We really have, as a nation, seen our train completely fall off the fairness track. The unprecedented income inequality in the nation today is such a blight that I thought it would stand on its own as an indictment of the actions and decisions since 1980 of certain of our political and business leaders which wrought this nightmare.

I also hoped that by now the American people would be standing up and saying en masse that "enough is enough".

In fact, not only is the inequality persisting, but it has become so embedded that it's now dictating our nation's finance industry practices, tax policies, and sense of corporate social responsibility.

In 1928, on the eve of the Great Depression when America began to keep track of income inequality, the top 10% of earners received 49% of total income and the top 1% received 24%. In 2007, on the eve of the current recession, the top 10% earned 50% of total income and the top 1% received 24%. In other words, the Great Recession of 2007 was foreshadowed by almost the exact same outrageous income imbalance as existed just before the Great Depression, the evidence of which is that the top one-tenth of 1% of earners now earn as much as the bottom 120 million earners combined.

As Louise Story of the New York Times has identified, after the 1929 crash the income gap narrowed dramatically and remained low for decades, because of, in large part, the sweeping financial reforms introduced in the 1930s that reined in Wall Street and the progressive individual taxation advanced by FDR. But such was not the case 'after the 2007 crash'. This time, the financial industry reform of 2010 leaves the people at the top unscathed and, in the dumbest move of all, some in Congress are actually considering retaining the Bush tax cuts for the wealthiest of Americans.

Ms. Story in her article, and her colleague at the Times Gretchen Morgenson in other articles, have raised our consciousness to the perversions which flow from long-term income inequality. Such inequality has the triple whammy effect of:

- Putting so much power in the hands of Wall Street titans that they are able to promote government policies - like deregulation - that enrich them and put the entire financial system in jeopardy;

- Influencing in dangerous ways the trading practices of financial industry leaders who have the potential to earn excessive compensation, because financial bubbles lead to higher financial returns and thus incomes in the short term; and

- Pushing people at the bottom of the earnings ladder toward personal consumption and borrowing choices that put the financial system further at risk.

Then there are our perverse individual income tax regulations which, since 1980, have been manipulated literally out of control, all with the intent of enriching the wealthiest of Americans so that they can 'trickle down' their wealth to the poorest - which of course they almost never do.

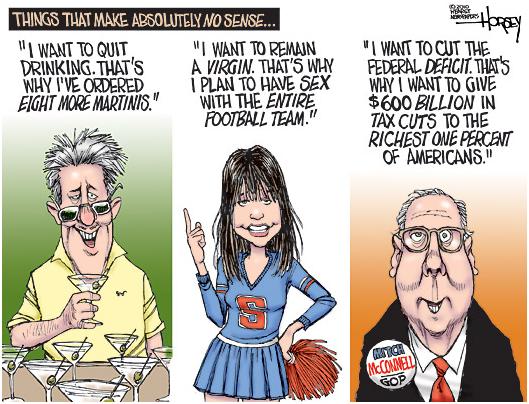

Sometimes it's ordinary income which is taxed as capital gains, sometimes it's legal (and often illegal) offshore accounts, sometimes it's tax deferrals that just keep on deferring, and right now it's trying to permanently preserve the Bush tax cuts for the wealthiest of American taxpayers, which according to the nonpartisan Tax Policy Center would cost the federal government an almost unbelievable $680 billion in revenue over the next 10 years.

President Obama and the Democrats in Congress want to preserve the Bush tax cuts that benefit the middle class and lower income earners, while letting those provisions that benefit only people with very high incomes expire on schedule at the end of this year. The Republicans disagree.

Under the Democrats' plan, everyone - families, small businesses and family farms alike - who doesn't make at least $250,000 a year ($200,000 for individuals) would see their tax status quo maintained.

Under the Republicans' plan, nearly all of the benefit would go to the richest 1% of Americans, people with incomes of more than $500,000 a year. The majority of even this amount would go to the richest one-tenth of 1%, the least wealthy of whom have annual incomes of more than $2 million and the average of whom makes more than $7 million a year. And as for the Republicans' argument that preserving the Bush tax credits for the wealthy is mostly about "helping small business and family farms", the reality is that no more than 3% of American small businesses make more than $250,000.

If the Republicans have their way, the richest 120,000 people in the country would receive an average tax break of $3 million over the next decade.

