A recent analysis of music sales by Ed Christman of Billboard had a comment that really caught my eye: "2010 could become the first year that digital track sales post a year on year decline."

Although digital album sales for 2010 are up overall, according to SoundScan, the first nine months of digital track sales this year are lagging behind the same time period in '09. This was a much discussed topic at Digital Music Forum West a few weeks back and a source of real concern to the music business... what would it mean if the physical business continued to decline without the growth in digital track and album sales?

I asked a few of my colleagues about their views on this disturbing trend and if the increased price point, now $1.29 for current hits, is one of the main culprits.

According to Jay Frank, SVP Music Strategy at CMT, "The change in pricing certainly had an effect on units sold. 99 cents is an impulse buy to the consumer. $1.29 is enough to make some people pause."

BigChampagne's CEO, Eric Garland, had an interesting observation: "In the short term, albums are gaining back some ground against singles. One could argue that digital is "up" in terms of the (higher priced) bundle gaining. And yes, this is probably in part a function of pricing: as individual songs get more expensive, the album is a relatively better perceived value."

Or could it be that on-demand access is so readily available and was so quickly embraced that it is no longer exciting -- it is expected, and consumers are quickly moving-on from technologies that don't provide it?

Photo: Esparta Palma

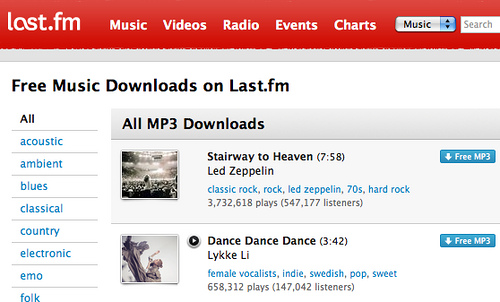

Garland underscored this view, saying "But the bigger issue is that ownership is losing ground to access. Impressions from on-demand audio and video streaming services (YouTube, MySpace) and programmed streams (Pandora, Last.FM) are all up and to the right."

Jay Frank also added "Digital music sales are flattening thru a multitude of factors. Streaming sites are becoming more prevalent, whether it be radio, subscription, or on-demand video. So more people than ever can just click a link to hear the song instead of buying it. If the song fails to be sticky, then there's no need for ownership. Then there's the additional growth of digital movies, TV and apps. All of a sudden, music has to compete with more "floor space" on iTunes. This means fewer promotions. Fewer promotions between fewer sales. Since retailers and labels have failed to adequately support enough alternative stores, the growth trajectory becomes more difficult."

So in this environment, we should not be surprised to learn that there is a rapid decline in the dedicated MP3 player. Apple's recent 3rd quarter financial review revealed the fact that iPod sales were down 11% year to year. That's not an unexpected development given the meteoric rise of the iPhone and iPad, which both include iPod capabilities, but it does point out that the dedicated music player is an endangered species.

Photo: BizMac

And perhaps not far behind it would seem is the dedicated listener. Consider how many of these devices now come with added features, including Wi-Fi web access, that take them away from their original music-only focus (e.g. the iPod Touch supplanting the iPod Classic). And with web access and a plethora of music apps comes distractions such as Pandora and other streaming services.

Not only does the Web bring competitive music services, it also brings video, whether it's MTV, YouTube, Vevo, Hulu or Instant Netflix. These sites and their content bring a completely different type of media into competition with music, downloaded or streamed.

In fact, the beginning of recorded music's slide, which began in the late 90s, is usually attributed to illegal downloading. However, one overlooked factor is that the slide in CD sales coincided with the rising popularity of DVDs. Consumers only had so much disposable income and some of that was redirected from music to films and TV shows.

The same thing is happening now in the digital space. As Jay pointed out, digital media has to compete with downloadable movies and TV shows. Look at iTunes, where much of the real estate, originally all about music, is now dedicated to promoting film and TV show downloads.

One of the major problems for downloaded music vs. the Internet is very basic: why have some when you can have it all? Why would I switch devices, or even merely applications, when I can watch/listen to whatever I want on Youtube?

Photo: John Blyberg

Ten years ago, the concept of physical stock controlling my access started to seem odd. When I stream a TV show or download a song, they are never out-of-stock, hence the demise of Blockbuster. Now, the concept of any sort of limited access/storage seems odd. I may have 16 gigs of memory on my iPhone, but the music I can listen to on it becomes infinite when I launch my Pandora app.

And how much of this is due to anticipation of soon-to-be-launched cloud-based music services such as the long-rumored iTunes cloud-based initiative, Google Music, Spotify, etc.? Ultimately, there are so many ways to instantly access everything that you want to hear and see that it's not surprising that paying for individual tracks is leveling off. Although consumers in general have been slow to embrace subscription, the affordability and immediate access of these services could set the stage for new models to finally gain some real traction.