This morning at breakfast, we watched out the window as our neighbor's nine-year-old daughter Ava walked to school. She was bundled in a coat and scarf, which maybe was a touch warm for the weather, and carried her trumpet at her side.

We see Ava walk by most mornings, and Jay often plays with her in the afternoons when she comes outside to kick a soccer ball. And this morning I was struck by how nice her childhood seems. She has a ten-minute walk to school. She plays an instrument, she plays soccer, she's a Girl Scout (who sold us those Thin Mints I'm always writing about), and her parents are around a lot. I don't know her family very well, but in broad strokes, she's got the kind of childhood I'd want for Jay and Wally.

Which got me thinking about how money influences the kind of childhood a kid experiences.

There's still some uncertainty about what our adult standard of living will look like, but between Caroline's academic salary and my less-predictable freelance income, we should be able to earn at least, say, $100,000 a year. And my sense is that that would be enough to give Jay and Wally a lifestyle that roughly resembles Ava's. We could afford to live in our neighborhood, where homes sell for under $275,000, and we'd send our kids to the Ann Arbor public schools, which are perfectly good.

But what if we found a way to earn more than $100,000? It's unlikely that we'll ever be rich by the standard President Obama was pilloried for using -- families that make more than $250,000 a year -- but if we made it a priority, we could probably earn an additional $50,000 a year. What would that mean in terms of how Jay and Wally grew up?

To answer that question, Caroline directed me to a report put out annually by the U.S. Department of Agriculture called Expenditures on Children By Families. The report analyzes the amount of money that families at different income levels spend on their children.

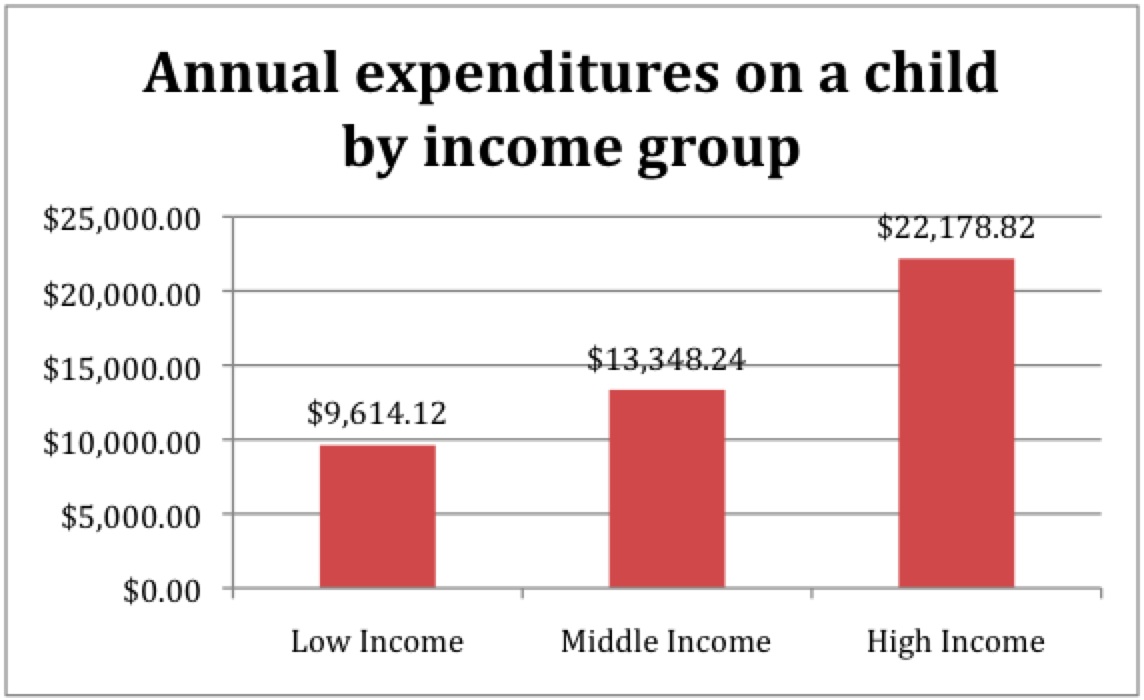

- Families earning less than $57,600 a year (Average=$36,840)

- Families earning $57,600-$99,370 a year (Average=$77,500)

- Families earning more than $99,370 a year (Average=$174, 530)

The most striking thing about the chart, to me, is the relative similarity between what low income and middle income families spend compared with what high income families spend. Put another way, high income families spend a lot more on their kids than other families do.

