When you criticize the Republican's plan for Medicare privatization, their kneejerk comeback is to claim that Medicare is going bankrupt. They've got to break it to fix it.

It's a misleading non sequitur that should not go unchallenged.

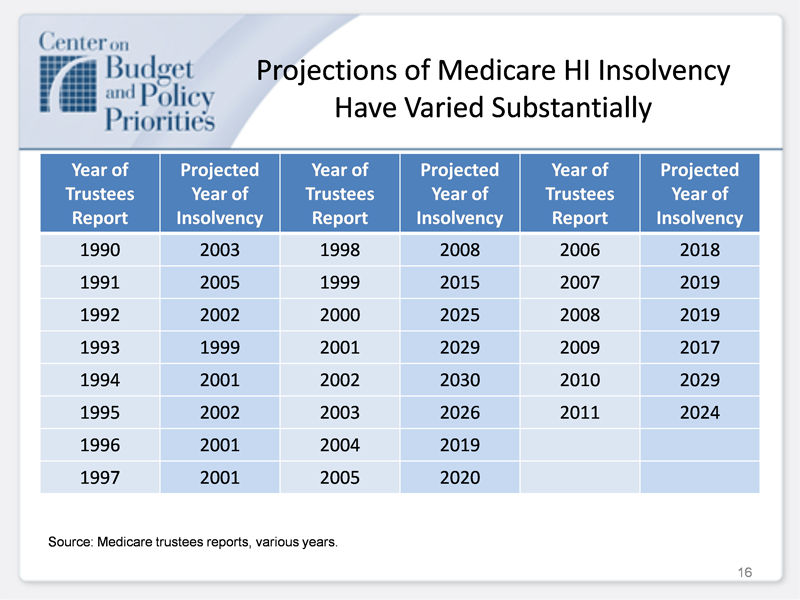

The claim was amplified recently by the Medicare Trustees report, which projects that the Medicare Hospital Insurance trust fund ("Part A" of the program) will become insolvent by 2024.

But before you jerk that knee, consider these points:

- The other main parts of the program, Part B (insurance covering doctors' services, outpatient care, medical supplies) and Part D (the prescription drug benefit) are mostly funded by premiums and general revenues, and, according to the trustees report, are "projected to remain adequately financed into the indefinite future."

- Note the highlighted word "fully" above. In fact, if the trust fund were to exhaust in 2024, income coming into the fund would still finance 90% of benefits. That's something to be avoided, but it's a different kind insolvency than that implied by the R's mantra.

Finally, Ryan and company did not discover this challenge of paying for health care. We have a law on the books to meet the challenge -- the Affordable Care Act. It has already improved Medicare's fiscal outlook, though the real work -- reducing the rate of health care costs for years to come -- hasn't even started yet.

Here's Bob Greenstein of CBPP on that point:

Despite the improvements made by the Affordable Care Act, Medicare continues to face significant long-term financial challenges, stemming from the aging of the population and the continued rise in health care costs, that contribute to the bleak federal fiscal outlook. It is essential that policymakers take further substantial steps to curb the growth of health costs throughout the U.S. health care system as we learn more about how to do so effectively in both public programs and private-sector health care, based in part on the Medicare research and pilot projects the ACA establishes to test new approaches to delivering health care in ways that can lower cost while maintaining or improving quality.

Complacency is not an option, neither for Medicare nor private sector health care. We need to continue to implement the ACA and get its cost-control functions up and running. But the bankruptcy mantra is a misleading tactic designed to scare you into accepting a privatization scheme that will significantly diminish the health care security of retirees. That too is not an option.

This post originally appeared at Jared Bernstein's On The Economy blog.