Moodys.com is out with their latest forecast, and here's a look at where they think unemployment is headed (thanks to economist Mark Zandi for sharing these data). First, they've got unemployment going up a bit before it comes down... and even then, it's still elevated by year's end... well into the 8s.

This comes right out of the type of analysis shown here on the economic consequences of below-trend growth. Moody's GDP growth forecast for this year is 1.7%-and unless GDP is beating the trend of around 2.5%, the unemployment rate will tend to rise.

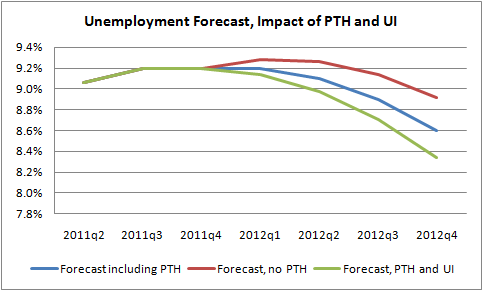

But let's look at some policy issues invoked by their unemployment forecast, particularly the impact of the payroll tax holiday (PTH) and extended unemployment insurance (UI). The president has, of course, been calling for Congress to extend these for another year given that they expire at the end of this year.

As I wrote yesterday:

These are both essential -- EPI estimates that to lose them next year would cost over one million jobs. But since they're already in the system, they don't add anything new, so it's like keeping your foot where it is now on the accelerator. If they expire on schedule at years' end, your foot comes off. But keeping them going only maintains current speed, such that it is.

Like most forecasts right now, Moody's assumes that the payroll tax holiday -- a 2% wage boost for most workers worth over $100 billion/year -- will be continued next year. That's built into their forecast.

Using Moody's estimates of the impact of these policies on growth and some of my own calculations about the growth of the labor force, one can back out the path of unemployment under two different scenarios:

- Iif we fail to extend the PTH (bad!)

- If we are able to extend both the PTH and UI (good!)

Source: Moodys.com, my calculations

If Congress lets the PTH expire, unemployment goes up more and ends up only slightly below 9% at the end of next year. If we extend the PTH and UI, the jobless rate falls a bit further, though it would still be up there at 8.3%.

At any rate, as Ezra Klein stressed Thursday on an MSNBC segment we did today (with Zandi, no less), it's way past time to stop inflicting wounds on ourselves. Keeping these measures in the economy next year is the least we can do -- that's the starting point upon which to build other job growth ideas, like FAST!

Update: A commenter asked the good question: how do the PTH and UI have an impact on unemployment? The PTH is a 2% wage subsidy, so it puts more money in your paycheck which lots of folks then spend. The extra spending creates more economic activity, including jobs, and that lower unemployment. Similarly, people receiving unemployment insurance benefits tend to spend them with the same result: more growth/jobs than would otherwise occur.

This post originally appeared at Jared Bernstein's On The Economy blog.