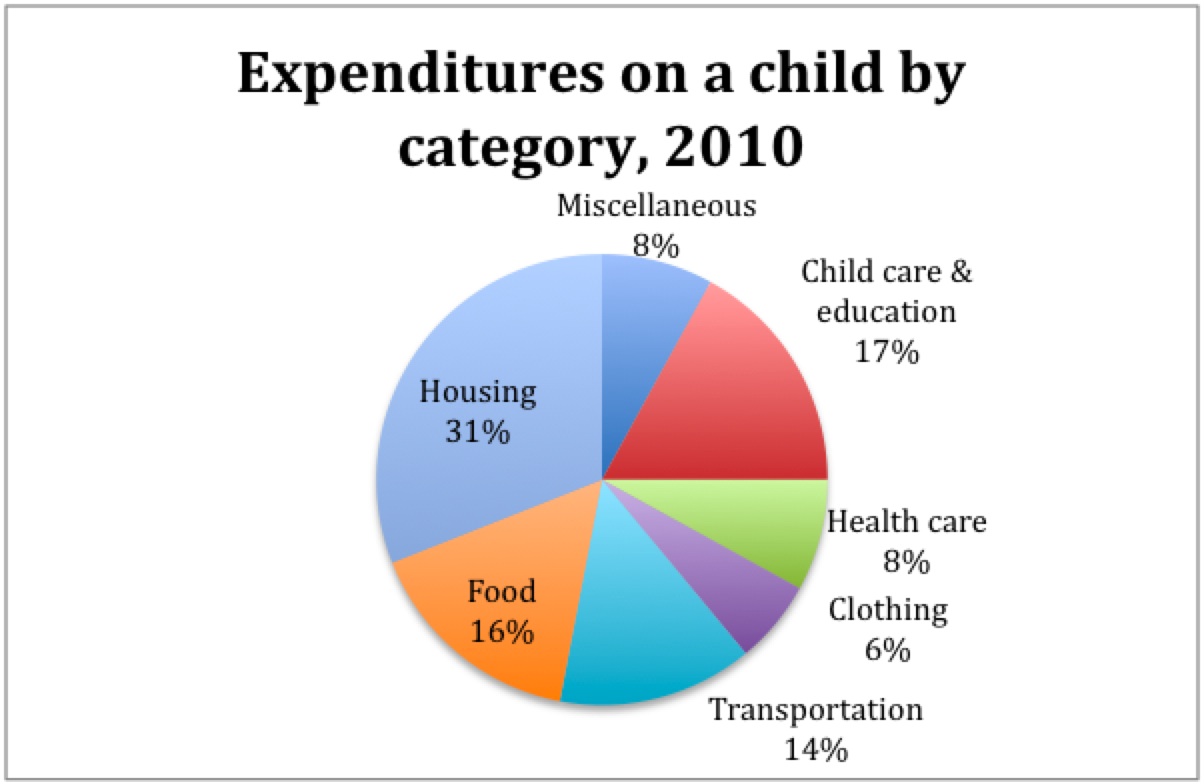

The following chart, recreated from page 18 of the report, breaks down expenditures on a child into seven categories. The chart is based on expenditure percentages in a middle income home, which are similar but not identical to the way expenditures break down in lower and high income homes.

One thing that leaps out at me from the chart is housing (which includes mortgage payments, property taxes, rent, maintenance, utilities and home furnishings like furniture and appliances). Housing is the biggest contributor to the expense of raising a child. It also seems to me to be one of the easiest places to save money without impacting the quality of life a child enjoys.

In Ann Arbor, for example, we could buy a house in our current neighborhood for $275,000 a year or we could buy one a mile away in Burns Park for $450,000. Both neighborhoods are quiet, leafy, and filled largely with two-parent families. Burns Park has nicer housing stock and is closer to campus. Living there would put a big pinch on our household budget but it's hard for me to see how it would really improve Jay and Wally's childhoods.

