This is the third time I am doing one of these articles. I also wrote this up for 2010 (Link) and 2011 (Link). When it sounds like the political football of Social Security starts getting tossed all over the place and I have the new rates and the caps from the Social Security Administration, it is time to do the update.

Social Security taxes as well as Medicare, state unemployment insurance and state disability insurance are all essentially calculated the same way. You have a rate and a cap on your earnings. The employer also has a matching tax, a cap and rate, based on the employer's experience. Any monies paid up to the cap are taxed at the rate. Once the year-to-date earnings pass the cap, there are no more taxes to be paid.

I know this because I wrote software waaaay back in the 1980's that calculates payroll taxes. In fact, my program has probably calculated the taxes on your paycheck somewhere along the line. Embedded within most payroll programs is a tax calculator that allows whoever is paying you to have the most up to date tax rates and methods. It blows me away that what I wrote is still for sale at VertexInc. No, I don't get residuals, but I guess I can take bragging rights for something lasting this long. It has probably lasted this long because the easiest way to get fired is to mess with your company's payroll system.

Rule 1: Do not fix something that is not broken when it comes to people's money.

There is a slight logical flaw in the way these types of taxes are calculated:

IT ISN'T FAIR.

Let's take a look at some charts -- please do not allow your eyes to glaze over.

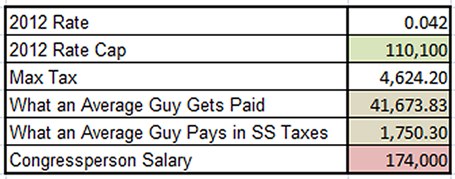

First we need to know what the government rates and caps are (Link).

For most of us, the 2012 maximum taxable earnings cap is $110,100. The tax rate for employees is 4.2 percent. 110,100 times .042 equals a max tax of $4,624.20. That is the most an employee will have to pay this year for Social Security.

The Average Guy figures are coming from the Social Security Administration (Link). The latest national average wage index for 2010 is 41,673.83. Their max tax for the year is just found by applying the rate.

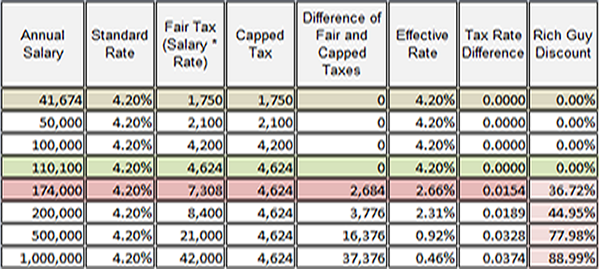

Let's see what this means in the real world.

As you can see, this year's $1,000,000 baby gets a discount of over 88%. Hey, no wonder they are rich.

But I wanted to do something a little different this year.

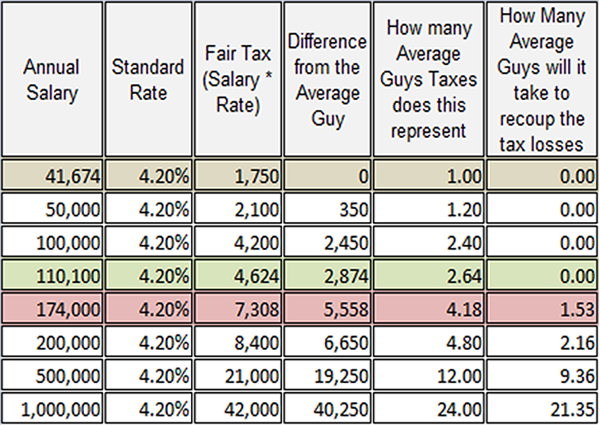

Because of that 88% discount, that means money is not going into the system. How many Average People have to haul the weight of that $1,000,000 baby for what they are not putting into the system? How many people does it represent?

So if an average guy pays in $1750 and our $1,000,000 baby should have fairly paid $42,000, that represents about 24 average guys. Since the $1,000,000 baby has already paid in their max of 2.64 Average Guys, that means there is a difference of about 21.36 (yeah, I know about rounding).

Look, nothing has really changed over the last three years about tax fairness with respect to this, but this is a pressure point that smart Democrats may want to exploit as there is talk about tax fairness and raising Social Security rates and retirement ages as we go into yet another election cycle.