The holiday season is often accompanied by New Year's prognostications, and this year you're likely to read plenty of downbeat projections regarding the venture capital environment. It's true that the industry has shifted, and that the amount of venture capital raised and deployed has decreased. But I don't share the popular outlook that the sky is falling.

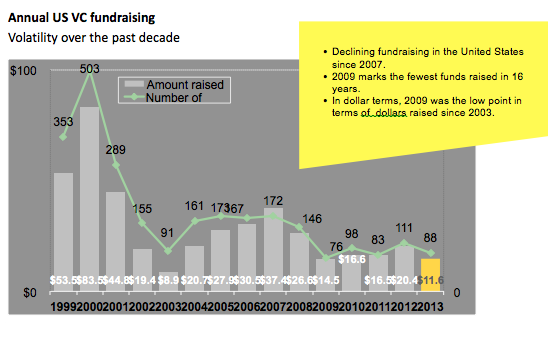

Venture capital fund raising (the dollars raised by venture capitalists that they invest in companies) has been decreasing since its turn-of-the-century glory days. In the three years from 1999-2001, $181.5 billion was raised - a spectacular run up that dropped precipitously starting in 2001. The life of a VC fund is typically 10 years, meaning that the funds deployed in 2001 should have paid back their investors.

Instead, the huge amount of venture capital raised from 1999-2001 was difficult for the industry to digest. It resulted in the over funding of companies in similar sectors. When the resulting returns didn't reward investors in venture funds in proportion to the large risks typical of VC investments, it became harder for VCs to raise funds to deploy. In addition, the Great Recession put a damper on the exit environment, which (best case) made liquidity events challenging and (worst case) drove investee companies out of business.

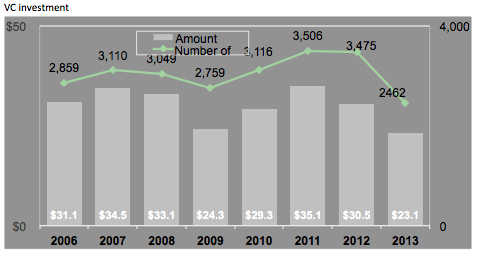

It took the industry twice as long - seven years - to raise $181.5 billion again. The decline in fundraising in the early and mid-2000s has led to the current decline in VC investments. Dollars and the number of deals decreased nationwide from 2011 to 2012, and we are on course to see another decrease for 2013.

You don't need a crystal ball to see that less venture capital will be available in the asset class in the future than was available in the past venture cycle. When funds aren't raised, they can't be deployed. Will the reduced VC funds put the brakes on the immense innovation cycle we are now in, with platform shifts (from feature phones to smart phones and from PCs to tablets at the consumer and enterprise level) driving opportunities for new companies?

I don't think so. Far less capital is needed to start companies today than was needed 10 years ago. Back then, starting a technology company was a costly endeavor. First, a web presence had to be established. This required spending hundreds of thousands of dollars on networking hardware, a space to put that hardware, and bandwidth connections. Next, the product had to be built, which required expensive software tools, databases and people to manage those resources. Finally, the product needed to be distributed. For consumer companies, that meant an expensive distribution deal with a web portal.

Fast forward 10 years and the landscape has gone from black and white to Technicolor - often thanks to prior technologies that were funded by VCs. Today, a company can establish its web presence via Amazon Web Services and pay on a usage basis. It can purchase most software tools on a freemium basis, greatly reducing its capital expenses. Finally, for distribution there's Facebook, LinkedIn and Twitter (free), and Adword campaigns on Google (inexpensive).

With the dramatic downturn in startup costs, it's become far less expensive to get a company off the ground. In technology hotbeds, angel investors have stepped into a role that formerly was played by venture capitalists, and have flourished, investing in young, emerging companies. As one entrepreneur recently said, "we're looking for angel capital to nail our business and venture capital to scale it." The numbers bear out this trend. We're seeing far more companies getting venture capital funding at the revenue generation and profitable stage than at the startup and product development stage.

(For more on this, see 5 Venture Capital Myths Busted)

With the wave of platform shifts at the consumers and enterprises levels, entrepreneurs have plenty of opportunities to innovate and start great companies. Like other investors, VCs are always looking for the next big thing. Just remember: too much money in the system leads to too many "me too" companies which drive down venture returns. Healthy venture returns keep investors coming back to the venture asset class.