Either way, there's too many un- and underemployed people out there.

And guess what else there is out there? There's too many crumbling public schools, too many bad roads, too many water systems, airports, rail lines, and you name it in need of repair. There are too many states and towns cutting back on vital services, laying off teachers, cops, firefighters. Too many homeowners underwater on their mortgages.

So let's marry a problem with a solution here, take advantage of historically low interest rates--a market signal that this is precisely the time to make these investments--and take out some serious insurance against the possibility that the March report is flashing red.

Or something to that effect.

9:26 AM, 4/6/2012: Payrolls surprised to the downside in March as employers added only 120,000 jobs on net, well below the almost 250,000 average monthly gains of the past three months and the smallest net gain since last October. While the unemployment rate ticked down a tenth to 8.2%, that was partly driven by a decline in the labor force (though this number is quite volatile month-to-month). Weekly hours slid a bit as well, another indicator of a dip in labor demand off of the recent trend.

The question, of course, is does this weaker report signal a true downshift in job growth, suggesting the recent acceleration was yet another false start. Since one month does not a trend make, this in unknowable, but numerous indicators suggest March's slowdown may be anomalous. Most industries added jobs last month, though retail trade was a big exception, down 34,000.

Seasonality could be playing a role in the disappointing March results. This past winter was the fourth warmest on record, but how does that play out in the jobs report? Retail trade provides a useful example. Stores that expect less traffic in cold months will downsize their staffs in the winter and boost hiring in the spring. Thus, the seasonal adjusters will add employment to the non-seasonal retail count in the winter and subtract it in the spring.

But in an unseasonably warm winter, stores will move their spring hiring up a few months -- folks who would have been hired in March were instead hired in January or February. In that case, the seasonal adjustment artificially boosts the earlier months and lowers the count for March.

The best way to control for that possibility is to average over the past three months. Given that March data completes the first quarter of the year, average monthly growth in this quarter was 212,000 per month, compared to 164,000 per month in the prior quarter (2011q4). So, smoothing out possible anomalies, we still see a clear acceleration in job growth.

Seasonals may be playing a role, or we may be looking at the beginning of yet another slowdown in employment gains. If so, theories that the U.S. economy is finally entering a self-sustaining recovery will have to once again be put on hold.

This post originally appeared at Jared Bernstein's On The Economy blog.