I continue to be amazed at the moral obscenity underway in our country. We are in a financial crisis, states are cutting education and health care, and we are wringing our hands over federal deficits -- yet there is no serious discussion about significantly taxing the rich, who have reaped hundreds of billions of dollars in the past decade. Yesterday, President-elect Obama talked about potential trillion-dollar deficits. I hope he will soon talk about demanding that the rich help soften those deficits by giving back some of their gains to keep the country from collapsing into an economic depression.

A few initial comments. First, I am among those who believe that we have to err on the side of spending a lot to get people back to work and I applaud the president-elect and his team for apparently leaning that way. It is, in fact, a good sign that the president-elect has succeeded in shifting the debate so significantly that the minimum number being considered for the stimulus is in the range of $500 billion, with the top number reaching one trillion dollars.

Second, I have also been in the camp that doesn't worry much about deficits -- as long as the country is spending money on something worthwhile and something that bears fruit in the future (i.e., I would hate to have a budget surplus while we are blowing up Iraq but have no problem racking up deficits if we are building schools, funding health care and financing climate-saving technologies). Having said that, I get that this is really a function of how big the fiscal deficits are relative to our overall GDP and that we can't simply ignore the costs of borrowing long-term to pay off...sovereign wealth funds.

But, here is what concerns me in the president-elect's remarks:

President-elect Barack Obama on Tuesday braced Americans for the unparalleled prospect of "trillion-dollar deficits for years to come," a stark assessment of the budgetary outlook that he said would force his administration to impose tighter fiscal discipline on the government.

And...

Mr. Obama declined to say on Tuesday whether the budget that his administration submits to Congress in February would be larger than the $3.1 trillion budget that President Bush submitted for the current fiscal year. He also did not offer any specific examples of how spending could be controlled, saying only that his advisers had been scouring the budget looking for programs that could be eliminated.

"I'm going to be willing to make some very difficult choices in how we get a handle on his deficit," Mr. Obama said. "That's what the American people are looking for and, you know, what we intended to do this year." [emphasis added]

When a political leader says the country will have to make some "very difficult choices", history instructs us that it is average people that get nailed. And it doesn't have to be that way.

The fact is that, at the federal and state levels, we can have the resources to do what needs to be done, avoid "very difficult choices" and keep deficits in a range that will keep the deficit fear-mongers muted.

But, only if we are willing to tax the richest people in America. I recently outlined what could be done just in New York State to deal with the state's deficits.

The federal tax solution is just as clear. Back when the president-elect was a candidate, I looked at his economic proposals. On taxes, I wrote:

He proposes a $250 immediate tax cut for 150 million workers and their families -- $50 lower than the recent Bush Administration's $300-a-person tax "rebate" that was widely derided as a political ploy that would do very little to alleviate the economic stress facing workers. And, if economic circumstances get worse -- a word on that in a moment -- the new Administration will send another $250 per person. The cost to the U.S. Treasury would be $70 billion if both $250 rebates were implemented -- a likely scenario given the economic crisis underway.

But, the truth is that the proposed tax cut is a distraction and an unnecessary drain on the U.S. Treasury when far more important challenges face American workers. Tossing American workers a few hundreds bucks out of the Treasury, which will further hobble the government's ability to do its job, will undercut the ability to launch national health care, fund infrastructure projects and move the economy towards a carbon-free future.

And, now, with the proposed tax cuts reaching $300 billion, it is even more unadvisable to be handing out money, in my humble opinion, that should be directed towards investment in job creation.

The main point, though, is this. By asking the rich to pay more, with very little trouble, we could have hundreds of billions per year to fulfill society's needs -- and that money would not come from 95 percent of the people. It would come from the top 5 percent of income owners, and, mostly, from the top one percent. During the campaign, candidate Obama pledged to return the top rates to the Clinton-era rates. That isn't enough.

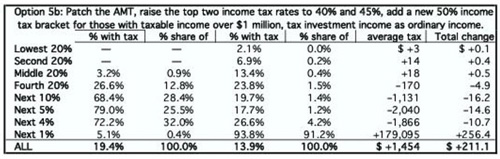

With the help of Citizens for Tax Justice, the premier non-partisan organization focusing exclusively on tax issues, I concocted an alternative tax structure: raise the top income tax rates to 40 percent and 45 percent (the top rate is now 35 percent for married taxable income above $351,000), add a top rate of 50 percent for those people with taxable income higher than $1 million and -- this is crucial -- tax investment income as ordinary income (the proposal also assumes that Congress will fix the Alternative Minimum Tax, which costs the Treasury money).

From this plan, we would realize an additional $211 billion in net revenues, with 91 percent of those revenues coming from the richest one percent of Americans (and, the above model should be adjusted to eliminate tax reductions for the higher income earners).

Here is the table:

Though the "free marketeers" (yes, the bankrupt philosophy that got us here in the first place) will argue that taxing the rich now is bad for the economy, in my opinion, there are zero -- zero -- serious arguments to back that up at the levels I'm suggesting. Frankly, the above chart is a relatively modest proposal, given as a taste of reality. We could -- and should -- easily raise the two new suggested top rates higher, with the top rate for the richest 1 percent set at least at 50 percent. From 1951-1964, the post-war era, which America's leaders and pundits like to point to as the beginning of a great boom and growth in the country, the top rate was 91% for married couples making $200,000 and up.

I'd throw in another thing that can raise another $150 billion a year: a very tiny "thank you for playing" fee on Wall Street stock transactions. Tiny means 0.25 percent. Something so miniscule that the small investor wouldn't even notice it. The lion's share of the income would come from the big traders and speculators who move millions of shares a day in an attempt to jump on any gyration in the market.

These traders benefit from government protections, not the least of which is a regulatory system (oh, there you go again, using that "regulation" word, which now seems to be back in vogue) that prevents, in theory, fraud and crazy speculation (ok, so that doesn't always work out well all the time). Plus, such a tax might also exercise some restraint, perhaps modest, on the wild and crazy big trades made on rumors and the thirst for a quick buck. My colleague Dean Baker has made this argument in far more detail here.

Bottom line: there is no need to cut government service if we go, as Willie Sutton used to say, where the money is. I hope the new president consider a serious hiking of taxes on those people who should demand that people pay their fair share of the dues that should be paid to live in this country. Freedom isn't free and wearing a flag lapel pin is a virtually cost-free act of patriotism that is 100 percent fashion statement and zero percent real investment in the country.