I don't mean to shoot everything that moves, but I thought I owed this post to Larry and Brian.

That is, I was on Larry Kudlow's radio show the other day along with Brian Westbury and the two of them asserted that government job growth crowded out private sector jobs. We were discussing last Friday's jobs numbers and I pointed to evidence of the sequester on federal government jobs-they're down 45,000 since the cuts took effect in March. They argued this was probably a good thing because it would mean more private sector jobs.

At which point I went all empirical and recalled running some simple analysis of this assertion, which thoroughly refuted it.

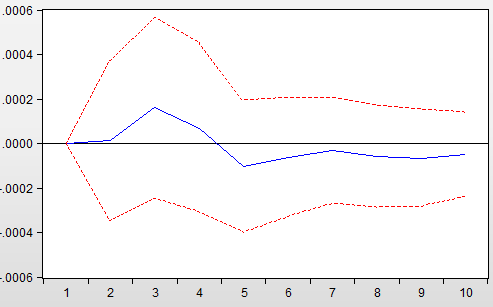

I update that here, using a simple statistical model called VAR* which estimates how one variable moves when you nudge another variable that's related to it. In this case, I look at the impact of private employment when you increase government employment. The figure shows the result.

If Larry and Brian were right re government jobs crowding out private sector jobs, when you "shock" -- i.e., increase the former's growth -- you should see private sector jobs head south. The middle line is private jobs, the two lines on either side of it are standard errors. The fact that the middle line basically hugs zero means no job crowd out and the standard error lines tell you that even what little movements you see are far from statistically significant.

Conservatives are always going on about crowd out -- government borrowing crowding out private borrowing is the most common claim -- and I'm not saying it's impossible or never happens. I am saying it's really hard to find in the data and I'd therefore be extremely wary of those who claim it's a big deal.

PRIVATE SECTOR JOB GROWTH WHEN YOU SHOCK PUBLIC SECTOR JOB GROWTH

*VAR stands for vector-auto-regression, and it's just a model that in this case runs the log changes in private and government jobs against each other and then asks how one moves when you shock the other. In this case, I ran the VAR on quarterly data from 1959q1-2013q1, using four lags for the jobs variables and controlling for the log change in real GDP and dummies for recessions.

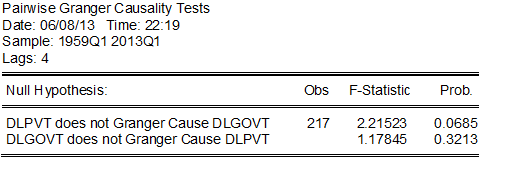

VARs are related to Granger Causality tests. If you run one of those for these variables, again using four lags, you get this result. It suggest a weak relationship between private sector growth and public sector growth-that would be "crowd in"-but nothing going the other way, i.e., no evidence that government job growth "Granger causes" private sector job growth (you cannot reject the null hypothesis which says there's no causality-confusing, I know, but there it is):

This post originally appeared at Jared Bernstein's On The Economy blog.