Why not tax capital gains as ordinary income?

That's an old chestnut among those of us who believe that the differential between tax rates on different types of income causes more harm than good.

James Stewart has a great piece in today's NYT asking this question. The usual objection to increasing the rate on capital gains -- that's the money you get when you sell an asset for more than you paid for it -- is that it will discourage investment.

And once again, we have a great quote from Warren Buffett:

I have worked with investors for 60 years and I have yet to see anyone -- not even when capital gains rates were 39.9 percent in 1976-77 -- shy away from a sensible investment because of the tax rate on the potential gain. People invest to make money, and potential taxes have never scared them off.

[Side note: I'm serious about this: Warren Buffett should be the next Treasury Secretary. No rush re: Tim, but when he steps down, I have a feeling Buffett would be a great Treas Sec'y. He knows business and markets, he's affable and could presumably work well with folks on all sides. And he's got great progressive instincts on taxes and fiscal sanity. Sure, the ruling classes would oppose him based on his recent calls to "stop coddling the rich" but that's a fight I'd very much welcome.]

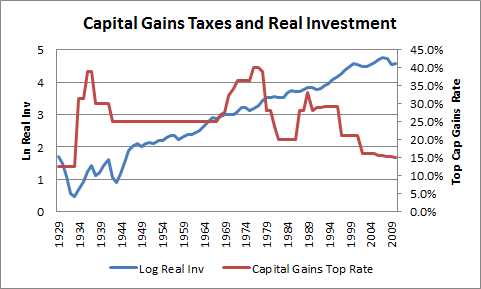

What about evidence? Plotting the top cap gains rate against real business investment doesn't show much (see first figure -- biz investment is in natural logs to show proportional growth over this long time series). Cap gains bounce around based more on politics than policy, while investment pretty much grows with the cycle. Hard to see anything in the picture supporting the view that either the level or changes in cap gains taxes play a determinant role in investment decisions, just like Warren said.

Sources: Citizens for Tax Justice and BEA

There's been considerable academic work on this question, but tax expert Len Burman, quoted in the NYT piece, called the academic evidence "murky, at best." A few correlations support this view.

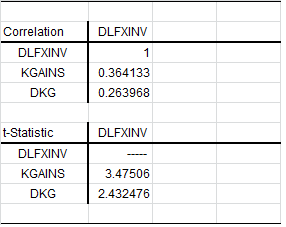

The table shows correlations between (the log change in) real private investment and both levels (KGAINS) and changes (DKG) in capital gains tax rates, from 1929-2010. The correlations have the "wrong" sign and are statistically significant, meaning increases in the level or positive changes in the capital gains tax rate are associated with an increase in the growth rate of real private investment.

Source: Same as prior figure

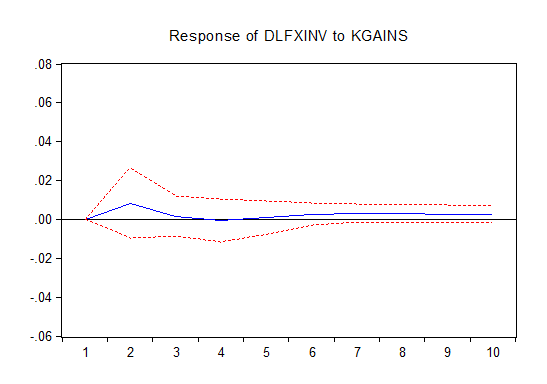

That probably just reflects the fact that both real investment and tax changes can be cyclical, so I did a second correlation exercise that controls for the cycle (I ran a VAR with 2 lags on cap gains, the log change in real business investment, and unemployment rates). The graph shows the impact on real private investment growth over a number of years if you raise the capital gains rate. The result is... nothing. The investment line barely budges and is statistically insignificant.

Sources: CTJ, BEA, BLS

These are quick correlations -- not causal models. But they are consistent with both the literature and the insights of practitioners like Buffett.

There are a few economic principles that we consistently get wrong in ways that do lasting damage to our economy and diminish our future. At the top of this list are arguments about large behavioral responses to changes in tax rates. I don't think it's zero, but I've simply never seen compelling evidence that tax increases significantly hurt growth, labor supply, jobs, wages, or that rate decreases provide much of a boost the other way. And when you factor in the benefits of the investment and services government provides -- something the literature tends to ignore -- the hyper-responsiveness arguments are even less compelling.

(That reminds me -- the one place Stewart slips up in the piece is buying into the argument that if you raise the cap gains rate, you should be open to arguments to return some of the revenue you gain back to taxpayers in the form of lower rates -- "Much of the [revenue] windfall from higher capital gains rates could be offset by cutting the rate on ordinary income." That doesn't make sense -- if you don't believe that taxing cap gains as ordinary income is a problem in terms of investment and growth, then why tweak other rates?)

So, in the interest of better, simple tax policy that diminishes a distortion in the system while raising some much needed revenue, we should seriously consider taxing capital gains as normal income. I know -- not exactly consistent with our current politics, but perhaps Sec'y Buffett can take a run at this someday.

This post originally appeared at Jared Bernstein's On The Economy blog.