Originally published on Wednesday, August 25, 2010

Of course the 'answer' to the Bush tax cuts issue - and to all individual taxation issues now and in the future - is a tax system with more brackets and thus more stratification, so that the super-rich pay higher rates, instead of a tax system that has an individual earning $200,000 paying at the same tax rate as an individual earning tens of millions of dollars.

A reason all of this is so important - beyond the screaming unfairness and the irresponsible behaviors it induces - is that extreme income inequality is also very bad economics. The economic measure that matters most in a large, diverse and highly developed country such as ours is the vibrancy of the middle class, which needs to grow robustly from the bottom up - and the best indicator of that vibrancy is our nation's nearness to full and fairly compensated real employment. Right now, we don't have either: a vibrant middle class, or anywhere near full employment - and we won't again until we beat back income inequality and restore some modicum of income equality.

All of these inequities and behaviors are in many ways just 'symptoms'. When one starts looking for the causes, two quickly come to mind.

First, is the benign enabling that the average American voter has gotten sucked into by misleading political efforts by conservatives that are suggested to be one thing, and turn out to be something much more selfish and insidious. For example, the "Bush tax cuts" were promised to fairly and equitably benefit all taxpayers, when the reality, as we know, is that they preponderantly benefited the extremely wealthy. Also, voters are told literally everyday that they need to get rid of estate taxes (the infamous "death taxes"), when the reality is that only about 3% of taxpayers - again only the extremely wealthy - ever even pay estate taxes.

More concerning as a 'cause', however, because it's systemic and malicious, are the views of academics/economists like Aneel Karnai, an associate professor from the University of Michigan who, clearly on behalf of the big business community and its wealthy executives, recently penned a 'planted' op-ed in the Wall Street Journal with the descriptive title, "The Case Against Corporate Social Responsibility." This graphic phrase, now commonly embraced by big business, is a modern redo of the title of Milton Friedman's infamous September 1970 article in the New York Times Sunday magazine which he labeled, "The Social Responsibility of Business is to Increase its Profits."

This 1970 article by Friedman, who was in many ways the original academic-cum-business-toady, turned corporate social responsibility, or CSR, on its ear until, in 1981, it became the very foundation of Reagan's supply-side economics. I actually find "The Case Against Corporate Social Responsibility" even more perfidious, however, since it argues that corporate social responsibility is now largely irrelevant and that companies end up increasing social welfare even if they only maximize profits.

This perceived linkage between maximizing profits and increased social welfare is absurd on its face, but then I thought trickle-down economics was absurd when it was first advanced as well - and for some that's lasted thirty years. Where the irresponsibility is most pronounced - and transcends even Friedman's selfish views - is Karnai's and his colleagues' contention that 'doing what's best for society' should almost never mean sacrificing profits, even if it involves such things as pollution caused by manufacturing and fair wages. For them, reducing pollution should never be voluntary, since that would eat into profits, just as companies should never, of their own wills, pay their workers more than they can get away with or consciously seek to avoid shipping jobs overseas.

Friedman believed that managers who sacrifice profit for the common good are in effect imposing a tax on their shareholders. Karnai et al today go two steps further by stating that:

- Such managers are in such sense usurping the role of elected government officials, which of course they would seek to minimize, and

It's this ideological 'crossover' from economics to how employees, customers, communities and the environment should be treated that is the perfidy I referred to. It's also pretty obviously one the big constants behind the extreme income inequality which now characterizes our economy.

So, there you have it. More income inequality now than ever before, proposed tax practices intended to make it even worse, and a movement underway to embed profit maximization as the only corporate responsibility, to the exclusion of employees, customers, communities and the environment.

This is an unholy combination that should have 90% of American workers and families screaming, "enough is enough." Of course in some ways they already are - and their objections can be found in the dismal polling figures around the administration's economic policies, around the equal unpopularity of both Democrats and Republicans in Congress (only a one-third approval rating for each), and the growing popularity of the purely obstructionist Tea Party movement. President Obama needs to heed these screams and help our nation get the fairness train back on track.

Leo Hindery, Jr. is Chairman of the US Economy/Smart Globalization Initiative at the New America Foundation and a member of the Council on Foreign Relations. Currently an investor in media companies, he is the former CEO of Tele-Communications, Inc. (TCI), Liberty Media and their successor AT&T Broadband. He also serves on the Board of the Huffington Post Investigative Fund.