Part I of an ongoing series on student loans

The student loan interest rate debate has gone viral, and a result, it's taken over Congress.

This is great news, because if Congress does not act by July 1, interest rates on Subsidized Stafford Loans will double from 3.4 percent to 6.8 percent. Right now, Democrats and Republicans in the House and Senate have each proposed their own plan to stop the hike. It's a good problem to have: in just a few short weeks this issue has grabbed the limelight, attracted bipartisan support, and a major piece of the Congressional agenda.

So what does it all mean, and why is it important?

Last week, Young Invincibles, along with Center for American Progress, Campus Progress and U.S. PIRG, released a report describing what will happen if the interest rates are allowed to double.

Currently, 7.4 million college students -- about one in every three undergraduates -- rely on Subsidized Stafford loans. They are need-based loans targeted at low-to-moderate-income students and families, providing them a chance at an education.

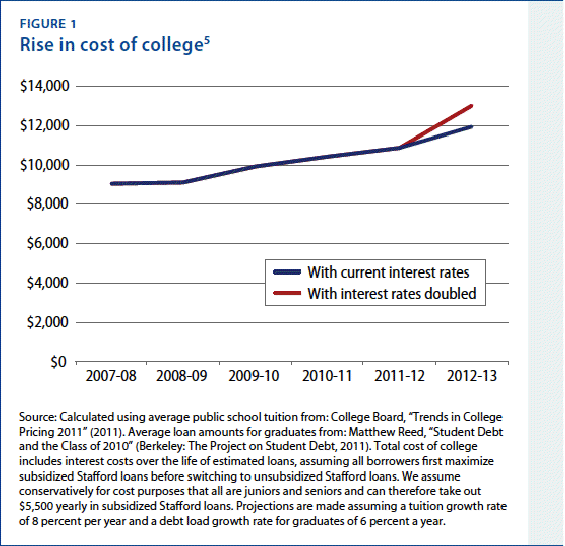

If interest rates double this summer, the change will cost the average college student about $1,000 more for each year of school. Tuition is already rising at about 8 percent per year at four-year public schools. Add an extra grand in interest and the effective cost of college will jump a whopping 20 percent next year for the typical student relying on these loans.

Meanwhile, young people and their families have never fully recovered from the 2001 "Dot-Com bust," let alone the Great Recession. As the report notes, median weekly earnings for 25 to 34-year-olds have actually fallen 5 percent since 2001. Yet even while this generation has been hit hardest, college graduates fare much better than their non-college peers, and a degree is increasingly becoming more important to 1) having a shot at entering the middle class, and 2) increasing the economic strength of our country.

In short, this generation needs higher education more than ever, even as the cost grows increasingly out of reach.

Young people and students of all political viewpoints get it. In a recent poll included in the report, 92 percent of young (18 to 34) Democrats and 78 percent of young Republicans say that increasing financial aid and making loans more affordable for college would help make the economy stronger. The need to keep down college costs and curb rising loan debt is a no-brainer, and it sounds like Washington is finally paying attention. Perhaps elected officials are listening to the people they represent?

Certainly, there will be an important discussion of how to cover the $6 billion cost of extending the lower interest rate. To put that number in perspective, $6 billion is how much the U.S. spends in three weeks for the war in Afghanistan. From a youth perspective, the overall goal and guiding principle for the debate is simple: Give all Americans a fair shot at the middle class, at the American Dream. The House GOP proposal to take the $6 billion by eliminating basic health care prevention programs fails that simple test. It offers a false choice: your health or a more affordable education?

There are far better ways to fund the interest rate extension. For example, our tax system is full of expensive loopholes that only benefit a privileged minority, at the expense of middle- and working-class families. Closing those unfair loopholes would more than pay for the extension of student loan interest rates, and would place the burden in the right place -- not on the backs of middle-class families. In short, there is simply no reason why Congress should not be able to come together and find a bipartisan way to keep rates low, and if students and their families keep up the clamor, Washington will simply have to respond.

As we debate the best way forward, it's important to remember that we're in a generation-long crisis when it comes to the cost of college. Student debt is one big part of the problem. Let's fix this interest rate issue, and build momentum over the coming months to discuss broader student loan and college cost reform, so that students aren't locked out of an education that is increasingly becoming the only path to financial security in America.

Jennifer Mishory is the deputy directory of Young Invincibles, Nicholas Kelly is a fellow with the organization.

This post marks the launch of a five-part series that will take a broader look at the issue of student debt. Tune in for next week's post: "$1,000,000,000,000: How Did We Get Here?"