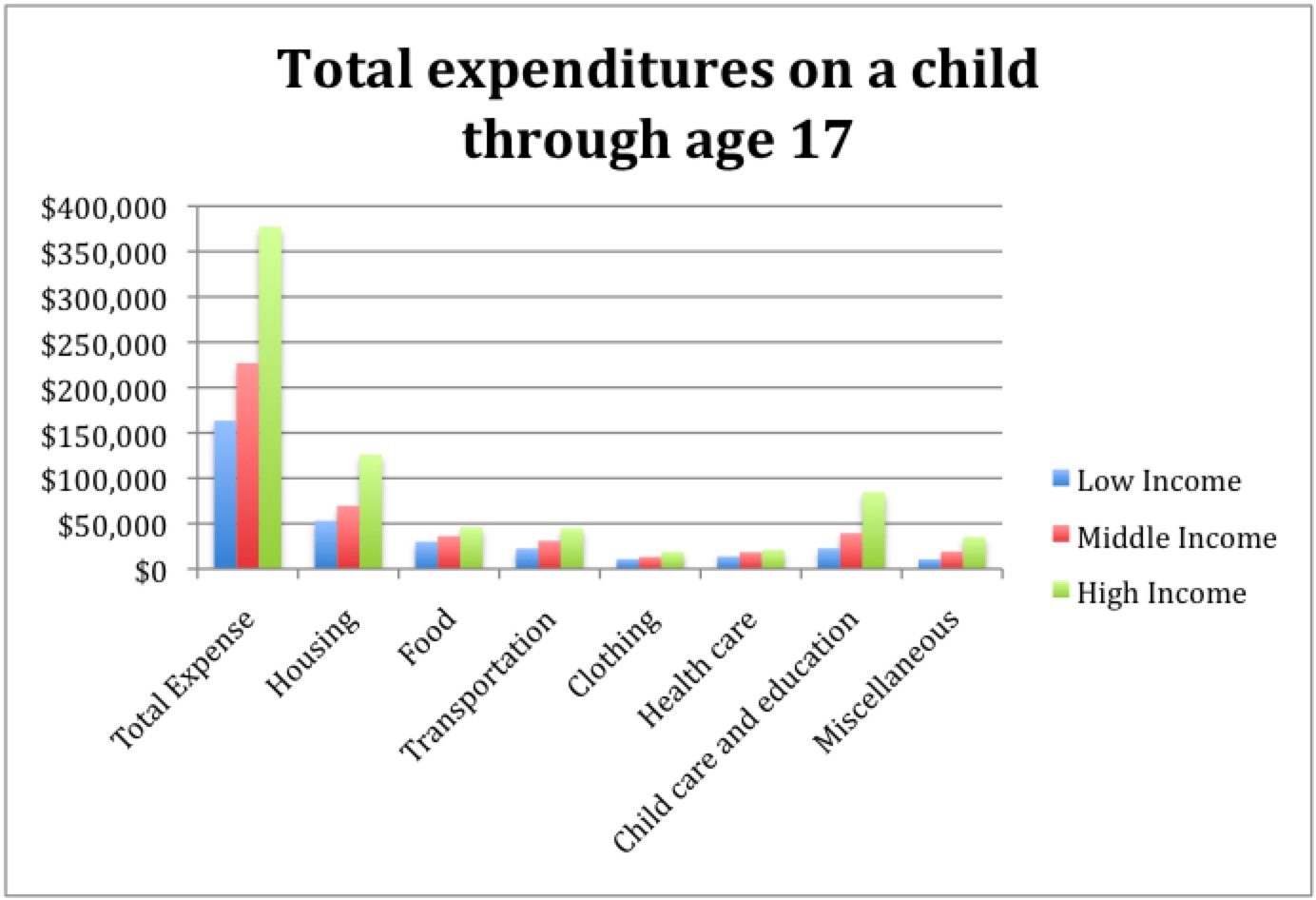

This next chart is the one you've been waiting for. It shows where the additional spending on a child goes as families move up the income scale.

High income families spend a lot more on their children over the course of their childhoods --almost double ($377,000) what middle income families spend ($226,920).

When I consider what that extra money gets you, I think in two categories: stuff and non-stuff.

Stuff includes housing, food, transportation and clothing, which comprise 67 percent of the cost of raising a child. Earning $150,000 a year versus earning $100,000 a year gets you more stuff, and better quality stuff, but I don't think it does much to improve the quality of a kid's childhood. What does it matter if your parents drive a Honda or a BMW, or whether your backpack costs $40 or $100? Once a certain minimum standard has been reached, each additional dollar spent on more or better stuff doesn't add a lot. And that minimum standard can be reached easily with a family income of $100,000 a year.

What about non-stuff? That includes health care and child care/education, which together comprise 25 percent of the cost of raising a child.

One interesting aspect of the data is that middle and high income families spend similar amounts on their children's health care ($18,420 and $21,150, respectively, from age 0-17). To me, this suggests two things: a) As families move from low to middle income, one of the first places they divert their increased income is to health care; and b) There's only so much you can spend on health care, at least for children who tend to be pretty healthy.

The other non-stuff category is child care/education. Here's where you see the single biggest gap between low, middle and high income families in terms of total dollars spent. Over the course of a childhood, low income families spend $22,710, middle income families spend $39,420 and high income families spend $84,870. That's a pretty staggering difference and it's pretty obvious what accounts for it: daycare vs. nannies when kids are young and public vs. private school when kids are older.

So, when Caroline and I think about how earning an additional $50,000 a year would impact Jay and Wally what we're really thinking about is the value of private school. I don't have any data that tries to quantify the value of private school but I'll do some digging. Of course, the added value of private vs. public school varies a lot depending on the quality of the public schools where you live. In Philadelphia, where we lived until last August, the gap between the private and public schools was huge; in Ann Arbor I imagine it's a lot smaller.

Before I wrap up, a few notes. First, this discussion only includes expenditures on children through age 17, so it doesn't include support for college, post-graduate education and the transition to adulthood, which are obviously huge and consequential expenses. Second, the expenditure categories don't capture things like vacations and summer camp, which are both places where I'd expect to see big gaps between middle and high income families. Third, I framed this post in deliberately simplistic terms in order to highlight top-level differences by income groups. I'd encourage people to read the USDA report and to raise questions in the comments section.

Overall, I'm interested in writing more about the tradeoffs that parents should consider as they think about how to organize family life. What would we gain by earning an additional $50,000 a year? What, if anything, would we have to give up to earn that money? And how does the organization of time and the availability of money effect a family culture and children's outcomes?

I look forward to thinking about these questions in future posts.

Related Posts from Growing Sideways